Medi Assist: Strong business growth, but margin moderates

Synergies from acquisitions can improve margins over the next 3-4 quarters.

Highlights

-

- Robust growth in premium under management

-

- Strong revenue growth, profit rises

-

- Margins fell due to integration-related costs

-

- Health insurance in sweet spot, TPAs have become indispensable

-

- Valuation reasonable considering business moats

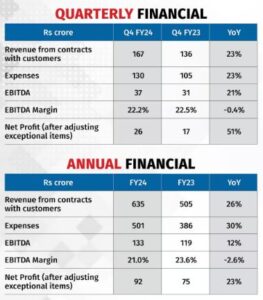

Medi Assist Healthcare Services (CMP: Rs 493; Mcap: Rs 3,460 crore; Rating: Overweight), the only listed third-party administrator (TPA) for insurance companies, has posted a mixed performance in FY24. While the net profit after adjusting exceptional items grew by 23 percent year on year), the EBITDA margin declined to 21.6 percent in FY24 from 24 percent in FY23.

The revenue grew by 26 percent YoY (year on year) led by strong growth in premium under management. Inorganic growth also added to the revenue in FY24. The EBIDTA margin fell mainly due to acquisitions done in the past 12-15 months. In FY24, Medi Assist completed the integration of three acquisitions — Medvantage TPA, Raksha TPA, and Mayfair We Care (UK). Margin came under pressure due to acquisition-related cost and the amortisation of intangibles. More importantly, the operating margin of acquired entities, especially Raksha, is lower compared to Medi Assist’s pre-acquisition EBITDA margin of 23-25 percent. As per the management, it will take 3-4 quarters to realise synergies from the acquisitions and for margins of acquired companies to improve. The ramp-up of these entities could act as a margin-kicker for the company going forward.

Medi Assist’s revenue is linked to the premium under management (PUM) of health insurance companies it services. Hence, it offers a unique opportunity to participate in the growth of the health insurance industry.

With heightened importance of health in today’s world, the growth in health insurance premiums cannot be disputed. Low penetration of health insurance, high out-of-pocket expenses, consistently higher healthcare inflation, and increased awareness post Covid are some of the structural factors that will drive the demand for health insurance.

In the last five years, insurance companies are focusing on the primary business of underwriting risks and marketing policies, while outsourcing the claims processing function to TPAs. Consequently, TPAs have become indispensable and account for more than half of the PUM in health insurance (54 percent of the premium in FY22).

Going forward, insurers are expected to rely more on TPAs to increase their process efficiency, contain costs, and capitalise on the ancillary services offered by TPAs to enhance customer experience. As a result, in the next five years, TPAs are expected to outpace the health insurance sector’s growth.

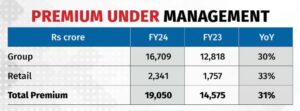

Robust growth in premium

The total premium under management increased to Rs 19,050 crore in FY24, a growth of 31 percent YoY. The bulk of the premium (88 percent) is from group policies, which increased 30 percent YoY. The company is also focusing on the retail health segment, which grew 33 percent YoY, albeit on a smaller base.

While there are 16 TPAs, as of September ’23, providing services to public and private health insurance companies, Medi Assist leads the industry in terms of total premium managed by TPAs. Its market share of the industry’s total (group+ retail) health insurance premium stood at 19.6 percent as of Mar’24, improving by 160 basis points (bps) YoY. In group business, its market share increased to 30.4 percent, a growth of 229 bps YoY, while the market share in retail segment increased by 50 bps to 5.5 percent.

Healthy Financials

The high retention rate of 95 percent in group segment is very encouraging and improves revenue predictability.

The take rate (revenue as percentage share of the premium) came in at 3.8 percent in FY24, slightly below 3.94 percent delivered in FY23. The management does not guide on take rates, but they are in range of 2.5-4.5 percent for group health and 2.5-5.5 percent for retail health business depending on the product/category.

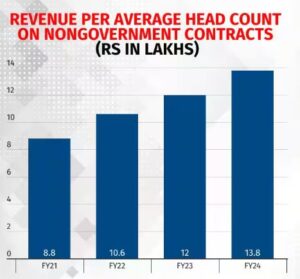

There are many TPAs (unlisted), but most generate high single digit margins. Except for FY24 that saw an EBITDA margin of 21 percent, Medi Assist has historically delivered an EBITDA margin in range of 23-25 percent. The key differentiator for Medi Assist is its scalable tech-enabled infrastructure. Technology use has enabled it to steadily increase the processing volume without having to correspondingly increase the employee base, thus optimising operating expenses and driving profitability in the past few years.

Technology expertise will be the competitive advantage for the company going forward and drive profitability.

The company had net cash balance in the books of Rs 245 crore at the end FY24 even after the acquisitions done in the past 12-15 months. It delivered an ROE (return on equity) of 19 percent in FY24.

Valuation premium justified by business moats

Medi Assist’s stock has risen 18 percent over its IPO price after its listing in Jan ’24. The company is trading at a valuation of 26 times estimated earnings for FY26, which is reasonable considering an ROE of 19% in FY24.

The valuation can re-rate given the annuity like revenues, high operating leverage, and dominant market position in a growing industry.

Given the sectoral tailwinds and Medi Assist’s vantage positioning, we expect the stock to be a long-term compounder. Long-term investors should accumulate the stock in a staggered manner.

Bymoneycontrol