Strong domestic flows help India outperform most EMs in FY23

It was a roller-coaster ride for the Indian stock market in the financial year ended March 31, 2023 amid aggressive monetary policy stance by global central banks, high inflation, the Russia-Ukraine war, and outflow from overseas funds.

The Nifty ended half a percent lower in FY23, while the Sensex gained about a percent.

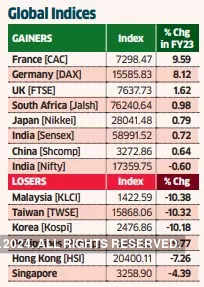

Still, India was the second-best performer among the emerging markets in FY23 after South Africa.

Equity benchmarks of some countries, such as Russia, Indonesia, Singapore,

Thailand, Hong Kong, South Korea, and Taiwan, fell between 3% and 10% in FY23.

The resilience in Indian equities was thanks to the flows from domestic investors.

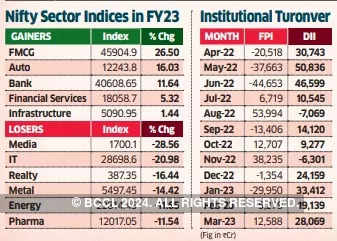

While FPIs sold Indian shares worth Rs 28,222 crore in FY23, domestic institutions pumped in nearly Rs 2.52 lakh crore.

Among the domestic sectors, the Nifty FMCG index gained 26%, while auto and bank indices rose 16% and 11%, respectively, in the fiscal ended March 31, 2023. Nifty Pharma, Energy, Metals, Realty, and IT indices fell between 12% and 28% in FY23.

By:ET