Axis Bank Q2 FY24 – Decent quarter amid deposit challenges

Highlights

-

- Steady quarter with healthy core pre-provision profit

-

- Advances strong, supported by all segments

-

- Deposits continue to lag advances, remain an area of focus

-

- Fees offer strong support to earnings amid treasury losses

-

- Costs elevated, have some one-time element

-

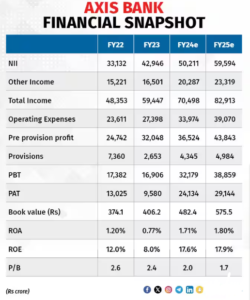

- We see long-term levers of RoA expansion

-

- At a valuation discount to peers, add for the long term

(CMP: Rs 955, Market cap: Rs 294,481 crore, Rating: Overweight) reported a steady show in the second quarter with continued acceleration in loan book growth, stable interest margin, supportive core fees, and improving asset quality. Costs remained elevated partially due to the Citi integration, certain one-offs, and technology investments while deposits continued to pose a challenge. However, we see levers for RoA (return on asset) improvement in the medium term and expect the valuation discount to peer private banks to narrow.

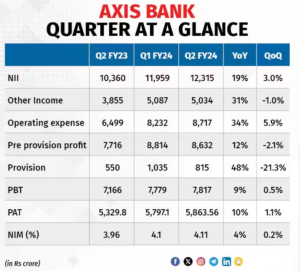

Q2 FY24 – steady quarter

he core pre-provision profit, excluding trading income, also grew 12 percent year on year (YoY) and sequentially over 5 percent.

Loan growth momentum strong

The healthy rate of growth continued with advances growing 23 percent YoY and 4.5 percent sequentially, aided by all the three segments of retail, SME, and corporate. The share of relatively higher yielding retail and SME is now 69 percent. Growth in unsecured has been faster and the share is now close to 14 percent of net advances. However, with the risk-weighted asset intensity remaining steady around 67 percent, we have reasons to believe that the overall quality of the book is stable. Given the macro outlook, it is confident of growing its book by at least 400-600 basis points ahead of the system.

Stability in net interest margin

Contrary to our expectations, Axis Bank saw 1-basis-point sequential improvement in net interest margin at 4.11 percent as the 14-basis-point sequential gain in interest-earning assets was almost matched by the rise in cost of funds. The management alluded to a sequential gain of 3 basis points coming from interest on income tax refund and one-offs.

The bank, so far, has seen an extremely measured increase in the cost of deposits as it tried to work on the quality of deposits. Going forward, deposit repricing will take place, but the pace of increase will be slower. The bank will see 69 percent floating and 47 percent of the fixed book maturing in less than a year. Overall we do not expect significant margin contraction.

The bank still has long-term structural levers of margin gains, such as a better loan mix in favour of high-yielding assets, reduction in the proportion of low-yielding RIDF bonds, and improving low-cost CASA.

Asset quality strong

The gross slippage ratio (annualised) at 1.49 percent declined 39 bps YoY and the net slippage ratio (annualised) was at 0.59 percent. The gross slippage was the lowest in the past 12 quarters. The bank saw a decline in annualised gross and net credit cost to 70 basis points and 42 basis points from 74 basis points of gross and 50 basis points of net annualised credit cost in the previous quarter. The gross and net NPA stood at 1.73 percent and 0.36 percent respectively with a provision cover of 79 percent. The bank carries an excess provision of Rs 5012 crore (56 basis points of loan book) for Covid. The restructured asset reduced to 19 basis points of gross customer assets and carries a provision of 21 percent.

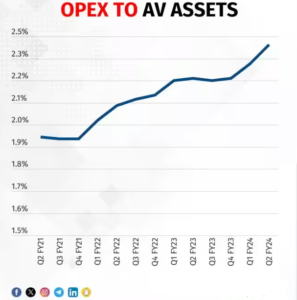

Opex remains elevated

The bank saw a significant increase in operating expenses – sequentially by 6 percent, taking the cost-to-income ratio to over 50 percent. A part of the increase was due to some one-off in the cards business not quantified by the bank and a part due to the Citi integration. However, the lion’s share of the increase was on account of spending on technology. The opex to average assets rose to 2.41 percent and the bank has the target to bring it down to 2.11 percent in the medium term. As the upfront costs in retail business starts yielding results, we expect the opex to assets ratio to gradually moderate.

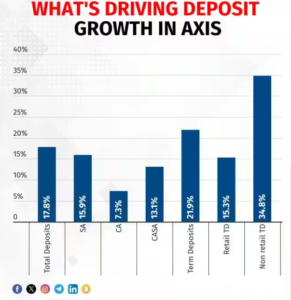

Deposit remains a formidable challenge

Axis Bank so far had compensated the slower pace of deposit growth by drawing down on excess LCR (liquidity coverage ratio). However, going forward, deposits remain critical to the growth journey. In Q2, the YoY and sequential growth in deposits at 18 percent and 1.5 percent, respectively, lagged credit growth and has taken the credit-to-deposit ratio to a level of 94 percent. Like the peers, growth was driven by term deposits and the low-cost CASA (current and savings account) share declined nearly 200 basis points YoY to 44 percent. The slower growth in retail term deposits also warrants focus.

The bank is well capitalised with CAR (Capital Adequacy Ratio) at 17.84 percent, CET 1 ratio of 14.56 percent, and net accretion to core capital of 18 bps in Q2. Fees growth has been strong at over 31 percent YoY and the bank is spending to win market share. While credit cost seems to have nearly bottomed out, in the medium term we see the possibility of RoA expansion on the back of a structural improvement in margins and a lower cost-to-income ratio as the operating leverage benefit plays out. Long-term investors should look at Axis as it gradually narrows valuation discount with larger peer banks.

Key risks: Unexpected future disruption due to macro uncertainty impacting growth and substantial worsening of asset quality. Citi integration turning out to be a drag on costs/profits.

Bymoneycontrol