Hero MotoCorp Q2FY24: Improving rural demand, input price correction boost margins

Hero MotoCorp has been exploring opportunities in the electric vehicle (EV) space as well. The company has launched its EV vehicle and is clocking a run rate of 1,000 units per week.

Highlights:

-

- Demand, especially from rural areas, is improving due to the festive season

-

- Operating margin expanded on raw material cost correction

-

- Multiple launches across segments expected to help gain market share

-

- Focus on the premium bike segment and EVs could be key growth drivers

- Buy this strong business for the long term

Hero MotoCorp (CMP: Rs 3,053.75; M cap: Rs 61,030 crore, Rating: Overweight) has posted a significant improvement in the operating margin in the second quarter of FY24, led by a sharp decline in raw material prices. The top line, however, continues to remain muted.

Customer preference for personal mobility, focus on electric vehicles (EVs), and a slew of launches, especially in the premium segment, are likely to aid demand, going forward.

We advise investors to accumulate this fundamentally strong and well-run business, which is valued reasonably (16.2 times FY25 earnings).

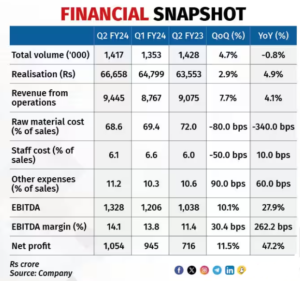

Quarterly snapshot

Key highlights

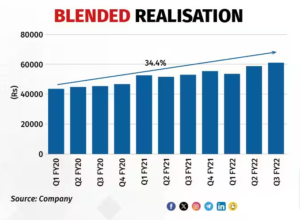

Demand continues to be a concern for the company as is evident by a decline of 0.8 percent on a year-on-year (YoY) basis in volumes. Improvement in realisations due to a rich product mix helped the company to post a 4.1 percent growth in top line.

In terms of operating profitability, the company’s EBITDA (earnings before interest, tax, depreciation, and amortisation) margin improved due to the rich product mix, and a correction in raw material costs.

Festive season is boosting rural demand

The management has indicated that the worst phase of weak demand is over. They are positive on demand owing to the upcoming marriage and long festive seasons, and peaking of interest rates. They indicated that demand, especially from rural areas, is improving due to the festive and marriage seasons.

Further, demand from urban areas continues to remain robust.

EV strategy: multiple products in the pipeline

The company has been exploring opportunities in the electric vehicle (EV) space as well. This could be a key demand driver in the years to come. The company has launched its EV vehicle and is clocking a run rate of 1,000 units per week.

The management has plans to cover 100+ cities in the near to medium term, and the company has started opening exclusive EV dealerships as well. The first one was opened in Pune. Further, the company plans to launch multiple in-house products in the near term.

Portfolio expansion

HMCL has started implementing a strategy to penetrate the growing premium motorcycle segment. The management would prefer to roll out the complete range of premium motorcycles before focusing on growing the market share. Further, the company has lined up multiple products in different segments with a view to building a premium portfolio.

Recently launched Super Splendor and Glamour 125 are getting good traction. More launches are on the premium side in next 4-6 quarters.

Further, the company plans to ramp up the production of Harley and Karizma by 10,000 units per month. This is expected to improve profitability as these are high- value and high-margin bikes.

We believe this segment could lead to a re-rating of the stock and be a key growth driver, going forward.

Attractive valuation

The stock is now trading at a reasonable valuation of 16.2 times FY25 projected earnings. Given the strong fundamentals of the company, we advise investors to buy and make it part of the long-term portfolio.

Risks

Any slowdown in demand could hurt financials. Moreover, adverse commodity price movements can increase raw material costs and hurt operating profitability.