Indian equities: Will FII inflows get stronger with US rate cuts looking imminent?

US retail inflation is likely to cool down faster than expected as labour market is back in balance and excess savings have been exhausted.

Highlights

-

- FII inflows have resumed post general election

-

- US policy rate cuts can further aid FII inflows

-

- Drivers of US inflation are fading with the exhaustion of excess savings

-

- Labour market is not a source of broad inflationary pressure for the economy

-

- The scenario of Trump’s Presidency can weigh on energy crisis

- Investors should look at policy tailwinds and go for bottom-up stock selection

There had been substantial FII outflows (about $2.7 billion) from Indian equities in the current calendar year before the general election. It was largely due to poll-related uncertainties and relatively better valued opportunities in the EM (emerging market) space (like China). Post the election, after some initial jitters regarding the coalition government, FII inflows have resumed. In the last 40 days, FII inflows into Indian equities has been to the tune of $3.5 billion.

As the possibility for US policy rate cuts is getting stronger, FII inflows are expected to get better. Flows to the Indian bond market is also expected to improve with the staggered inclusion of Indian bonds in the global indices. This should eventually aid USD/INR appreciation.

Why do we think US rates cuts are round the corner?

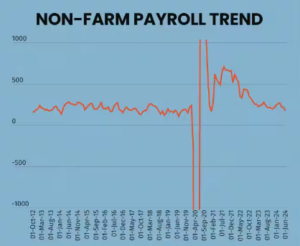

Fed chair Jay Powell’s testimony to the US Congress indicates that the labour market appears to be back in balance and it is not a source of broad inflationary pressure for the economy now.

He said that “most recent labour market data do send a pretty clear signal that labour market conditions have cooled considerably compared to where they were two years ago.”

Further, job opening data continues to have a downward drift. The unemployment rate is already ahead of FOMC’s year-end target of 4 percent. Hence, the probability of a Fed rate cut in September has already gone up to 70 percent.

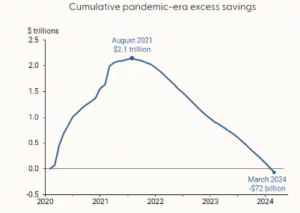

Second, one big driver of robust US household spending, post Covid-19, has been the excess savings during the pandemic years. This was because of the US government’s pandemic-related support and a steep decline in consumer spending during the pandemic. Now various research insights, such as the one from Federal Reserve Bank of San Francisco, point out that the excess savings have been exhausted.

Taking both points into account, we expect that US retail inflation can potentially cool down faster and the Fed may have to opt for multiple rate cuts in CY24 instead of the FOMC projection of just one.

While this is not the base case, unexpected weakening of the labour market can prompt the Fed for a pre-emptive action.

US President election outcome can facilitate monetary action

In our recent macro note, we pointed out that Donald Trump’s potential victory in the upcoming US Presidential election can have a salubrious effect on the global energy market. Trump could push Ukraine and Russia into accepting a ceasefire, which can help contain energy prices and consequently inflation.

What it means for Indian equities

Our base case is not of a global/US recession, which usually triggers “flight to safety” moves for fund flows. We rather see the success of the Fed-engineered slowdown, which is resulting in a soft landing accompanied by reasonable control over inflation. But for that to fructify, the Fed needs to act before it gets too late.

In such a case, FII inflows to India should add up in response to better yields and USD/INR appreciation along with stable polity (vs. domestic policy risks in the US), fiscal discipline, and a steady corporate earnings cycle. FII inflows along with already strong liquidity (DIIs and retail flows) will keep the broader market valuations elevated.

In this context, investors should keenly track the government’s policy choices in the upcoming budget. We believe policy tailwinds and bottom-up stock selections remain crucial for the near term.

Bymoneycontrol