Capital Small Finance Bank – Why the time is right to look at this stock

Unlike most SFBs, Capital’s loan book is largely secured and the liability profile is granular.

Highlights

-

- Tepid debut in February, significant underperformance thereafter

-

- Loan growth picking up

-

- Relatively insulated book from loan waiver buzz — dominated by secured loans

-

- Gradual NIM expansion as CD ratio improves

-

- Non-interest income remains the next area of focus

-

- Operating expenses unlikely to decline in a hurry

-

- With benign credit cost, gradual uptick in RoA expected

-

- Valuation reasonable post the steep correction

Capital Small Finance Bank (Capital SFB, CMP: Rs 345.5, Market Cap: Rs 1556, Rating: Overweight) had a tepid debut in February. Till date the stock has fallen 26 percent from its IPO price. Does the correction merit a look as the SFB has a secured asset book and granular liability profile?

Capital SFB operates mainly in Punjab and four other northern states in India along with the Union Territory of Chandigarh. Unlike most Small Finance Banks (SFBs), it lends to the middle-income group (Rs 4-40 lakh annual income), has built a relationship-based banking model, and has a secured asset book.

Loan growth picking up

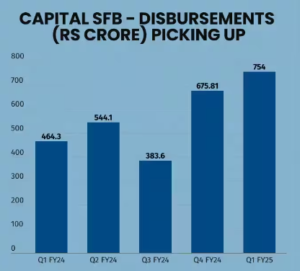

Despite its very small size, the growth in advances from FY19 to FY23 had been at a CAGR (compounded annual growth rate) of 15 percent and the book grew 12 percent YoY in FY24. However, loan growth has accelerated to 16 percent YoY in Q1 with sequential growth inching up to 4 percent. The traction in disbursements also point to a steady pick-up.

Relatively de-risked asset book

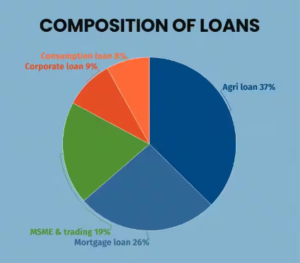

The entire book (almost 99 percent) is secured unlike the unsecured micro-finance loaded book of most SFBs (Small Finance Banks). The portfolio is granular with an average ticket size of Rs 14.2 lakh.

The management has clarified that its agri-lending is to middle-income farmers (loan size of Rs 5-25 lakh) who do not come under the ambit of loan waivers and the exposure is backed by collaterals. Hence, even if credit culture worsens due to loan waiver, it is unlikely to impact its portfolio quality.

Granular liability book

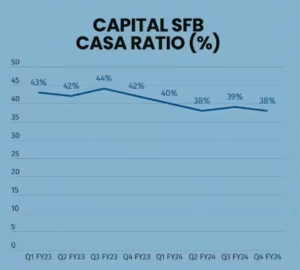

On the liability size, the emphasis is on granular. With a relationship-based approach to banking, close to 94 percent of the deposits are retail and with 91 percent rollover of term deposits, the base is fairly stable. The bank has also built a commendable CASA (low-cost Current and Savings account) base that is comparable to large commercial banks despite not paying high rates on savings account like peer SFBs.

Thus, Capital SFB’s cost of deposits stood at 5.6 percent at the end of the fiscal and is comparable to several private sector commercial banks. It expects the cost of funds to peak out in another quarter, should systemic rates remain stable.

NIM uptick

Capital SFB’s spreads have been stabilising. With deposit repricing largely over, the spread compression is unlikely. However, on the back of an improving CD (credit to deposit) ratio post the capital infusion of Rs 450 crore through an IPO, it expects some improvement in NIM (net interest margin).

Non-interest earnings in focus

Capital SFB’s performance on the non-interest earnings front has under-performed competition as the focus was solely on adding new customers. With a decent customer base and an array of tie-ups on the product distribution side, it now expects cross-selling and uptick in non-interest earnings.

Costs to remain sticky

To build a completely granular liability and secured granular asset book, a lot of expenditure has been incurred upfront, leading to a very high operating expenses ratio. The opex-to-assets at close to 3 percent is much higher than competition and unlikely to fall in the next couple of years as the expansion spree continues. A meaningful decline is expected post this build up which remains an important driver of an RoA (return on assets) improvement in the medium term.

Secured assets lend stability to asset quality

Thanks to the secured asset book, the bank did not face any asset quality issues during Covid. It has almost zero write-off and very low credit cost which is comparable to the best in class in the industry.

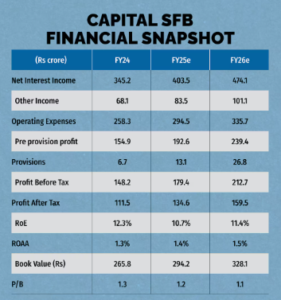

Why a gradual uptick in RoA

Despite a very decent interest margin, Capital SFB has a modest RoA of 1.3 percent, thanks to lower non-interest earnings and significantly higher operating expenses to assets. It expects a modest uptick in the RoA in the next couple of years, thanks to NIM expansion and a pick-up in non-interest earnings. However, in the long run, a drop in opex could be the real trigger.

Post the correction, the stock offers value and could be added gradually. However, while Capital SFB’s home-market understanding gives it a competitive edge, it remains an investment risk as its sizeable exposure to Punjab makes it vulnerable to the economic fortunes of a particular state.

Bymoneycontrol