Thermax: Improving growth outlook led by margins and orders

All-round improvement with decent growth in different businesses and segment.

Highlights

-

- Strong recovery in execution driving growth

-

- Margins recovered due to scale and the easing of input costs

-

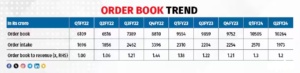

- Strong order in hand to support revenue visibility

-

- Order pipeline strong, expecting to win larger projects

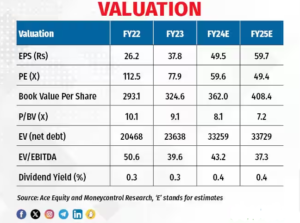

- Stock valued at 49 times fiscal 2025 estimated earning

Thermax has seen a strong recovery led by better order inflows and improving execution. The company is bullish of doing even better in the second half of the current fiscal. It expects some of the large projects to the tune of Rs 300-400 crore to get finalised and, with input prices remaining stable, margins could be higher.

Results Analysis

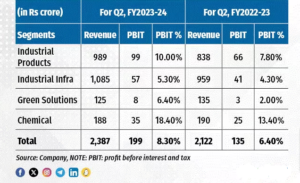

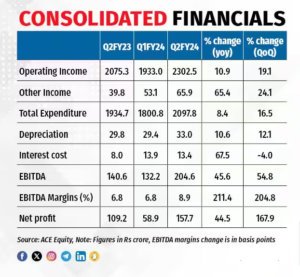

In the quarter ended September 2023, the company achieved an all-round improvement with decent growth in different businesses and segments. On a consolidated basis, it reported an 11 per cent year-on-year (YoY) growth in revenues.

The industrial products business (41 percent of total revenue) saw a growth of 18 percent, led by higher orders. The industrial infra business reported a 13 percent growth, while the green solution and the chemicals businesses were down marginally.

Aided by stable input prices, higher scale, and efforts to control cost, Thermax continues to see a strong growth in profitability.

During the quarter, the EBIT margins improved by nearly 200 basis points to 8.3 percent. Segments such as green solutions delivered strong growth in margins and profitability.

The overall improvement in margins, coupled with a 65 percent year-on-year growth in other income (cash and cash equivalent of close to Rs 2705 crore) helped the company report a 46 percent growth in net profits.

Earnings outlook

In the September 2023 quarter, the company’s order inflows were lower. However, the management is quite bullish about order inflows in the second half of the current fiscal. It indicated that the enquiry pipeline is quite strong from sectors such as green energy, chemicals, pharma, food, beverages, etc.

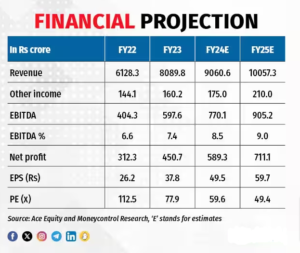

The company also indicated that the current environment is far better as international projects are picking up. Overall, the order pipeline is strong. With orders in hand of close to Rs 10264, about 1.2 times its annual revenue, the company has a decent visibility. Execution continues to be good and that, along with improving margins, should support higher earnings growth.

For instance, in industrial infrastructure (45 percent of revenue), the company is expecting the EBIT margins to inch up to 6-7 per cent from the current level of 5 percent.

Valuations

In terms of valuations, the stock has rallied in the last one year from around Rs 1920 in January to Rs 2896 a share now. The stock is now trading at 49 times its fiscal 2025 estimated earnings. While business is improving and the earnings outlook is better, the stock valuation is expensive for the near term. One should be cautious and have moderate expectations in terms of returns as large part of the earnings growth over the next two years is well discounted in the stock prices.

Bymoneycontrol

Insidesmarket.com