Hindustan Unilever: Road to recovery likely to be gradual

Gradual rural recovery and softening of commodity prices to aid margin gains, to be partly offset by higher spends on advertisement.

Highlights

-

- Most categories saw subdued growth

-

- Spends on advertising remained high

-

- Competitive intensity has increased in some categories

- Remain positive, investors expecting moderate return can accumulate on declines

The September-quarter results of

(HUL, CMP: Rs 2550; Market capitalisation Rs: 5,98,911 crore, Rating: Equal-weight) were marginally below expectations.

Rural recovery is likely to be gradual and regional competitive intensity continued to remain high. Advertisement spends are likely to remain firm in the near term, given the competitive intensity and brand building. HUL has declared an interim dividend of Rs 18 per share.

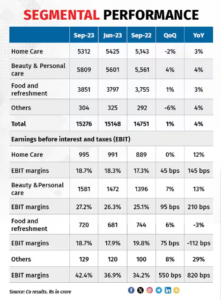

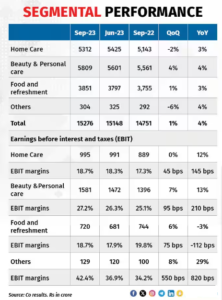

September 2023 quarter performance

Home care (35 percent contribution to revenues) saw a sales growth of 3 percent on the back of a mid single-digit volume growth and the high base of last year. Fabric wash saw a volume growth in mid single digit, driven by the outperformance in the premium portfolio. Household care saw high single-digit volume growth led by dish-wash. HUL cut prices in both fabric care and household care portfolios. Premium portfolios such as Surf and Comfort grew in double digits.

Beauty and Personal care (38 percent contribution to revenues) saw a 4 percent sales growth on the back of a mid single-digit volume growth. Skin cleansing saw a revenue decline, thanks to price cut which was partly off-set by low single-digit volume growth. Lux and Hamam continued to outperform. Hair care saw high single-digit growth, led by Clinic Plus and Indulekha. Skin care and colour cosmetics both saw double-digit growth, led by outperformance by Ponds and Vaseline. The lower base of last year may also have helped. Oral care saw a mid single-digit growth led by Closeup.

Foods and refreshments (25 percent contribution to revenues) saw an underlying sales growth of 4 percent on the back of a mid-single-digit decline in volumes. In beverages, tea saw modest growth but coffee grew in double digits, driven by pricing. Health food drinks (Horlicks and Boost) saw a mid single-digit growth, driven by activations and innovations. Foods grew in mid single-digit on a high base. Food solutions, Mayonnaise and Peanut butter, continued to deliver strong growth.

Lower raw material prices led to higher gross profit and margins which were invested in media campaigns on account of high competitive intensity. Advertisement spends were at 11.4 percent of revenues compared with 7.2 percent in the September ’22 quarter and 10 percent in the June ’23 quarter. The September ’23 quarter has seen one of the highest media spends by HUL.

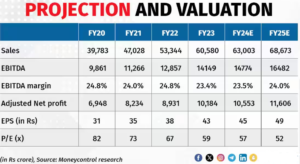

Outlook and Valuations

The FMCG market saw a gradual recovery in volumes albeit on a soft base. The growth was led by the urban market, which saw a 3 percent growth in the September ’23 quarter on a 2-year CAGR basis. The rural market saw a 1 percent decline. Price growth has been coming off, thanks to the softening of commodity prices. The FMCG market price growth was around 10 percent in the March ’23 quarter, 8 percent in the June ’23 quarter, and around 3 percent in the September ’23 quarter, while the cumulative price growth on a 3-year perspective has been around 25 percent. More than 75 percent of HUL’s portfolio has gained market share in volumes terms, while over 60 percent of the portfolio has gained in value share.

HUL expects tailwinds from a better festive season to aid the December ’23 quarter. This year, the majority of festive spends is likely to accrue to the December ’23 quarter. The recovery in the rural market is likely to be gradual, given that inflation is moderating and the disposable rural income has turned positive. The capex push from the government has led to better income levels. HUL expects price growth to be marginally negative if commodity prices remain where they are. HUL is focused on driving competitive volume growth.

Following the softening of commodity prices, there has been a resurgence of smaller players in select categories. In tea, competitive intensity from smaller players have been 1.4x compared to large players and in detergent bars it has been 6x. Media spend has been 1.2x in the September ’23 quarter compared with 0.9x in the September ’22 quarter and 1x in the September 21 quarter. HUL has spent nearly one-third of the advertisement spends on digital media, while two-thirds were spent on traditional channels. HUL maintained that its advertisement spends are likely to remain firm to retain market share.

We have marginally cut our growth expectations for FY24 and FY25. We remain positive on HUL and recommend long-term investors, expecting moderate returns, to add and accumulate on the decline.

Bymoneycontrol