First Mover Asia: Resilient Bitcoin Rebounds Above $24K Despite Investors’ Inflation, Labor Market Concerns

Prices: Bitcoin tossed and turned above and below $24K before settling over the threshold

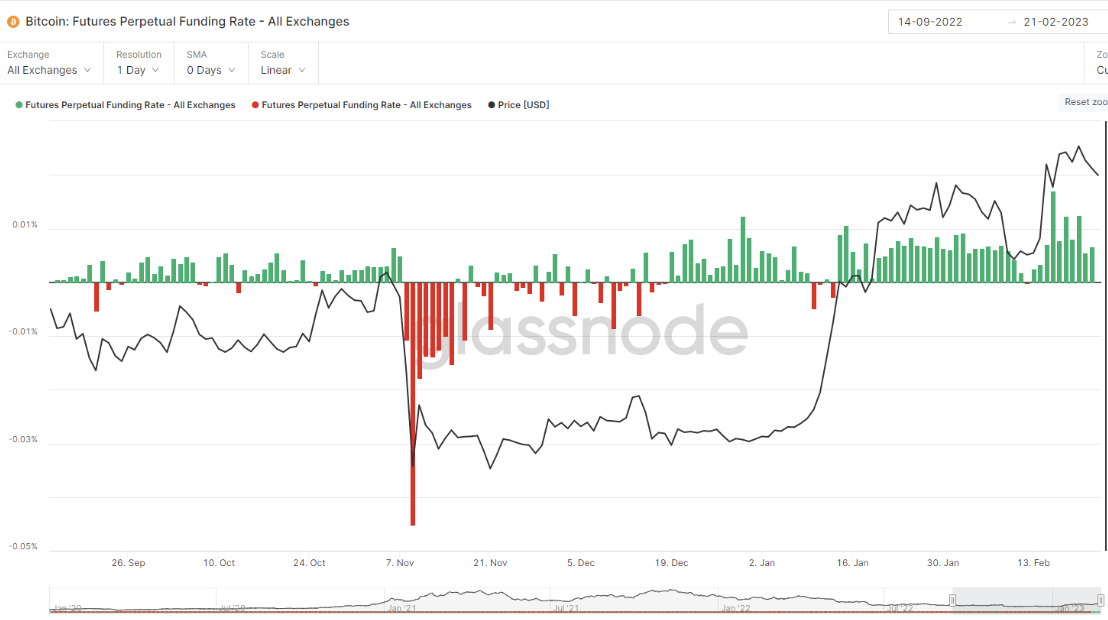

Insights: Bitcoin funding rates have been positive for 10 consecutive days.

>

Why should investors care?

Prices

Bitcoin Shows Its Mettle in Rebounding Above $24K

Bitcoin spent Thursday in a fretfully, uncertain mood, teeter-tottering below and above $24,000 as investors continued to evaluate the U.S. central bank’s ongoing dialogue about monetary policy and jobs data suggesting that inflation would remain problematic.

The largest cryptocurrency was recently trading at $24,052, down 0.4% over the past 24 hours but well off its earlier week high over $25,000.

Still, analysts remain cautiously optimistic about BTC’s prospects after watching it surge about 40% since the start of the year amid an improved, overall economic backdrop.

“People feel that the worst may be over in terms of bad news that we had in the crypto sector last year, and that’s why it’s [bitcoin] more resilient,” Bradley Duke, co-CEO of institutional-grade digital asset-back securities provider ETC Group, told CoinDesk’s “First Mover” program.

In a separate CoinDesk TV interview, Julius de Kempenaer, senior technical analyst at research platform Stockcharts.com, said that he was encouraged by bitcoin’s ability to hold support first at $18,000 and than at higher levels in recent months, including its recent perch around $24,000.

“As long as we remain around that level, where we now are – we can put in a low here and break through 25k – that is a signal to go up to that 30k area,” de Kempenaer said.

Ether was recently changing hands at $1,659, up about 1.1%. Other major cryptos were flat, albeit tinted slightly red with AVAX, the token of base-layer network Avalanche Network, and MATIC, the token of layer 2 platform Polygon, dropping about 3% and 2.5%, respectively.

OPT, the native crypto of layer 2 scaling tool Optimism, was up more than 6% hours after crypto exchange Coinbase said it was building its layer 2 blockchain using the OP Stack in collaboration with the protocol.

The CoinDesk Market Index (CMI), a measure of the digital asset market’s performance, was down 0.2%.

Stocks rose with the S&P 500, which has a technology heavy component gaining 0.5% to break a four-day losing streak and the tech-focused Nasdaq and Dow Jones Industrial Average (DJIA) rising a few fractions of a percentage point.

The Nasdaq took heart from semi conductor manufacturer Nvidia, which on Wednesday said it expected business to improve amid the euphoria about the ChatGPT artificial intelligence chat tool.

AI tokens have been surging since the public unveiling of chatbot ChatGPT and image generation software Dall-E in mid-2022.

Meanwhile, the U.S. Labor Department reported that initial jobless claims for the week ending Feb. 18 fell by 3,000 to 192,000 but were below the consensus estimate of 200,000.

Strong jobs data has been thorny for the U.S. Federal Reserve as it tries to reduce inflation from 6.4% to a target rate of 2%.

The ongoing angst about high prices has made risk-on investors hesitant.

On an eventful day, crypto news was mixed.

As CoinDesk reported, venture capital powerhouses a16z led a $25 million Series A investment in Here Not There to build out Towns, a Web3 group chat protocol and app that lets online communities build blockchain-based gatherings in a fully decentralized way, and Pantera invested $10 million in Worldwide Webb, creator of a pixel art-based metaverse game.

But Federal law enforcement authorities added to charges against Sam Bankman-Fried, the disgraced, former CEO of crypto exchange FTX, and NFT platform Dapper Labs said that it was laying off 20% of its employees less than four months after a 22% workforce cut.

Stockcharts.com’sKempenaer noted that the “risk appetite of the investor is increasing again.”

Bitcoin and cryptocurrency in general could benefit on the back of that,” he said.

And if you just look at what’s happening in the Crypto market, you see buyers coming in.

They’re willing to pay higher prices, sellers are holding on longer – they only want to sell at higher prices.”

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Chainlink | LINK | +3.5% | Computing |

| Cosmos | ATOM | +1.6% | Smart Contract Platform |

| Ethereum | ETH | +1.1% | Smart Contract Platform |

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Avalanche | AVAX | −2.7% | Smart Contract Platform |

| Gala | GALA | −2.2% | Entertainment |

| Polygon | MATIC | −1.9% | Smart Contract Platform |

Insights

Bitcoin Funding Rates 10-Day Streak Reflects Investor Bullishness

Funding rates for bitcoin were positive for the 10th consecutive day.

Funding rates represent payments between holders of perpetual futures contracts.

When the rate is positive, holders of long positions pay holders of short positions in order to remain on that side of the trade.

When funding rates are negative, the opposite is the case, where shorts pay longs.

In bitcoin’s case, funding rates have been positive every day since Jan 14, with the exception of a neutral reading on Feb 12.

Investors holding long positions expect an asset’s value to increase, while those who are short an asset expect its value to decline.

Persistently positive funding rates indicate that BTC traders currently view the asset favorably, and are willing to pay a fee to express their bullishness.

Bycoindesk