Does Aarti’s result suggest a turnaround for the chemical sector?

While the Indian chemicals industry remains a multi-decade opportunity and Aarti Industries is among the front runners, it faces many challenges in the short run.

Highlights

-

- Sequential growth more a restocking and doesn’t provide any clue for underlying growth

-

- India’s organic chemical exports have severely contracted in CY23

-

- Exports to the US have sharply come down

-

- Consumption slowdown in advanced economies compounds near-term prospects

-

- Remain cautions on Aarti Ind

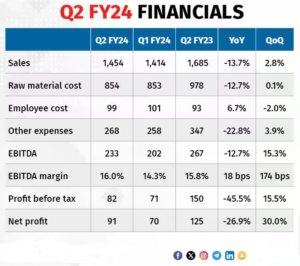

’ (CMP: Rs 515; Market cap: Rs 18,676 crore; Rating: Equal weight) Q2FY24 result was a welcome relief for the stock as it posted a sequential improvement in both top line and margins.

Sequential improvement was skewed – led by exports – which grew by 27 percent quarter on quarter (QoQ). This was mainly exhibited in the volume-led recovery in regulated markets for the discretionary end-markets – polymers, additives and dyes. Agrochemicals, however, remained a major drag due to prevailing inventory de-stocking.

The management’s expectation that there could be a progressive improvement in H2FY24 and a phase-wise ramp-up in FY25 signals that the worst may be over.

While we maintain that the company has the potential to be a global player in benzene and toluene derivatives in due course, a near-term sustainable recovery is a function of global macros, which, at the current juncture, is fragile.

On top of that, equities, as an asset class, are less appealing, compared to fixed income in terms of risk-reward ratio. In this context, a competing investment option in equities should have a bond like cash flow visibilty which we don’t see in some of the export-oriented chemical names.

A sequential sales growth of 3 percent has come after a 15 percent QoQ de-growth in Q1FY24. This makes the current result more a sign of stabilisation rather than a recovery.

The segments highlighted by the management – additives, polymers and dyes – as having witnessed a recovery in Q2FY24, have had a long-drawn phase of inventory destocking.

The management has as well confirmed that recovery in these end-markets is a reflection of channel restocking and doesn’t provide a directional change in the underlying demand trends. Further, all these segments are discretionary in nature and the export markets they are exposed to have a distinctive slowdown in consumption.

In addition, the agrochemical and pharma segments, which make about 50 percent of sales, continue to see weak demand trends and inventory destocking. As per our estimates, sales from agrochemicals and pharma have actually degrown by the order of 19 percent QoQ.

How is the demand-supply balance in chemicals?

There is an extreme demand volatility for the chemicals value chain. Most companies are resisting from giving guidance and those giving it have to sharply revise it every quarter.

Channel inventory has come down for most of the chemicals as the risk of timely procurement of raw materials has come down. Supply is ample as global logistic has healed, though the implications of the Israel-Hamas conflict is yet to be seen.

Supply from China is translating into dumping as there is not adequate demand in China. At the same time, the risk of slowdown in consumption in the US and Europe adds to concern that inventory de-stocking has more legs. As a result, we are in a seriously adverse supply-demand scenario.

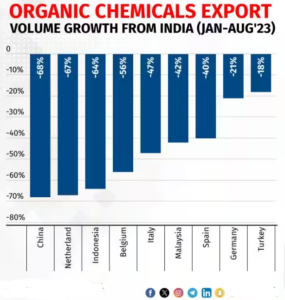

This is reflected in export numbers. In the first seven months of CY23, India’s organic chemicals export volumes have degrown by 27 percent. If we look at some of the key Asian and European export destinations, volume degrowth has been to the order of -15 percent to -70 percent.

The US, which is among the most prominent export destinations, in our last update, was holding up the consumption of chemicals. But in last three reported months (June-Aug’23), the exports of organic chemicals from India to the US have come down by 29 percent.

Note: Countries shown above account for 50% of chemical export volumes from India

What should investors do?

Given the risk of sustained dumping from China and the potential slump in consumption in advanced economies, investors should resist the temptation of timing export opportunities for a short-investment horizon.

While the Indian chemicals industry remains a multi-decade opportunity and Aarti Industries is among the front runners, it faces many challenges in the short run. One such challenge is the relatively leveraged balance sheet (net debt/equity of 0.56x), which would likely peak out in FY26, given the heavy capex cycle (Rs 3,000 crore) for FY24 and FY25. We believe debt-funded capex programmes would be among the least preferred from investors’ point of view, given the elevated interest rate regime.

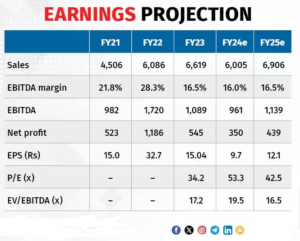

The stock is trading at 16.5x FY25 EV/EBITDA. This is fair, in our opinion. Given the macro risks, we maintain a cautious stance. At the same time, we continue to favour domestic-facing opportunities (Nocil, Apcotex, PCBL) or segments with better competitive moats such as fluorochemicals (SRF, Navin Fluorine).

Bymoneycontrol