Federal Bank Q4 FY24 – Steady quarter marred by one-off, valuation attractive.

Loan growth remains healthy and deposits are catching up while margins improve.

Highlights

-

- Steady quarter from Federal Bank

-

- Loan growth maintains momentum, pivoting the book towards high-yielding products

-

- Deposits catching up, albeit at a higher cost

-

- Interest margin improves sequentially, guiding to improvement

-

- Solid asset quality, negligible credit cost

-

- Cost-to-income ratio worsens on one-time staff cost

-

- Guiding to a steady uptick in RoA

-

- Comfortably placed post the capital raise

-

- Attractive valuation

Federal Bank’s (CMP: Rs 168, Market cap: Rs 40,926 crore, rating: Overweight) Q4 report card was a show of consistency although the reported numbers were impacted by a one-time employee pension related provisioning. Loan growth remains healthy, deposits are catching up although riding on costlier term deposits, margins showing a sequential improvement, asset quality showing strength, and fees lending support. The bank is guiding to a gradual RoA (return on assets) uptick, thanks to improving margins, fees, benign credit cost, and normalisation of operating expenses. We do not see much risk from the change in CEO in September ’24.

While the stock of Federal Bank has outperformed the Nifty and Bank Nifty in the past four months, the valuation is still reasonable for long-term accumulation.

Q4 FY24 – steady quarter marred by one-off

The non-interest income didn’t have the benefits of one-off seen in Q3 with the stake sale in Fedfina. The employee expense line had a Rs 162-crore one-off pension related provision. There was provision write-back on standard assets as well as the reversal of excess provision made in Q3 that resulted in an overall drop in total provision. The core performance was steady.

Loan growth momentum sustains

Federal Bank reported a 20 percent YoY and a 5 percent sequential growth in advances in Q4. While the corporate book was subdued, the growth leaders were the high-yielding products such as commercial vehicles, MFIs, mid corporate, gold loans etc. The share of high-margin products in the loan book is now close to 25 percent – up 280 basis points YoY (year on year). The risk weightage density is low at 61.5 percent and there is still headroom to grow the high-yielding piece.

Deposits catching up — higher cost on expected lines

The last reported quarter saw a sequential growth in advances of 5 percent being matched by a 5.4 percent sequential growth in deposits. This resulted in a marginal drop in the credit-to-deposit ratio.

For FY24, the growth in deposits of 18 percent was driven by term deposits, with low-cost CASA (Current & Savings account) growing by a paltry 6 percent and the share of CASA falling from 33 percent to 29 percent over one year.

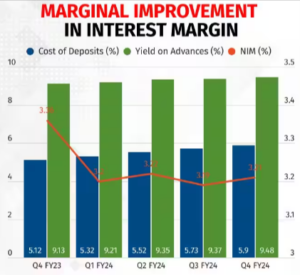

Margin stable – guiding to gradual improvement

Federal Bank has a largely floating rate book with only 27 percent in fixed rate. However, yield improvement has been tardy. Deposits have largely repriced but hasn’t peaked yet. The bank has seen a marginal improvement in margin in Q4 and expects this trend to continue riding on the peaking of funding costs in the coming quarters and an improving share of high-margin loans.

We expect margins to remain range-bound for Federal Bank.

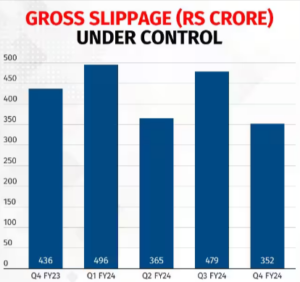

Asset quality good, high recovery

The slippage to NPA was lower sequentially at Rs 352 crore. The bank saw a very strong recovery and upgrades and reported a lower gross and net NPA of 2.13 percent and 0.6 percent respectively with a provision cover of 72 percent. Credit cost in the quarter was negligible and for FY24 it was 23 basis points. The bank remains confident of the quality of its book and expects a credit cost of 30 basis points in FY25.

Fees to lend support

Core fees continue to remain supportive growing 19 percent in FY24.

Federal Bank to spend on network and technology

After the one-off provision for wage and pension in Q3 and Q4, the bank is looking at a normalisation in the cost-to-income ratio. Other than network expansion and technology, the bank is not expecting a step-up in operating expenses.

Federal Bank has recently raised capital, which should support its growth journey. The bank is guiding to a slight uptick (a few basis points) in the RoA from the FY24 level of 1.32 percent in the coming years. Seen in this context, the valuation looks undemanding despite the recent outperformance of the stock.

Key risks: Severe impact of economic slowdown on earnings and asset quality, and/or the inability to garner deposits at competitive rates resulting in margin contraction.

Bymoneycontrol