Coforge Q4: A large acquisition overshadows a decent quarter

Near-term jitters may be an opportunity for gradual accumulation of the stock for the long term.

Highlights

-

- Coforge delivers in-line growth in Q4

-

- Strong order inflows and backlog lend confidence

-

- Margin expansion lower than expected

-

- A very large acquisition clouds the near-term outlook

- Markets may punish the excessive aggression of a professional management

The stock of Coforge (CMP: Rs 4546 Market Cap: Rs 28,150 crore, Rating: Overweight) has underperformed both the Nifty and the IT index in the past five months, including today (May 3, 2024), as the Street got spooked by a large acquisition, which shows the management’s hurry to achieve the coveted revenue target of $2 billion. That said, the quarter was steady in terms of growth. In fact, it was excellent from the perspective of bookings but a tad disappointing in terms of margin. The fact that the management skipped the revenue guidance for FY25 despite its solid order book raises questions about execution or challenges regarding integration that may consume disproportionate management bandwidth.

However, Coforge is now a board-governed company and run professionally. So the near-term jitters may just be a great opportunity for gradual accumulation for the long term.

A decent quarter

Revenue growth momentum maintained

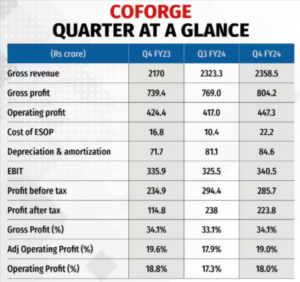

For Q4FY24, the company reported a revenue of $286.8 million showing a sequential constant currency growth of 1.9 percent. However, the growth driver for the quarter was the BFS (banking & financial services). In terms of markets, growth in America was noteworthy.

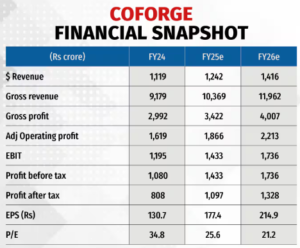

For FY24, the company delivered a revenue of $1.18 billion – Constant Currency growth of 13.3 percent, which was at the lower end of the guided band of 13-16 percent. While sounding confident on the near-term growth and execution, the management, in a significant departure from the past, refrained from giving a growth guidance, which is seen as a big negative.

Margin lower than expected

With a BFS-heavy portfolio, Coforge was impacted by seasonal furloughs. In Q3, the reported operating margin rose by a muted 30 basis points sequentially despite an uptick in gross margin and lower ESOP costs due to the impact of seasonal furloughs. The company was guiding to a sharp sequential 170/180 basis points margin gains.

However, reported operating profit margin (adjusting for ESOP, employee stock option) rose by 70 basis points sequentially to 18 percent in Q4 and adjusted operating margin at 19 percent rose 110 basis points sequentially.

Coforge is confident of margin improvement in FY25 by at least 50 basis points in gross and adjusted operating margin, whereas the reported margin may stagnate due to the new ESOP policy. However, beyond FY25 margin improvement is expected thanks to the peaking out of sales and marketing expenses (now over 15 percent of revenue), higher offshoring (now 52.5 percent and has headroom to improve), stable resource cost as attrition has fallen to a low of 11.5 percent, and improving utilisation, which at 81.7 percent is lower than most peers.

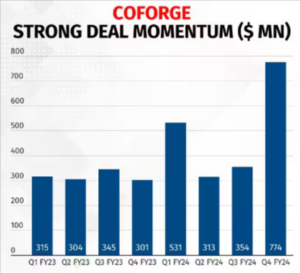

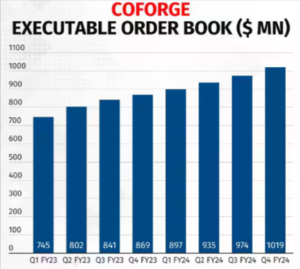

Order inflows extremely strong

Despite the challenging market environment, the company continued traction in deal wins thanks to its aggressive sales and marketing efforts. In Q4, the company won two large deals, including one $400-million deal in BFS and $54 million in insurance, and order inflows stood at $774 million.

For FY24, the company signed 11 large deals and two in excess of $300 million. The executable order book at $1.1 billion rose 17 percent YoY as against 20 percent YoY growth seen at the end of FY23.

Cigniti acquisition – measured step or excessive aggression?

In recent times, the stock of Coforge had reacted negatively to large capital raising plans of Rs 3200 crore primarily to fund its inorganic ambition. The much awaited acquisition was announced with Coforge taking a controlling stake (at least 54 percent) in Hyderabad-headquartered Cigniti Technologies, a listed company at a price of Rs 1415 per share, implying a cash outgo of close to Rs 2086 crore and valuing the target at 23X trailing P/E. While the net margin of Cigniti is similar to Coforge (as Coforge had few exceptional items impacting margin in recent times), the operating margin of Cigniti is much inferior. In fact, the offerings of Cigniti, which is principally digital assurance and digital engineering service, are inherently low-margin compared to Coforge.

Coforge’s rationale for the acquisition was to have three additional industry verticals — retail, hi-tech. and healthcare — through Cigniti. In addition, Cigniti has a good footprint in south-west, mid-west and western parts of the US whereas Coforge is concentrated in the east coast. Coforge has a relatively smaller presence (48 percent of sales) in the US and this acquisition should aid in fortifying presence in a key market. Finally, Coforge believes that testing, which is a principal offering of Cigniti, isn’t going to get eliminated with the adoption of the AI as it believes that the need for testing should increase as new complexities and opportunities arise.

We feel the principal rationale of this acquisition is to get access to a large client pool of Cigniti and upsell Coforge’s offerings to them. However, a sharp jump is margin as a result of this may be easier said than done.

The combined entity of Coforge and Cigniti, at $1.3 billion at the end of FY24, is targeting to achieve $2 billion revenue, implying a revenue CAGR of 15 percent. Coforge is also expecting 150-250 basis points margin gains over this period.

The good news is Coforge may downsize the QIP from Rs 3200 crore. However, there are many more contours of the deal that would unfold — like post taking controlling stake in Cigniti, it would like to merge the business with Coforge and go for a share swap.

We have not tweaked our estimates factoring in this acquisition and would advise gradual accumulation in this weak phase with an eye on the long-term.

Key risks: Severe demand slowdown and/or heightened competitive intensity

Bymoneycontrol