Aditya Birla Capital: Recalibrating growth in unsecured loans

NBFC portfolio to double in size in the next three years with key growth drivers in place.

Highlights

-

- Positive trends in lending business

-

- Retail & SME share to increase and aid margins

-

- Fintech concerns abate

-

- Sharp traction seen in Udyog Plus

-

- Asset management business improves

-

- Life insurance business growth softens

-

- Health insurance loss rises on seasonality

Aditya Birla Capital (ABCL; CMP: Rs 185; Market cap: Rs 47,950 crore; Rating: Equal-weight)

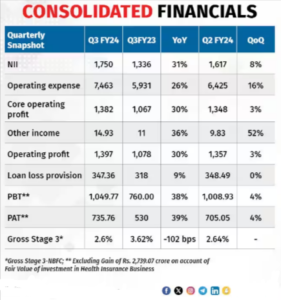

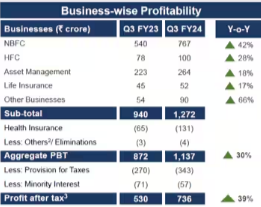

has posted strong numbers in the quarter ended December 2023 (Q3 FY24) with net profit rising 39 percent year on year (YoY) on the back of strong growth momentum across businesses.

Aditya Birla Finance Limited or ABFL: The sequential disbursement growth was muted, but asset under management (AUM) is growing at a healthy rate (up 5 percent QoQ) and reached Rs 98,601 crore in December.

The growth in secured business loans (40 percent AUM mix) was driven by a rising share of loan against property (LAP) and micro-LAP (500 bps YoY rise in share to 54 percent of AUM). Sharp growth was also seen in the unsecured portfolio – unsecured business loans and personal & consumer loans grew 38 percent and 53 percent YoY, respectively.

However, ABFL has been reducing the share of unsecured consumer loans by tightening the underwriting norm in small ticket size loans, which led to a 34 percent QoQ contraction in the segment. The trend is expected to continue.

The reduction in small-ticket digital consumer loans led to a decline in its share to below 4 percent of overall personal & consumer loans from 11 percent in Q2. More importantly, the share of these loans sourced from Paytm (fintech partner) reduced to less than 1 percent of the total loan portfolio as of February 2024 (2.5 percent in Q2).

In housing finance, a rising market share is aiding growth, driving a healthy sequential disbursement growth of 7 percent. Consequently, the AUM crossed Rs 16,500 crore in Q3.

ABFL managed to maintain margins despite the rise in cost of bank borrowings due to the increase in risk weights by the RBI. The increase in NHB (National Housing Bank) borrowing mix to 23 percent also helped in keeping the interest cost stable in housing finance.

Better asset mix and lower credit cost (negative provision for housing finance) on the back of an improved asset quality led to a stable return on asset (ROA) across the lending portfolio.

Improved asset quality

About 68 percent of the lending portfolio is secured. Around 58 percent of Gross Stage 3 (GS3) book (gross NPA) is covered under government guarantee schemes.

The NBFC’s asset quality stabilised and credit cost improved, while the successful management of the pre-delinquency portfolio led to 415 bps YoY decline in GS 2&3 ratio to 3.54 percent in the housing loan segment.

Asset management business – strong capital market performance aided profit

The AUM growth was muted sequentially. It reached Rs 3.25 lakh crore in December 2023, while the company saw a sharp rise in net profit (up 17 percent QoQ) backed by growth in equity mutual funds and passive investments.

Insurance businesses – Premium growth better than industry

ABCL has presence in both life insurance (through Aditya Birla Sun Life Insurance Company) and health insurance (through Aditya Birla Health Insurance Company, ABHI).

In life Insurance, individual First Year Premium (FYP) grew 8 percent YoY and the expansion in VNB (value of new business) margin continued. The VNB margin increased by 140 bps QoQ to 15.6 percent, driven by a strong new business growth and product-mix changes.

In health insurance, ABHI was the fastest growing led by a strong growth in the retail business. However, the combined ratio of 121 percent was higher than the overall industry,

Outlook and valuation

The total capital infusion in the NBFC subsidiary was Rs 1,600 crore (Rs 850 crore of fresh capital in Q3), which will fuel the next leg of growth. The key growth drivers remain B2B MSME platform, Udyog Plus, strong synergies within the ABC group’s ecosystem, and branch expansion in emerging geographies. In all, 25 NBFC branches were added in Q3, which will target untapped market in Tier 3/4 towns.

The management expects repricing of lending rates (20-25 basis points) to offset the marginal rise in the cost of funds in the coming quarter. Also, NBFC credit cost is expected to remain at the current level of 1.5 percent. This coupled with a rising share of retail & SME mix (expected to increase to 75 percent from 67 percent currently) will help increase margins to 7.5 percent, driving the ROA in the long term.

The stock valued on a SoTP (sum of the parts) basis indicates full valuation. Investors should wait for dips to accumulate the stock.

Bymoneycontrol