Britannia Industries: Execution of volume growth guidance remains crucial

Key Highlights:

-

- Maintains market leadership in core business

-

- Adjacent business to grow faster

-

- Margin compression likely on higher project cost, commodity inflation

-

- Distribution expansion in focus states and rural market aiding growth

- Long-term investors should wait for better price levels

The Q4FY24 results of Britannia Industries (BIL; CMP: Rs 4,745; Market capitalisation: Rs 1,14,296 crore; Rating: Equal weight) were subdued, but in line with expectations.

Despite heightened competition and tepid demand scenario, Britannia managed to grow volume at a higher rate than peers in the quarter.

The stock surged 10 percent after the Q4 earnings commentary on May 6, 2024, primarily related to the volume growth surprise and a positive outlook.

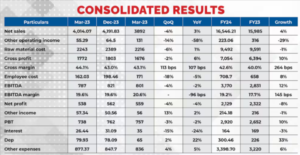

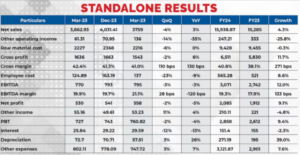

March-quarter performance

Britannia took price interventions as inflation softened. This, coupled with faster volume growth in Q4 (double the sales growth), led to a 3 percent YoY growth in top line. In FY24, volume growth was at par with sales growth.

Britannia continued to promote premium products by leveraging high-growth channels in the adjacent categories (non-biscuit businesses contributed around 25 percent to revenue). In terms of categories, bread and cheese continued to deliver a healthy growth, while rusk saw double-digit volume growth in Q4. The company will leverage the ongoing summer season with a focused distribution to drive growth in the drinks business.

Innovation continued in the core categories, while fresh launches was seen across diverse categories, including non-biscuit products like rusk and dairy. This contributed more than Rs 275 crore on an annualised basis.

With respect to the growing cheese business, commercialisation of the cheese factory at the Ranjangoan plant was completed in Q4. The dairy business outlook remains positive, led by large investments in the business and strong partnership (joint venture) with Bel SA for cheese production.

Raw material prices were soft. Flour and sugar prices saw inflationary trends, offset by lower palm oil and packaging material costs, driving gross margin expansion. However, higher ad spends and other expenses have more than offset the benefit of gross margin gains, leading to a 96 bps YoY contraction in the EBITDA margin.

Britannia’s cost-efficiency programme helped it save around 2 percent of revenue in Q4.

International business performed well and saw consistent growth in revenue and profitability.

Outlook and valuation

Pricing competitiveness in focus states helped Britannia to maintain leadership position in the biscuit business in FY24. The company continued its distribution expansion in focus states and rural markets. This, coupled with more brand investments and pricing action, will drive market share in the coming period.

Demand trajectory will remain the key driver for top-line growth. The adjacent business is expected to grow 1.5 times faster than the core biscuit business, led by channels like modern trade and e-commerce, which grew in double digits in Q4. Volume growth will improve on the back of better monsoon after the general elections and is guided to grow in double digits in FY25, as per the management.

The route-to-market project will expand the total addressable market (TAM), with improved service and right brand placement in key outlets. This, coupled with its rural distribution expansion plans, offers a huge potential for top-line growth in the long term.

While new category growth will slow due to the consolidation of already launched products, the company will continue to invest behind core brands and launch new products.

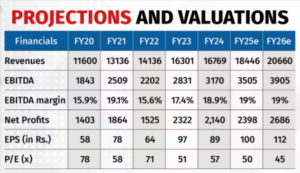

Britannia has maintained relatively higher margins despite intense competition. We believe price hikes in select brands where Britannia has the pricing power, and cost-efficiency programmes will continue to support margins. However, EBITDA margin could see marginal contraction on the back of commodity inflation and on-going project-related costs. Britannia anticipate 3 percent inflation in FY25.

The stock is trading at 45x FY26e P/E, in line with average P/E. Once rural demand picks up, better execution and reasonable valuation could offer a decent upside.

Bymoneycontrol