BIS blueprint for Future Monetary System

BIS blueprint for Future Monetary System – fusion of new technology with trust of Central Banks

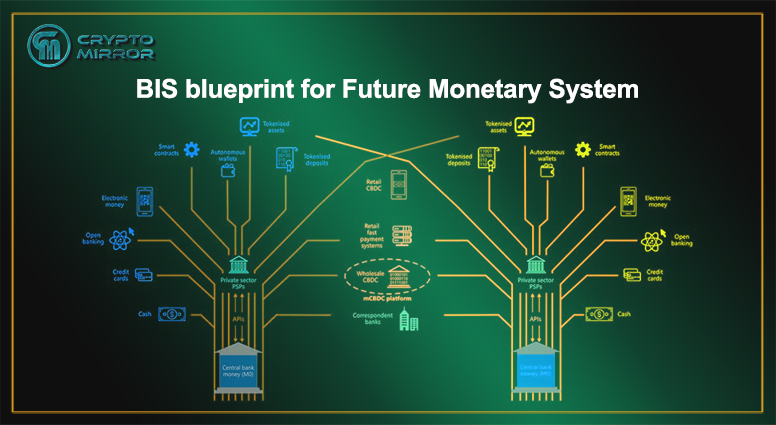

Bank for International Settlements (BIS) recently released a blueprint for future digital monetary system. They suggested that the monetary system based on central banks digital currency as the foundation could foster innovation while safeguarding stability and security.

BIS is an umbrella body for central banks. They suggested in their upcoming annual report that the future recourse for a better safer, stable, open and accountable digital money is only with the digital version of sovereign currency, rolled out by Central Banks.

Crypto turmoil and BIS’ attack on Crypto

Recently crypto world faced a lot of turmoil. The market prices of cryptos plunged and some big crypto exchanges announced layoffs. Crypto enthusiasts always claimed that crypto assets are a way to beat inflation and would never be affected by macroeconomic forces. However, the last few weeks have shown that even crypto assets are susceptible to changes in interest rates etc.

This all has led to loss of confidence in the crypto ecosystem. And BIS is one of the biggest critics of the crypto-based financial system. According to BIS General Manager, Agustin Carstens, there is structural problem in crypto assets. He said the collapse of Terra, 70% slump in Bitcoin and the current market conditions are indicators that this could not be the future of money.

His further commented that, “the soul of money belongs neither to a big tech nor to an anonymous ledger. The soul of money is trust.” And Central Banks worldwide have the trust that is required to build a system capable of adapting continuously to serve the public interest. The conclusion of the BIS report is that CBDC’s should use underlying technology of crypto crypto cannot fulfil the role of money.

What experts say about “CBDC’s can do it better”

The BIS Annual Report will release on 26th June. However, the glimpse of the summary on crypto has created ripples around the world, especially ‘the trust’ comment from Agustin Carstens.

According to Ben Caselin, Head of Research & Strategy at Crypto Exchange AAX, BIS is a legacy institution protective and in favor of legacy vision for digital money. The current monetary system already suffers from policy changes and countries economic policies, inflation etc. CBDC’s would be the same, suffer from same pressures without giving the global equality that crypto can provide.

Crypto has seen massive adoption in the last few years. It is still in nascent stage and it is only natural that we would see projects come and go. Failure of Terra is an indicator of the scope in the crypto ecosystem. According to experts, crypto will come in force and rule the world. The technology is the unsurpassed we only have wait for the best to come out of this market situation. For many the situation is similar to the dotcom boom.

However, according to the report, this would only serve to strengthen the central bank monetary system. Programmability, composability and tokenization built on top of CBDC’s will be the future monetary system, the report said.