Aditya Birla Capital: Growth on track with key drivers in place

NBFC portfolio to double in size in the next three years.

ighlights

-

- Positive trends in lending business

-

- Retail & SME share to increase and aid margins

-

- Rapid growth in housing finance disbursements

-

- Asset management business improves

-

- Life insurance saw muted performance

- Health insurance market share improves

CMP: Rs 220; Market cap: Rs 57,240 crore; Rating: Overweight) has posted strong numbers led by continued growth in key businesses.

The stock has delivered strong returns and outperformed the market year to date (over 30 percent against 1.8 percent return on Nifty) led by strong business growth and the announcement of the merger of Aditya Birla Finance Ltd (ABFL), the NBFC arm, with the parent company. The proposed restructuring is expected to be completed in the next 9-12 months subject to necessary regulatory approvals.

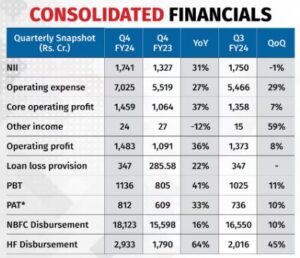

March-2024 performance

ABFL saw robust loan growth, backed by a well-diversified asset book, which crossed the Rs 1-lakh-crore mark led by continued growth in secured loans (43 percent of lending book) with a focus on MSME (micro, small and medium enterprises) and direct sourcing channels. The B2B platform Udyog Plus continued to scale up MSME credit growth.

The company has scaled down personal loans following the RBI’s increase in risk weights on unsecured loans. The rising share of retail SME loans (expected to increase to 75 percent from 67 percent currently) led by geographic expansion, digital platforms, and more cross-selling opportunities will continue to drive the NBFC portfolio, which is guided to double in size in the next three years.

The housing finance (HF) loan portfolio delivered strong growth in disbursement and AUM, led by affordable and prime segments (including loan against property), while the credit quality remained robust.

Improved asset quality

The asset quality remained stable led by continued improvement in the pre-delinquency portfolio. The GS 2&3 ratio of NBFC and HF businesses improved sequentially by 35 basis points (bps) and 65 bps to 4.5 percent and 2.9 percent, respectively.

Given the cautious stance in the small ticket personal loan segment, we expect the credit cost to remain within the guidance range of 1.5 percent in the NBFC segment.

The asset management business saw a quarterly average AUM growth of 21 percent YoY in FY24 led by strong capital market performance. ABCL sold 5 percent stake in the business through an offer-for-sale in March 2024.

ABCL has presence in both life insurance (through Aditya Birla Sun Life Insurance Company) and health insurance (through Aditya Birla Health Insurance Company, ABHI).

In life Insurance, individual First Year Premium (FYP) growth was a muted 2 percent YoY, while the VNB (value of new business) margin declined by 280 bps YoY to 20.2 percent. However, the embedded value improved by 28 percent YoY in FY24.

In health insurance, ABHI was the fastest growing, led by a strong growth in the retail business. The combined ratio improved to 110 percent against 121 percent in the previous quarter. It is expected to further improve to 100 percent in the coming period, as per the management.

Outlook and valuation

After one year of the launch of the MSME platform, the company launched ABCD (Aditya Birla Capital Digital fintech app), an omni-channel D2C platform with a plan to acquire 30 million new customers in a seamless manner in the next three years. This will further strengthen the credit growth.

After the reverse merger, ABCL will convert from a holding company for the financial services businesses of the group to a large unified operating NBFC with better access to capital and improved operational synergies.

The lending business outlook remains positive backed by strong growth in the NBFC loan book and increased disbursements in the HF segment. The simpler business structure and the ramp-up of digital capabilities will drive long-term growth, while stable credit cost and better product mix will likely aid the RoA (return on asset).

The NBFC’s RoA is guided to increase to 3 percent over the next three years (now 2.5 percent).

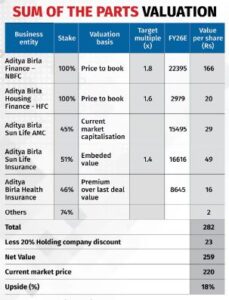

The stock is valued on an SoTP (sum of the parts) basis and there is reasonable upside at the current market price.

We believe that there is potential for the stock to re-rate after the merger, which could lift the valuation in the coming period.

Bymoneycontrol