Accenture’s Q3 earnings report: any cheer for Indian IT?

No incremental deterioration in the demand environment and orders are driven by large-scale transformation projects.

Highlights

-

- Accenture’s report largely in line

-

- Order booking strong, green shoots in consulting

-

- Meaningful progress reported in Generative AI

-

- Demand environment no different from the past

-

- We expect commentary from Indian IT players to be similar

-

- Huge order backlog should drive execution in FY25

- Investors should tactically go overweight on IT

Accenture’s reported numbers lacked the sparkle. However, bookings showed strength and the commentary on progress in Gen AI does point to the company’s pole position in capturing the opportunity in this new technology once it gathers momentum. What does all these translate for Indian IT companies?

Our takeaway from Accenture’s Q3 earnings

Reported revenue at $16.5 billon was down 1 percent YoY in US dollar, with consulting revenue down 3 percent while revenues from managed services rose 2 percent. Adjusting for a higher forex impact, Accenture’s third-quarter fiscal 2024 revenues were slightly above the midpoint of its guided range.

In terms of markets, North America was positive, whereas EMEA (Europe Middle East and Africa) showed a decline and growth markets too declined due to currency impact. Turning to verticals, health and public services continued to show strength, while Communication Media Technology as well as Financial Services showed a decline. Adjusted margin saw an improvement of 10 basis points YoY.

Order inflows were strong. The quarter saw $21.1 billion of bookings, a 22 percent increase in dollar terms and 26 percent in local currency YoY. While consulting new bookings were $9.3 billion, managed services were $11.8 billion.

Thanks to the higher foreign exchange impact of a negative 0.7 percent compared with fiscal 2023, the company has revised downwards the full-year revenue guidance to 1.5-2.5 percent compared with 1-3 percent that was guided earlier. For Q4, revenue is expected to be in the range of $16.05-16.65 billion, or 2-6 percent in local currency.

What’s so good about the earnings report?

The Accenture’s management alluded to no incremental deterioration in the demand environment although discretionary spending is yet to come back, and orders are driven by large-scale transformation projects where the conversion is typically slower. The total number of large clients (above $100 million) at 92 is higher by 7 this year. Consulting is also showing signs of early uptick.

Accenture is benefitting from businesses looking to adopt Gen AI to strengthen their digital core first.

Accenture’s strategic focus on client needs and significant milestones in Generative AI are yielding results with $900 million bookings from Gen AI in Q3 and $2 billion year-to-date, while revenues are $500 million so far. The M&A engine is also firing with 35 deals amounting to $5.2 billion of capital deployed year-to-date.

Why IT could be a tactical call now?

Indian IT stocks have done reasonably well in recent times with returns slightly ahead of the Nifty in the past one month. Many players have so far alluded to the bottoming out of the demand slowdown and early green shoots of a demand pickup and the return of discretionary spending. Accenture’s commentary seems to somewhat echo that as well.

The long-term secular technology demand is undeniable. With a higher probability of a soft landing (averting recession) in the US, the environment should start getting better from the second half of fiscal 2025.

We expect Q1 of FY25 to reflect cautious optimism on the demand environment as the sector stands at the crossroads of macro challenges and a major disruptive technology change.

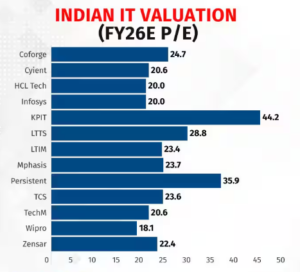

With global macro challenges waning incrementally and pressure points emerging on growth/valuation of domestic plays, a portfolio diversification may warrant higher allocation towards IT. We are tactically overweight on IT, although we remain selective on names that are better equipped to navigate the technology disruption.

Bymoneycontrol