Inox India IPO offers a long-term compounding opportunity.

The company is likely to benefit from the rising demand for cryogenic equipment.

Highlights

-

- Largest supplier of gas storage equipment and solutions in India

-

- Largest Indian exporter of cryogenic tanks and solutions

-

- It worked with ISRO for the Chandrayan-3 project

-

- As at September 30, 2023, the company’s order book was Rs 1,036 crore

-

- Diversified domestic and international customer base across industry sectors

Inox India

has created a niche and dominant position in the gas storage tanks and solutions segment over three decades of operation. The company is present in the entire value chain — from the manufacturing of cryogenic tanks, transportation to storage and solutions such as bulk and critical handling of gases, particularly sensitive gases. It handles most of the gases catering to diverse industries such as industrial gases, liquified natural gas (LNG), green hydrogen, energy, steel, medical and healthcare, chemicals and fertilisers, aviation and aerospace, pharmaceuticals, and construction.

Handling gases, particularly highly sensitive gases, requires expertise, knowledge, and experience. Some of these gases can exhibit extremely high pressure and others need to be liquified and stored at minus 150-200 degrees of temperature. This is where Inox has created a strong position as customers always look for someone who is reliable, expert, and maintains the highest standards of business practices. This is why the company has been able to work with almost all the renowned customers, including defence, marine, ISRO, and leading corporates in India and abroad.

It has three manufacturing locations in Gujarat and Silvassa with an installed capacity of 3,100 Equivalent Tank Units (which are cryogenic storage tanks of 10,000 litres) and 2.4 million disposable cylinders. It provides equipment and systems to over 1,201 domestic customers and over 228 international customers. Exports contributed around 46 percent of the revenue in FY23.

Long-term compounding

The demand for cryogenic equipment across geographies is expected to be driven by the increased demand for cleaner fuels such as LNG and hydrogen because of the focus on reducing carbon emissions from conventional energy sources. While organic growth continues, energy transition could provide a big push in the light of the expected jump in demand for different kinds of gases.

In the near term, the company is sitting on a Rs 1037 crore order book which is equal to its annual revenue. Typically, the order book cycle is around 6 months and, hence, the strong order book reflects good visibility.

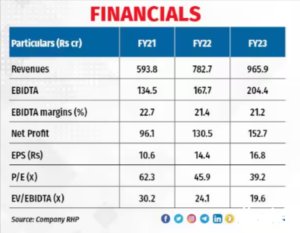

The company is expanding capacities, products portfolio (new gases and specific critical solutions), and markets. This will further support growth. At present, it is operating at around 70 percent capacity utilisation and the good news is that the business does not require a lot of capital. The gross asset turnover (how much revenue a company can generate by investing each rupee on capex) stands at around 4 times, which is good for a business that earns high margins and high return on capital.

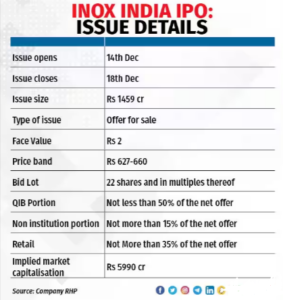

This is also a reason that it does not rely on debt. It is sitting on surplus cash of Rs 225 crore and thus the IPO is entirely an offer for sale. Most of the growth capital is actually funded internally helped by strong cash flows.

Valuation

In terms of valuation, at the higher end of the IPO price, the issue is priced at 29 times its annualised fiscal 2024 earnings. This is quite reasonable considering the quality of business, strong orders, business leadership, industry opportunity, strong balance sheet, and prudent and experienced management.

Bymoneyc0ontrol