Himadri Speciality: Play on new energy transition

While there is still room for margin expansion for the legacy business, the stock is now more a play on the global energy transition which includes electric vehicles (EVs) and new-age battery systems.

Highlights

-

- Operating performance back to historical levels

-

- Traction for lithium-ion battery ingredients to support valuations

-

- Near-term growth to be driven by speciality carbon black

-

- Technology & execution risk can’t be ignored

-

- Premium valuation; add stock on declines

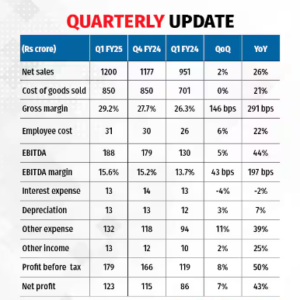

Himadri Speciality Chemical Ltd (HSCL; CMP: Rs 432, Market cap: Rs 21,345 crore; Rating: Overweight) posted a good set of numbers for Q1FY25 as the company ramped up existing capacity for carbon black and coal tar pitch (CTP) and simultaneously improved operational metrics.

Gross margin of 29 percent is now close to the pre-COVID levels, and that of the closest peer, PCBL.

While there is still room for margin expansion for the legacy business, the stock is now more a play on the global energy transition which includes electric vehicles (EVs) and new-age battery systems.

We had included the stock as part of our ‘Make-in-India portfolio’ in April 2024 for its rapid strides in the field of electrode materials and speciality carbon black, having applications in EVs, batteries etc.

While there is still a long way ahead for emerging technologies in this space, the company has certainly moved out of the pilot stage. Given the government’s incentives for this sector and maturing demand ecosystem, companies better- positioned with R&D would continue to warrant attention.

Q1FY25 performance: Margin trajectory back to historical levels

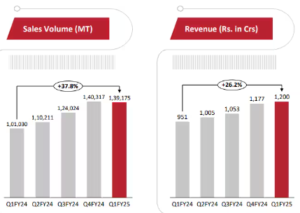

HSCL posted a 38 percent year-on-year (YoY) growth in sales volumes, helping it to showcase a 26 percent revenue growth. Higher volume was aided by new specialty product lines like Onyx.

Gross margin expanded due to better product mix. This helped EBITDA (earnings before interest, taxes, depreciation and amortization) margins, despite higher other expenses.

New levers of growth towards Lithium-ion Battery materials

Himadri plans to produce 200,000 tonnes of Lithium-ion Phosphate (LFP) Cathode Active Material, in phases, over 5-6 years. In phase1 of the expansion plan, the company would spend Rs 1,125 crore for a capacity of 40,000 tonnes. This is expected to be operational by Q3FY27.

In addition, Himadri continues to invest in startups working on Lithium-ion electrode materials. It has a 12.79 percent stake in Australian startup Sicona, which is working on silicon-based anode material, with a better capacity than conventional graphite anodes.

The company has also taken a 40 percent stake in a startup called Invati Creations, which is engineering lithium-ion electrode materials for efficient energy storage.

Secondly, the company is undergoing brownfield expansion of 70,000 tonnes for speciality carbon black, which would take the overall capacity to 130,000 tonnes.

The expected capex for the same is Rs 220 crore and it would get operational by Q3FY26. Some of the new speciality carbon black would be used for lithium batteries.

And lastly, the ramp-up of the acquired assets of Birla Tyres is another key watch. This would essentially help the company foray into B2C and launch tyres for EVs.

Takeaways

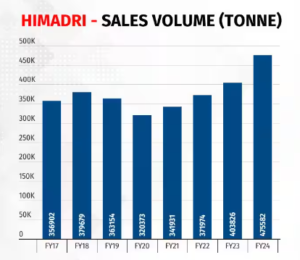

The company’s annualised sales volume for the last two quarters is close to 5,60,000 tonnes, which is 48 percent higher than the FY18 sales volume (highest in the pre-COVID years). On an aggregate level, this implies 75 percent utilisation level. Considering that Coal Tar derivatives have a captive usage as well, the utilisation level could be close to optimum.

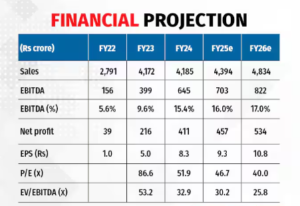

Not surprisingly, there is a new capacity announcement for speciality carbon black. Further, taking cue from the sequential stagnation in volume growth, in the next few quarters, the company’s effort would be more towards expanding gross margins through the traction in new speciality grades. We believe there is still scope for a 200-300 bps gross margin expansion in the near term.

That said, the stock is advisable for investors looking for a potential play in energy transition. This certainly has a technological and execution risk.

However, what works in favour for the company is years of R&D activities in this space on multiple products. Further, the company is cash-surplus, which provides fund-raising scope to partly utilize it for the ~Rs 1,500 crore capex in three years.

As the valuation is rich (26x EV/EBITDA FY26e), long-term investors can wait for a market-wide correction to add the exposure.

Bymoneycontrol