HCL Tech Q1 FY25: Looking at a second-half recovery

The company expects to gradually recoup margin as revenue momentum picks up.

Highlights

-

- Better-than-expected performance on top line, ERD suppressed

-

- A sequential uptick in all verticals in Q2 except BFSI due to SSB JV divestment

-

- Riding on better growth, maintains FY25 growth and margin guidance

-

- AI opportunity limited overall, more relevant in certain areas

-

- Order inflow decent, near-term upside limited post the rally

-

- Macro tailwinds to drive upside in the medium term

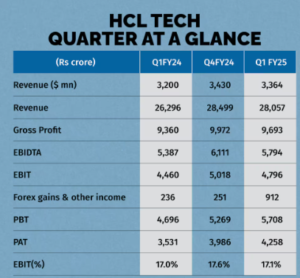

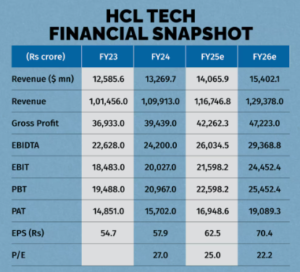

HCL Tech (CMP: Rs 1,560, Market Cap: Rs 423,440 crore, Rating: Overweight) has delivered in-line performance in Q1, with a better-than-expected top line, unchanged full-year guidance, and decent order inflows. However, given the outperformance over the Nifty and the IT Index in the past one-year, the valuation appears full and medium-term upside is contingent on macro recovery.

The reported after-tax profit got bumped up by the divestment of stake in State Street JV.

Revenue performance better than expected, despite softer ER&D

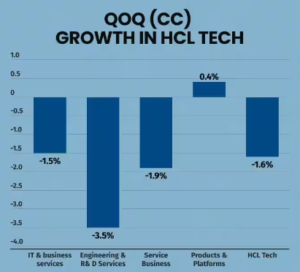

HCL Tech had guided to a 2 percent sequential decline in revenue in Q1 due to the usual annual productivity pass-back to clients and offshoring of a large deal. The outcome turned out to be better than the guidance with a sequential revenue decline of 1.6 percent in Constant Currency (CC). This was possible because of the stable show by HCL Software and a decent performance by IT & Business Services despite the offshoring of a large deal impacting the BFSI (banking finance service & Insurance).

The weakness came from Engineering R&D (ER&D) and the management alluded to weakness in manufacturing and med-tech. The sector was impacted by the concentrated pass-back of productivity benefits in manufacturing, weakness in automotive/EV — particularly in Germany that was also reflected in the subdued show by its recent acquisition ASAP, and a decline in asset revenue. The management expects growth revival in manufacturing from the coming quarter.

In fact, the management expects a sequential uptick in all the verticals in Q2 except BFSI, which will be impacted by the divestment of the State Street JV (90 basis points impact on services revenue).

However, Q3, the seasonally strongest quarter, and Q4, a more normal quarter, should make up for the H1 performance. HCL Tech is still guiding to a full-year revenue growth of 3-5 percent in Constant Currency (CC) and margin in the band of 18-19 percent.

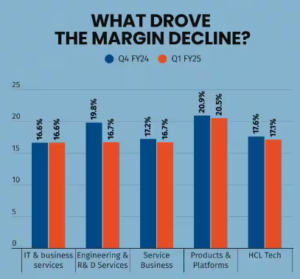

Margin – gradual uptick

Thanks to the weakness in services margin — impacted by ER&D due to the revenue miss, the overall margin for the quarter came down by 50 basis points sequentially. The company is expecting to gradually recoup margin as the momentum in revenue picks up and is confident of the margin guidance for the year. The margin for Q1 FY25, nevertheless, showed YoY improvement of 10 basis points.

Moderate inflows, AI not an imminent revenue driver

Order inflows too were a tad soft, although the company remains reasonably confident of the pipeline. The discretionary spending environment is still tentative. There is significant interest in AI (artificial intelligence). The company is training 50,000 people in AI and is heavily investing in Gen AI technologies through its AI Force and Enterprise AI Foundry platforms. The business opportunity is limited now but it expects meaningful productivity gains in BPO, testing, and 10-30 percent productivity gains in software development.

The divestment of the State Street JV resulted in a significant net headcount reduction, although on a gross basis the company added people.

For HCL Tech, FY25 is likely to be a year of consolidation. However, the company is ready to ride the uptick in demand led by a revival in the macro scenario. This is a good stock to add on any decline.

Bymoneycontrol