Havells India: Q4 tops Street expectations

Revenues and EBITDA both showed improvement on the back of a rebound in the ECD business.

Highlights

- ECD revenues were largely driven by fans

- Price deflation hampered the performance of the lighting business

- Lloyd disappointed on growth front whereas margins flourished

- New capacity for underground cables to commence in Q1/Q2

- Stock is up ~30 percent in the last 6 months

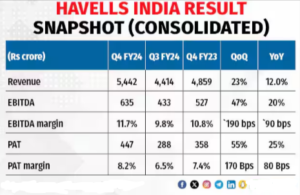

Consumer durables manufacturer Havells India (CMP: 1,664; Market cap: Rs 104,245 crore; Rating: Equal weight) posted a decent set of numbers in Q4 FY24, driven by a rebound in the electrical consumer durables (ECD) and cables business. Revenues for the quarter grew 12 percent year on year (YoY), while the EBITDA (earnings before interest tax, depreciation, and amortisation) margins improved by 90 basis points (bps) to 11.7 percent despite elevated advertising spends (up 21 percent YoY).

ECD rebounds amid continued momentum in cables

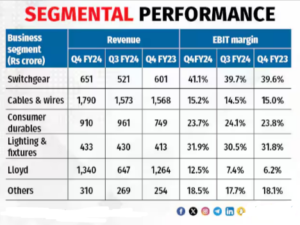

The Wires & Cables (W&C) segment, the largest business vertical contributing 33 percent to the total revenue in Q4, sustained its infrastructure-led growth momentum. The segment achieved a revenue growth of 14 percent YoY on the back of an impressive volume growth of 18 percent YoY.

Havells is grappling with capacity limitations in its underground cables business. However, the company’s capex plans for the W&C segment are progressing as planned and the new capacity for underground cables is anticipated to come online by June 2024.

The Electrical Consumer Durable (ECD) segment surprised positively with a growth of 21 percent in Q4, rebounding from a mediocre growth performance over the past few quarters. The early onset of summer and extreme heatwave conditions in many parts of the country fuelled the demand for fans and air-coolers in the quarter gone by. Although EBIT margins were stable YoY, the company may consider a price hike in the coming months owing to the recent increase in raw material prices.

The Lighting segment once again exhibited muted revenue growth trends as strong volume off-take was offset by the steep price erosion seen in the sector over the past 12 months. The management has indicated that prices have stabilised in recent months. Additionally, the company is gradually expanding in the professional lighting sector and is experiencing good demand in residential markets.

Lloyds posted a lacklustre top line despite a realignment of channel strategy, expansion of distribution network, and addition of new product lines. However, profitability showed a big improvement as EBIT margins rose 630 basis points, driven by better absorption of overheads, favourable commodity prices, and cost-saving measures. The southern and the western regions showed strong growth, but the north and the east are still lagging behind. Lloyds maintains a position among the top three players in the room air conditioner (RAC) industry and is expanding its brand presence in new product categories such as refrigerators, washing machines, and LED TVs leveraging the brand strength and the distribution network. The management reiterated its focus on enhancing the product portfolio and capturing market share.

An upswing in the realty sector continued to drive the sales of the Switchgear segment, which grew 8 percent YoY on a high base. However, Havells continued to face poor demand challenges from telecom original equipment manufacturers (OEMs).

Outlook & Valuation

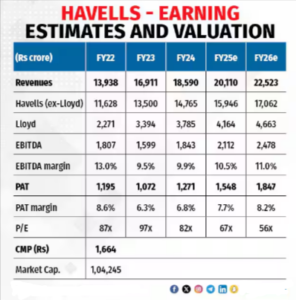

Havells maintains a balanced approach to growth and profitability. Going forward, the management is hopeful of broad-based growth in the core business led by favourable consumer sentiments, following a promising start to the summer season. While the company enjoys a solid cash position of over Rs 3,000 crore, it has outlined an investment of Rs 800 crore for the current fiscal year (FY25). The detailed break-up of the same will be shared in the subsequent quarters.

The stock currently trades at 56 times FY26e earnings, having risen by ~30 percent in the last six months. The current valuation fairly reflects its industry-leading position, free cash flow strength, and capital efficiencies. Therefore, we advise investors to remain on the sidelines and wait for better price points to initiate positions.

Bymoneycontrol