India Shelter Finance: Should investors home in on this housing finance company?

Strong sectoral tailwinds, large under-penetration, and increasing government initiatives are positives.

Highlights:

-

- Operates in the niche segment of low-income housing finance

-

- Compounding of asset base with improving asset quality

-

- Higher spread than pears due to the unique business model

-

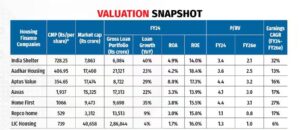

- Valuation at a discount to most peers

India Shelter Finance Corporation Limited (India Shelter; (CMP: Rs 730; M Cap: Rs 7,863 crore; Overweight) is a pure play in the informal, affordable housing finance (AHF) segment with a large presence in Tier 2/3 towns. It is backed by an experienced management team and strong promoters, such as WestBridge Capital (47 percent stake).

After the capital market listing in December 2023, the company’s performance was marked by scalability with profitability, and comfortable asset quality.

Sudhin Choksey, the chairman of India Shelter who was a key architect in building and scaling up Gruh Finance, is now holding the reins of this young company. We believe that his experience in the AHF sector will definitely help the company in its growth journey.

In one of its first decisions, the new government expanded the PMAY scheme (Pradhan Mantri Awas Yojana) on June 10, 2024, post which the stock rallied more than 20 percent. As per the management, this could boost the sector’s growth in the range of 10-12 percent.

Why India Shelter stands out in the over-crowded low-cost housing finance space?

The new-to-credit customers contributed 70 percent of the asset under management (AUM). This remains one of the key business moats and offers good pricing power to the company.

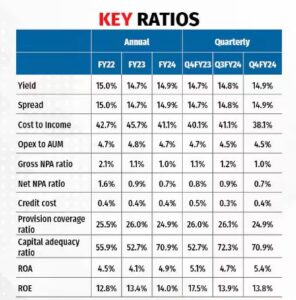

Moreover, a large proportion of the loan book consists of high-yield, secured non-housing loans/loan against property (LAP share is 40 percent of AUM). The diversified loan mix and the distinct customer profile (49 percent low-income group or LIG), coupled with a high proportion of fixed-rate advances (84 percent of AUM), have helped the company to maintain yields in the 14-15 percent range. Obviously, the higher yield compensates the greater risk involved.

Strategic expansion and policy thrust to aid growth

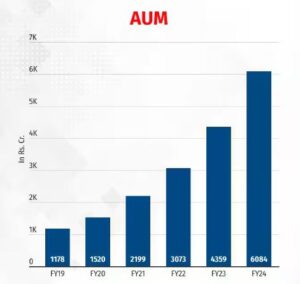

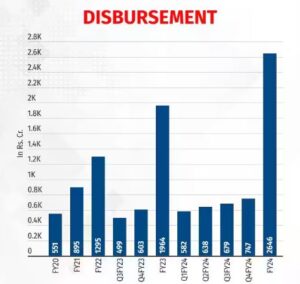

The company’s AUM grew at a four-year CAGR of 41 percent and has crossed the Rs 6,000-crore milestone, led by a 35 percent YoY growth in disbursements in FY24.

The company has been trying to improve geographic concentration (Rajasthan accounted for 31 percent of AUM in FY24 against 41 percent in FY18), while strategically expanding presence in Tier 3 cities, which accounts for half of the loan book. The company added 40 new branches in FY24.

According to the management, loans under the PMAY scheme accounts for around 10-12 percent of the overall home loan portfolio (housing loan is 60 percent of AUM) and is expected to aid disbursement growth if the scheme comes into play after the budget. The scheme has been effective in driving the AUM growth and attracting new customers (5-6 percent of the customers are benefiting from the ongoing PMAY schemes).

The AUM growth guidance is in the 30-35 percent range and the affordable HL segment will remain the key growth driver. The AUM mix will be in the 60:40 ratio between HL and LAP.

Robust asset quality; benign credit cost

Despite the higher share of first-time home buyers and self-employed customers, asset quality is at a comfortable level.

Sharp improvement was seen in early delinquencies (30+DPD down 110 bps QoQ to 2.4 percent in Q4FY24) led by a robust credit appraisal process and recovery. The GNPA (gross non-performing asset) ratio has been range bound between 1 percent and 1.3 percent, led by a higher collection efficiency.

Credit cost is guided to remain at the current level with a higher focus on customers having better credit profiles.

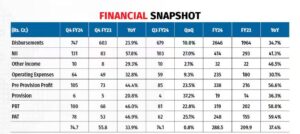

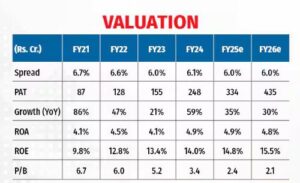

Improved profitability, sustained return ratios

The company’s spread is better than peers and is expected to sustain at the current level, led by a better product mix.

Due to complete in-house sourcing, the opex-to-asset ratio (opex) is higher than the peers. However, the operating leverage will improve with increased productivity. Opex is expected to reduce by 20-30 bps in FY25.

High growth in net profit is attributed to higher yield, stable borrowing cost (well-diversified funding profile), improved operating leverage, and low credit cost.

The lower return on equity (ROE) in Q4FY24 was due to the capital infusion of Rs 800 crore after the IPO (initial public offer).

The ROE has seen consistent improvement over the years and the trend is expected to continue with a higher leverage (now 2.5x).

Outlook and valuation

Large headroom for growth – Multi-fold growth in the loan book (5x) and profitability (8x) in the last five years were supported by contiguous branch expansion and the government impetus, while the healthy asset quality was backed by a strong recovery trend in the AHF space.

The company plans to add around 40-42 branches in FY25 in a staggered manner over the next 4 quarters (8 to 9 branches sequentially).

Self-employed customers remain a key focus area for the company and its share in the AUM is guided to increase steadily in the 75-78 percent range over the next three to four years, which will drive yields in the long term.

Moreover, the company expects 15-20 bps improvement in the funding cost in FY25 due to an increase in the National Housing Bank (NHB) funding share to around 18-20 percent (now 15 percent), coupled with a credit rating upgrade. An undrawn sanction of Rs 210 crore from NHB will be utilised in Q1FY25.

Given the comfortable asset quality, the credit costs remain low and support the company’s earnings profile. As the loan book seasons, the ROA is guided to sustain in the 4 percent range in the long term.

After the recent run-up, the stock is available at a 2.1x FY26e P/B ratio and is trading at a discount to most of its peers. We believe that India Shelter’s strong return ratios could lead to valuation re-rating.

Given the large market opportunity for exponential growth, the stock could be added at the current valuation with a long-term view.

Bymoneycontrol