GAIL: Is there more upside to the stock?

The management guidance includes an FY25 gas marketing EBITDA of at least Rs 4,000-4,500 crore and volume of 105 mmscmd, and gas transmission volume of 130-132 mmscmd in FY25 and 140-142 mmscmd in FY26.

Highlights

-

- Q4FY24 revenue, EBITDA below expectations

-

- Weakness in gas marketing business led to soft performance

-

- Strong recovery in petchem business

-

- Transmission business volume growth as expected

-

- Guidance of Rs 11,500 crore capex, Rs 4,000-4,500 crore marketing EBITDA

-

- Valuation reasonable; retain overweight rating

GAIL India (CMP: Rs 208.75; Market capitalisation: Rs 1,37,255 crore; Rating: Overweight) missed Street expectations, mainly due to the underperformance in gas marketing.

Gas marketing volume was in line with expectations but a 9.2 percent quarter-on-quarter (QoQ) decline in realisation led to a 7.5 percent fall in revenue. Marketing EBITDA (earnings before interest, tax, depreciation and amortization) fell to Rs 1,627 crore, down 22 percent QoQ. Petchem’s business performance, on the other hand, was better than expected, with volume rising to 242 MMT (million metric tonnes).

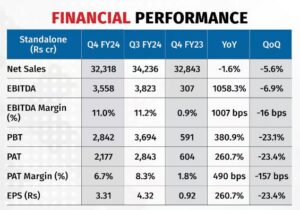

Despite softer realisations, revenue grew by 10 percent QoQ to Rs 2,234 crore. Gas transmission volume at 123.7 mmscmd was in line with guidance and our estimates. Overall revenue contracted by 5.6 percent QoQ, 1.6 percent year on year (YoY), and EBITDA margin, at 11 percent, was slightly lower than Q3FY24 but better than consensus estimates.

Q4FY24 financial performance

Gas marketing business EBITDA stood at Rs 1,627 crore, down 21.5 percent sequentially, and stabilised after a strong show in the last two quarters as volatility in LNG prices reduced.

EBITDA per scm is now down 22 percent QoQ to Rs 1.79 while LNG prices have been rangebound in CY24. Volume at 99.9 mmscmd increased by 1.8 percent sequentially and was broadly on expected lines.

Petrochemical business recovery

The petchem business saw a strong rebound this year, with Q4 revenue growing 10 percent, sequentially, to Rs 2,234 crore, with an EBITDA of Rs 426 crore, translating into an EBITDA margin of 19.1 percent — the highest since Q4FY22. Petchem production volume stood at 248 MMT. It improved significantly, QoQ and YoY, while volume sold at 242 MMT was up 12.6 percent, sequentially.

Mixed performance of gas transmission business

The gas transmission business volume of 123.7 mmscmd was in line with our expectations and was up 1.7 percent QoQ. However, soft realisation led to muted revenue growth. EBITDA per unit at Rs 1.44 per scm was better than our expectations and translated into an EBITDA of Rs 1,599 crore.

LPG & other liquid hydrocarbons

LPG & LHC (liquid hydrocarbons) business volume improved over Q3FY24 and led to a 6 percent rise in revenue to Rs 1,195 crore, despite a small increase in realisation. Similarly, EBITDA came in at Rs 361 crore, up 30 percent QoQ, driven by better unit margins.

Outlook

FY24 proved to be a good year for GAIL, driven by solid execution. Recovery in the petchem business was better than expected in a soft pricing environment. FY24 gas transmission volume growth stood at 12.3 percent YoY, driven by rising gas demand and gas grid expansion. Softening LNG prices contributed immensely to the demand, which appears sustainable at the current levels now.

Domestic demand has been solid and expansion of gas network within the new geographical areas (GAs), along with supportive gas prices, are likely to keep consumption strong.

The commissioning of the KKBMPL – II, Srikakulam-Angul, and Mumbai-Nagpur-Jharsuguda pipelines later this year would drive transmission volume further.

The petchem business is likely to see better margins due to soft gas prices and higher volumes. Gas marketing revenue should see moderate growth from here. The management guidance includes FY25 gas marketing EBITDA to be at least Rs 4,000-4,500 crore and a volume of 105 mmscmd, gas transmission volume of 130-132 mmscmd in FY25 and 140-142 mmscmd in FY26, and a total capex of Rs 11,500 crore.

Valuation

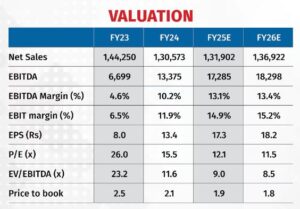

GAIL has been our high-conviction stock and has gained 97 percent in the last one year, led by superb profitability in the marketing business, transmission tariff revision and petrochemical business turnaround.

At the current market price (CMP), the stock trades at an FY26 EV/EBITDA of 8.5x, on a standalone basis. In our view, this is reasonable. Further, GAIL’s valuation on an SOTP basis indicates further upside. Therefore, we retain our buy recommendation with a medium-term view.

Risks

An increase in LNG prices, regulatory changes.

Bymoneycontrol