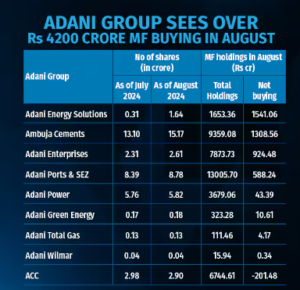

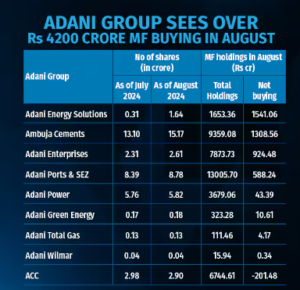

Further, mutual funds were net buyers in eight of the group’s listed entities with only ACC witnessing marginal selling.

In August, Adani Energy Solutions and Ambuja Cement saw the highest amount of mutual fund investments, with Rs 1,541 crore and Rs 1,308 crore, respectively. The surge in Adani Energy Solutions was fuelled by a $1 billion QIP, while Ambuja Cement’s rise came from a Rs 4,250 crore block deal.

Other Adani Group stocks also attracted mutual fund investments in August. Adani Enterprises led with Rs 924 crore, followed by Adani Ports & SEZ at Rs 588 crore. Adani Power saw Rs 44 crore, Adani Green Energy Rs 11 crore, Adani Total Gas Rs 4.17 crore, and Adani Wilmar Rs 34 lakh. Meanwhile, ACC witnessed mutual fund outflows of Rs 201 crore.

In terms of fund houses, SBI Mutual Fund led the buying in Adani Energy Solutions with Rs 740 crore, followed by Tata MF and HDFC MF with Rs 237 crore and Rs 202 crore, respectively. Other notable buyers included Bandhan MF, Helios MF, Axis MF, and Whiteoak MF, investing in the range of Rs 10-60 crore each.

In Ambuja Cement, Invesco MF was the top buyer with Rs 231 crore, followed by Mirae Asset and ICICI Prudential, which bought Rs 193 crore and Rs 97 crore, respectively. Kotak MF, Tata MF, Baroda BNP Paribas MF, Edelweiss AMC, and SBI MF also invested between Rs 10-60 crore each.

In Adani Enterprises, Invesco was the top buyer with Rs 319 crore, followed by Aditya Birla Sun Life MF and Kotak Mahindra MFs, investing Rs 132 crore and Rs 65 crore, respectively. For Adani Ports, SBI Mutual Fund led the buying with Rs 261 crore, while Kotak MF and ICICI Prudential MF invested Rs 129 crore and Rs 100 crore, respectively.

Interestingly, the steady rise in mutual fund buying in the diversified conglomerate comes even as most asset management companies chose to stay away from the group earlier even as there was a huge spike in stock prices of all the listed entities of the group.

Bymoneycontrol

Insidesmarket.com