What’s the Nifty upside in the Modi victory rally?

Given the possibility of market volatility, investors should buy the lows for a meaningful return.

Highlights

-

- Possible Modi victory removes a key overhang, although on expected lines

-

- Domestic macro in fine fettle, global improving

-

- Earnings growth to remain supportive

-

- We see upside in the Nifty Index in the near and medium term

- The road ahead has many potholes, so strictly buy the lows

The markets have given a big thumbs-up to the likely start of Modi 3.0 as all exit polls have predicted a landslide victory for the ruling NDA. The latest GDP numbers have been an icing on the cake too. With the election outcome on expected lines, it puts to rest a key domestic uncertainty.

The Nifty comfortably reclaimed and handsomely crossed Mount 23K on Monday morning — it had slipped from 23k level last week due to pre-poll jitters. Given the exit poll trend, the question now is whether investors sitting on the fence, expecting a correction, should rush to the market driven by the FOMO (fear of missing out) factor.

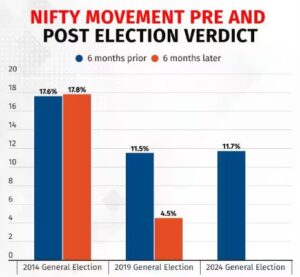

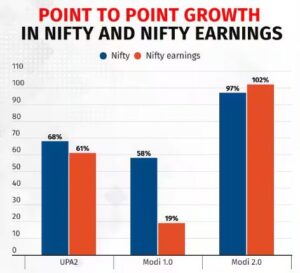

It is important to remember that the 6-month return of the Nifty in the run-up to the 2024 Lok Sabha elections has been similar to 2019. However, India’s earnings growth has steadily picked up, rendering the valuation more reasonable compared to 2019.

The Nifty 50 earnings grew a healthy 25 percent in FY24 and domestic cyclicals were key drivers of earnings. With the economy in fine fettle, assurance of political stability, and the expectations of soft landing in the world’s largest economy, Nifty earnings are expected to grow at a CAGR of 15 percent in the coming two years.

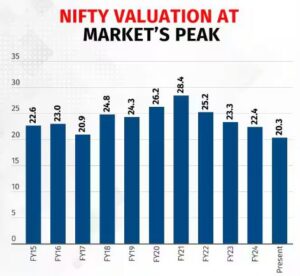

Going by the median valuation of 23.8X one-year forward earnings at the peak, we can expect Nifty to rally to 27,000 — an upside of 17 percent from the current level in the absolute bull case scenario in the coming one year.

The potholed road ahead

However, this isn’t going to be a one-way street for the markets. Geopolitics remains a nagging trigger for correction. Rate action by the US Fed, America’s presidential election, and China’s growth outlook are the key global events that could be predictable sources of volatility.

At home, the buzz on higher capital gains tax on equities, the tone of incremental reforms, outcome of the monsoon, and the pragmatism of the Union budget would be key determinants for market movements. Hence, while remaining convinced about the overall direction, we see a volatile journey for the Nifty. Investors can better their return expectations by going long on any correction than buying into the rally.

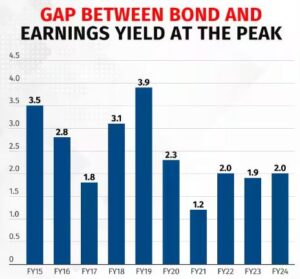

Bond yield earnings yield gap at the peak

The other tool that has a great degree of accuracy in predicting market top and bottom is the analysis of the gap between bond yield and earnings yield. The gap widens at the top as earnings yield declines and narrows at the bottom as equities get cheaper and earnings yield improves.

At the peak of the market, the gap between bond yield and earnings yield has ranged between 1.2 percent and 3.9 percent in the past 10 years, with a median gap of 2.2 percent and mean gap of 2.4 percent, which is higher than the current gap of 2 percent. Going by this analysis, the Nifty has the headroom to rally another 5 percent from the current level in the near term.

While we see value in the large-cap Nifty index, investors should be wisely buying the lows for a meaningful return.

Bymoneycontrol