Aptus Value: Is it a good time to add this high-growth housing finance player?

Improved earnings and healthy asset growth along with stable asset quality underlined the performance.

Highlights

-

- Robust growth with sustained profitability

-

- Disbursement momentum to pick up in the coming quarters

-

- Undrawn credit lines to lower funding cost, aid margins

-

- Substantial improvement in collection and reduction in overdue

-

- Valuation reasonable considering the promising outlook

- Management transition needs to be monitored

The stock of

(Aptus; CMP: Rs 284; M Cap: Rs 14,230 crore) has underperformed the market, correcting about 10 percent in the past one year despite a healthy earnings show.

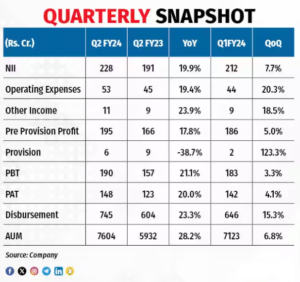

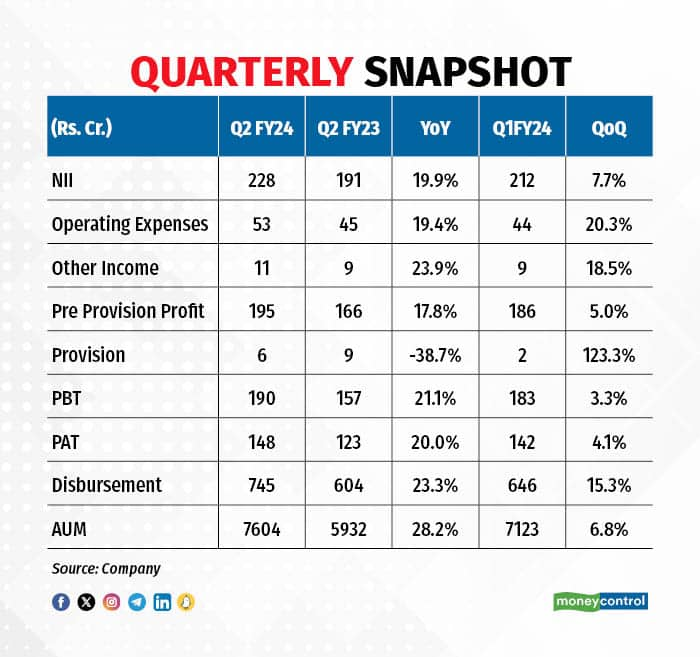

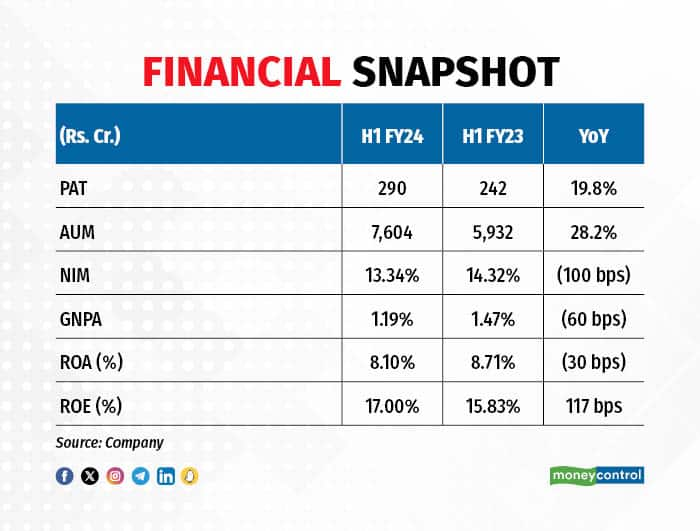

The business growth was healthy in the September quarter (Q2 FY24), backed by branch expansion and the strategic addition of new states. Net earnings increased 20 percent on a year-on-year basis (YoY) to Rs 148 crore in Q2 FY24. Moreover, asset quality stabilised on the back of efficient collections and return ratios remained above the peers.

Perhaps, the upcoming management transition has weighed on the stock performance. M. Anandam, founder promoter (25 percent stake) and former managing director (MD), will retire at the end of his tenure on December 24, 2024, making way for Balaji P., the newly appointed MD.

Although the stock has a limited trading history, it could be a promising buy for investors with a high risk appetite.

Q2 FY24 Update

The company’s performance in the September quarter indicates a sustained growth trajectory.

Loan growth momentum sustained, outlook encouraging

The management is confident of maintaining the current sequential growth of around 15 percent to reach the target disbursement of Rs 3,400 crore in FY24 (Rs 2,100 crore – housing finance loans/HFC).

The management maintained an AUM growth guidance of 35 percent on the back of consistent loan growth across housing loans (HL) and small business loans (SBL). The outlook remains positive, considering the large headroom available in the low and middle-income segment in Tier 3/4 cities.

