Hindustan Aeronautics: On a high-altitude orbit

Strong balance sheet, monopolistic business, and other factors augur well for the company.

Highlights

-

- Expanding production capacity to support growth and meet increasing demand

-

- Improving execution and orders in hand are driving higher revenue growth

-

- Earnings guidance remains strong, supported by current orders and efficient execution

- The stock is reasonably valued, given the earnings growth and balance sheet strength

Since its IPO in 2018 at Rs 620 (post-split), we at MC Pro have been bullish about the prospects of Hindustan Aeronautics (HAL)(CMP: Rs 5462, Market capitalisation: Rs 3,65,284.91 crore, Stock Rating: over weight). Our confidence in the company stemmed from the opportunities in the industry, the monopolistic business, strong balance sheet, high entry barriers, cash in the books, high technical capabilities, and orders in hand.

While the stock has done exceptionally well, it can do even better despite the slightly higher valuation. More so because of the upcoming new facilities and the growing order book.

Huge expansion to increase capacity significantly

The company recently inaugurated a new facility to support the production of Launch Vehicle Mark-3 (LVM-3) for ISRO’s space programme. HAL will manufacture all the critical components which will support six LVM-3 in a year as against two LVM-3 in the past.

It is embarking on an ambitious expansion plan that includes building Asia’s largest helicopter facility. The first phase of this project, expected to be completed by October 2024, will produce 30 helicopters, with the capacity set to double to 60 in the second phase. HAL is working on building different capabilities and intends to incur a capital expenditure of Rs 14,000-15,000 crore annually over the next five years to boost production.

In addition to expanding the physical infrastructure, HAL is enhancing its technological capabilities through strategic partnerships. A notable collaboration with GE Aerospace on advanced GE 414 engines positions HAL as a global player with the state-of-the-art technology. This commitment to innovation aligns with HAL’s export aspirations. Aiming to tap international markets, HAL is exploring opportunities in countries such as Argentina, the Philippines, Egypt, Southeast Asia, and more. Although exports make up only 1 percent of HAL’s total revenue, HAL’s focused efforts in this area indicate a potential for growth in the future.

Strong pipeline of orders

Moreover, these new facilities will be critical at a time when existing orders are growing and execution is expected to be high. Last month, the Ministry of Defence issued RFPs to procure 156 light combat helicopters. This is a big order and will support growth in the coming years. Its order book stands at Rs 94,000 crore (3 times FY24 revenue) and the management expects this to jump to Rs 1,20,000 crore by the end of the current fiscal. It is expecting orders worth around Rs 1,60,000-1,70,000 crore in the next 18 months to three years.

Execution is improving

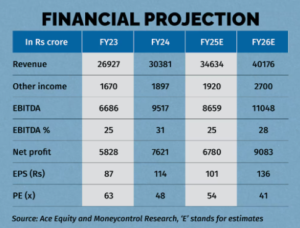

The company reported a strong financial performance in the March quarter and fiscal 2024. Revenues grew 18 percent in Q4, driven by a healthy backlog of orders and efficient execution. This positive trend continued throughout the fiscal year, with year-on-year growth of 13 percent fuelled by large contracts such as Dornier Aircraft and Tejas MK-1A.

The company’s profitability soared in Q4, with a 52.2 percent increase in net profit. This improvement was largely due to a 1398-basis-point jump in the EBITDA margins. Reduced cost pressures, effective outsourcing, improved internal cost management, and economies of scale all contributed to this margin expansion.

Valuations

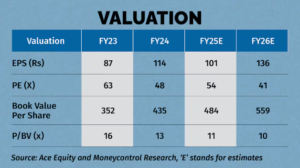

Since earnings visibility is improving, the stock is reasonably valued at 41 times its fiscal 2026 estimated earnings despite the recent run-up in its price. Moreover, with predictable and sustainable growth, the stock should continue to trade at premium valuations.

Bymoneycontrol