Fidelity Investments cuts SoftBank-backed Meesho’s fair value by 10%

Fidelity Investments has marked down the fair value of social commerce startup Meesho by 10 percent in its books, making it the latest US-based asset management company (AMC) to slash the fair value of private technology companies amid a challenging macroeconomic environment.

Fidelity Investments holds stakes in Meesho Inc, the holding company of the Bengaluru-based social commerce unicorn, through multiple funds.

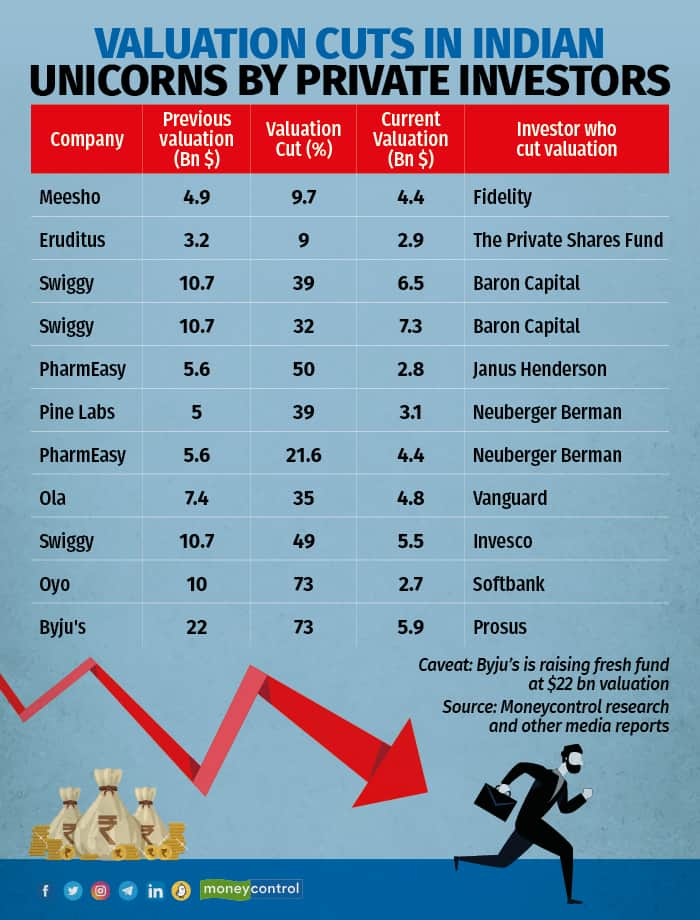

The latest filings of these funds, such as Variable Insurance Products Fund III and IV, and Fidelity Central Investments Portfolio LLC, show that the US-based AMC slashed the fair value of Meesho by 9.7%.

This effectively pegs the valuation of the company at $4.4 billion.

“Funds attribute value to their portfolio investments, taking into account multiple factors.

In this case, factors like an increase in the ESOP (employee stock option plan) pool of nearly 4 percent in the applicable period could have influenced the attribution of value,” said a source aware of the development.

Meesho declined to comment.

The social commerce startup is the latest Indian unicorn to experience a reduction in its fair value.

Other prominent startups such as Ola, Swiggy, Eruditus, and Byju’s have also seen their fair values reduced by US-based AMCs.

However, the markdowns for Eruditus and Meesho are significantly smaller than those for Ola, Byju’s, and Swiggy, which have been marked down between 30 percent and 50 percent.

It is important to note that these adjustments to fair values are typically based on AMC’s internal assessment of the macro and microenvironment.

They do not necessarily indicate a permanent markdown in the startup’s overall valuation.

Fidelity, along with Facebook co-founder Eduardo Saverin’s B Capital Group, led a massive $570 million funding round in Meesho in September 2021 as part of the social commerce startup’s Series F funding round.

The funding valued Meesho at $4.9 billion, making it one of the biggest unicorns in India.

However, since the start of last year, amid a deteriorating macroeconomic environment, Meesho, like most other startups, has been aggressively cutting costs to reduce its monthly burn.

The SoftBank-backed company had previously been criticized for its high burn rate.

Meesho has laid off 500 employees since 2022 while also rebranding its grocery arm to reduce burn.

Earlier this month, Moneycontrol reported that Meesho has reduced its monthly burn to $4-5 million from about $40-45 million during the peak of Covid in 2021.

Meesho, founded in 2015 by Vidit Aatrey and Sanjeev Barnwal, runs a three-sided marketplace with suppliers, resellers, and customers.

Resellers buy goods such as unbranded fashion items from suppliers and sell them via platforms such as WhatsApp and Instagram. The company saw its revenue surging manifold to Rs 3,232 crore in FY22 (2021-22) from Rs 836 crore in FY21 (2020-21).

But its loss, also widened to Rs 3,247 crore during the year, from Rs 498 crore in FY21.

While Meesho started out this way, its share of direct sales has also been increasing, putting it in direct competition with incumbents Flipkart and Amazon.

The company derives approximately 75 percent of its business directly from customers, while the remaining 25 percent comes from resellers.

In 2022, Meesho experienced a 135 percent surge in order values compared to the previous year, reaching a total of 91 crore orders.

ByMoneycontrol