Is Muthoot Microfin’s huge valuation discount to CreditAccess Grameen justified?

Solid financial performance in FY24 and upbeat guidance for FY25 augur well for the stock.

Highlights

-

- Solid performance in FY24

-

- Robust loan growth, improving asset quality

-

- Strong return ratios, IPO proceeds enhanced the capital strength

-

- Management’s guidance for FY25 is very encouraging

-

- Valuation at more than 50% discount to CreditAccess Grameen

The microfinance sector historically is on a roller coaster ride. However, the current period is favourable due to economic buoyancy. NBFC-MFIs are on a firm growth path and asset quality is on an uptrend after being hit by the pandemic.

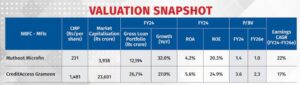

We suggested the recently listed Muthoot Microfin (CMP: Rs 231; Mcap: Rs 3,938 crore; Rating: Overweight), a non–bank microfinance company (NBFC–MFIs), as part of our Discovery Series in March ’24. The stock has risen 15 percent since then. Despite the rally, the stock is trading below the IPO issue price of Rs 291. However, that’s not the only reason for our optimism.

The lender’s solid financial performance in FY24 and upbeat guidance for FY25 pave the way for a big rally in the stock, especially as the valuation is very attractive relative to strong return ratios and even when compared to peers.

Robust loan growth

MML’s loan book increased 32 percent YoY (year-on-year) to Rs 12,194 crore as of end March ’24, after growing 36 percent (compounded annually) between FY21 and FY23.

The operations of the micro-lender are concentrated in South India. The three states accounted for around 49 percent of the asset under management (AUM) as on March 31, 2024, with Tamil Nadu, Kerala, and Karnataka contributing 25 percent, 15 percent, and 9 percent, respectively. The company has been expanding operations outside southern India to around 14 other states over the past two years. As a result, per-state concentration has been consistently declining, with the top state accounting for 25 percent of the total portfolio as on March 31, 2024, down from 53 percent as on March 31, 2016. The company plans to reduce the geographical concentration of the portfolio to around 20 percent per state over the medium term.

Improving asset quality

MML’s asset quality has been on an improving trend after being hit by the pandemic. Consequently, there was a sharp fall in credit cost to 1.7 percent in FY24 from around 3 percent in FY23.

As the collection efficiency during the most months of FY24 has been around 99 percent, the asset quality pressure can ease further.

That said, investors should note that micro-finance is a relatively riskier asset segment with a weak borrower profile susceptible to socio-political issues (loan waivers, political interferences) and economic slowdown (rising inflation, unemployment).

Strong return ratios

Along with the high growth, the company’s profitability has steadily improved. The company consistently reported ROA (return on assets) above 4 percent in the last five quarters. MML’s net profit in FY24 more than doubled compared to FY23, leading to an ROA of 4.2 percent in FY24.

Are the return ratios sustainable?

MML’s profitability, which was on an improving trend in the past couple of years, is likely to stabilise in FY25 as the expansion in margins takes a backseat even as credit costs remain benign.

There was a continuous expansion in their pre-provisioning operating profit (PPOP) margins over the past two years due to declining credit costs. The expansion in PPOP margins has also been supported by the removal of a prescriptive/regulatory cap on lending rates in March 2022.

The profitability is likely to be maintained in the near term, mainly supported by lower credit costs in the absence of any major negative event playing out. Profitability may even improve as operating leverage plays out, reducing the cost-to-income ratio. The company expanded its branches during the last 2-3 years, leading to higher operating cost. As it will now be leveraging on all these branches for incremental growth, the operating expenses are expected to remain stable with no material increase over the medium term.

While MML’s cost-to-income ratio has improved to 45.5 percent in FY24, it is much higher compared to the industry leader CreditAccess Grameen’s cost-to-income ratio of 30.5 percent, indicating a scope of further decline.

The ROE (return on equity) will be diluted in the immediate future quarters on the back of the capital infusion. The company raised fresh equity capital of Rs 760 along with an offer-for-sale of Rs 200 crore through an IPO in December’23. Consequently, the capital adequacy ratio (CAR) improved to 28.9 percent as of March 31, 2024 (21.87 percent as of March 31, 2023) and will support growth over the medium term.

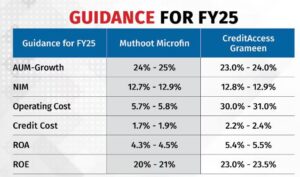

The management’s guidance for FY25 is very encouraging and is tad below the guidance of the industry’s leading player.

Attractive valuation

Muthoot Microfin is trading at just 1-time estimated book value for FY26, which is very attractive given the returns profile (ROA of above 4 percent) and strong guidance.

On a relative basis also, valuation looks compelling when compared to peer CreditAccess Grameen that is now trading at 2.3 times the FY26 estimated book. Surely, CreditAccess enjoys premium valuation because of its strong parentage and higher return ratios. But the huge valuation gap is unjustified and should narrow in the future leading to an upside potential in the MML’s stock price.

Investors with an ability to shoulder risks associated with the microfinance business and looking to participate in the growing business at the bottom of the pyramid should buy the stock for long-term gains

Bymoneycontrol