Stable asset quality

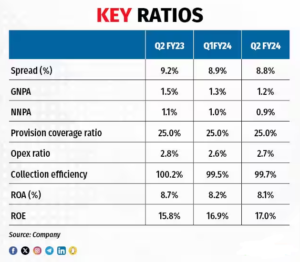

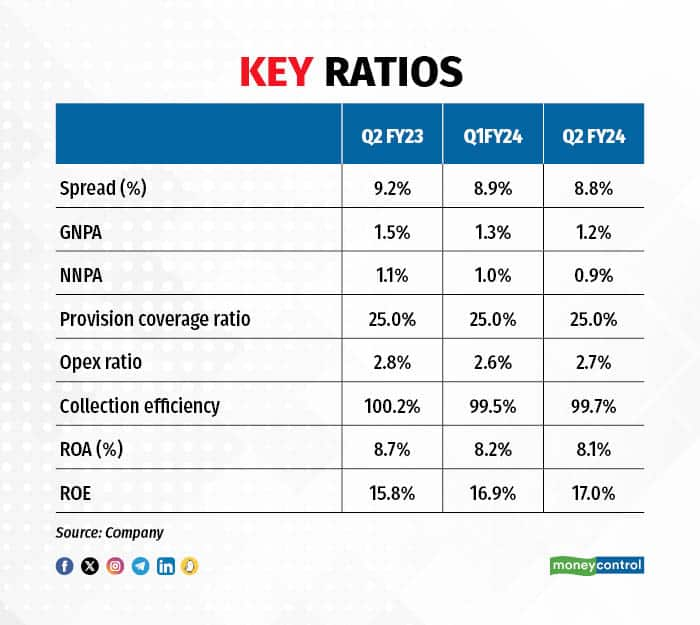

The collection efficiency improved during the quarter, while the GNPA and the NNPA (non-performing assets) ratios were stable at 1.2 percent and 0.9 percent, respectively, in the quarter.

Improved profitability

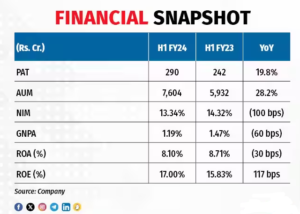

The net interest margin (NIM) saw a compression of 100 basis points YoY to 13.3 percent in H1 FY24 due to higher cost of funds.

The opex-to-asset ratio was higher as expenses increased largely due to branch expansion (19 branches opened in Q2) and higher employee cost.

The yield will likely increase in the coming quarters as Aptus has increased the interest rate in the non-HL segment by 50 basis points (bps) from September 2023. This coupled with a better funding cost will keep margins stable going forward.

The spread stabilised at 8.8 percent in Q2 and will sustain in the 8.5-9 percent range in FY24.

Aptus Value: Is it a good time to add this high-growth housing finance player?

Improved earnings and healthy asset growth along with stable asset quality underlined the performance

aa

Highlights

-

- Robust growth with sustained profitability

-

- Disbursement momentum to pick up in the coming quarters

-

- Undrawn credit lines to lower funding cost, aid margins

-

- Substantial improvement in collection and reduction in overdue

-

- Valuation reasonable considering the promising outlook

- Management transition needs to be monitored

The stock of

Aptus Value Housing Finance(Aptus; CMP: Rs 284; M Cap: Rs 14,230 crore) has underperformed the market, correcting about 10 percent in the past one year despite a healthy earnings show.

The business growth was healthy in the September quarter (Q2 FY24), backed by branch expansion and the strategic addition of new states. Net earnings increased 20 percent on a year-on-year basis (YoY) to Rs 148 crore in Q2 FY24. Moreover, asset quality stabilised on the back of efficient collections and return ratios remained above the peers.

Perhaps, the upcoming management transition has weighed on the stock performance. M. Anandam, founder promoter (25 percent stake) and former managing director (MD), will retire at the end of his tenure on December 24, 2024, making way for Balaji P., the newly appointed MD.

Although the stock has a limited trading history, it could be a promising buy for investors with a high risk appetite.

Q2 FY24 Update

The company’s performance in the September quarter indicates a sustained growth trajectory.

Loan growth momentum sustained, outlook encouraging

The management is confident of maintaining the current sequential growth of around 15 percent to reach the target disbursement of Rs 3,400 crore in FY24 (Rs 2,100 crore – housing finance loans/HFC).

The management maintained an AUM growth guidance of 35 percent on the back of consistent loan growth across housing loans (HL) and small business loans (SBL). The outlook remains positive, considering the large headroom available in the low and middle-income segment in Tier 3/4 cities.

Stable asset quality

The collection efficiency improved during the quarter, while the GNPA and the NNPA (non-performing assets) ratios were stable at 1.2 percent and 0.9 percent, respectively, in the quarter.

Improved profitability

The net interest margin (NIM) saw a compression of 100 basis points YoY to 13.3 percent in H1 FY24 due to higher cost of funds.

The opex-to-asset ratio was higher as expenses increased largely due to branch expansion (19 branches opened in Q2) and higher employee cost.

The yield will likely increase in the coming quarters as Aptus has increased the interest rate in the non-HL segment by 50 basis points (bps) from September 2023. This coupled with a better funding cost will keep margins stable going forward.

The spread stabilised at 8.8 percent in Q2 and will sustain in the 8.5-9 percent range in FY24.

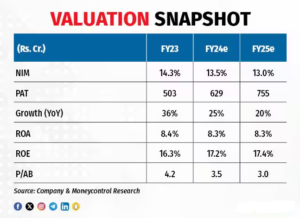

Outlook and valuation

Contiguous branch expansion to support the growth envisaged

The strong growth momentum seen in Q2 will continue in H2 FY24, primarily driven by increased penetration in the existing geographies, the commencement of operations in Odisha and Maharashtra, and stronger digital adoption across segments. Aptus plans to add 30-35 branches annually.

Stable NIMs on the back of a better product mix

Aptus charges around 21 percent to SBL (small business loans) customers, while the yield in HFC is in the 14-15 percent range (on the HL). The NHB (National Housing Bank) refinance is expected to lower the current incremental cost of borrowings of around 8.3 percent by around 50 bps, further aiding profitability.

We like Aptus among the affordable housing finance companies, given the niche customer focus, strong pricing power, and improving asset quality. Strong demand and network expansion will likely drive the long-term growth.

At the current market price, Aptus is trading at 3.0 times FY25 estimated book value. The valuation seems reasonable on the back of robust return ratios (RoA above 8 percent) and a higher earnings growth potential. Investors should remain watchful of the management transition.

Bymoneycontrol