Is there a correct level to start buying IT stocks?

By MC

Long-term investors could look to add some strong technology companies at a price correction

Highlights

-

- IT sector one of the worst performers in 2022

-

- Irrespective of fundamental performance, stocks have corrected

-

- So far macro concerns have played on sentiment

-

- Going forward macro uncertainties may start impacting business

-

- Near-term outlook clouded

-

- Long-term technology demand remains robust

-

- As stocks veer towards pre-pandemic valuation, they could be ripe for accumulation

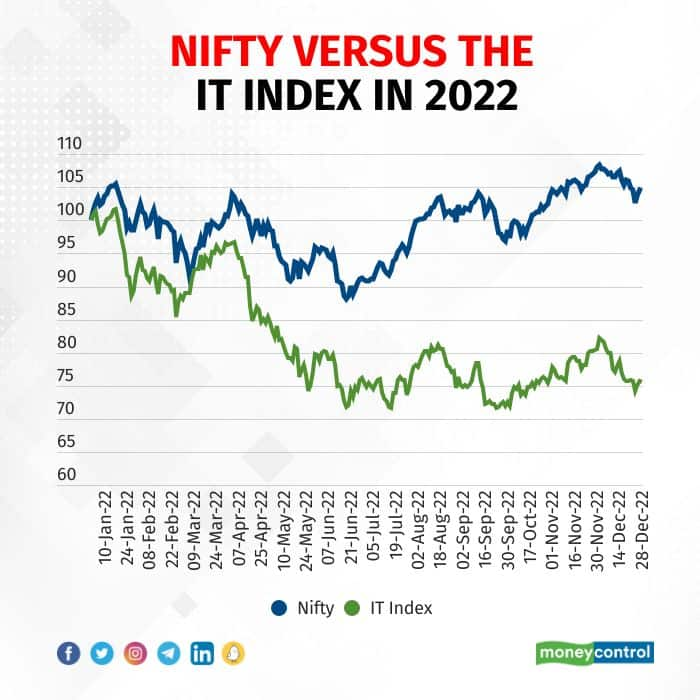

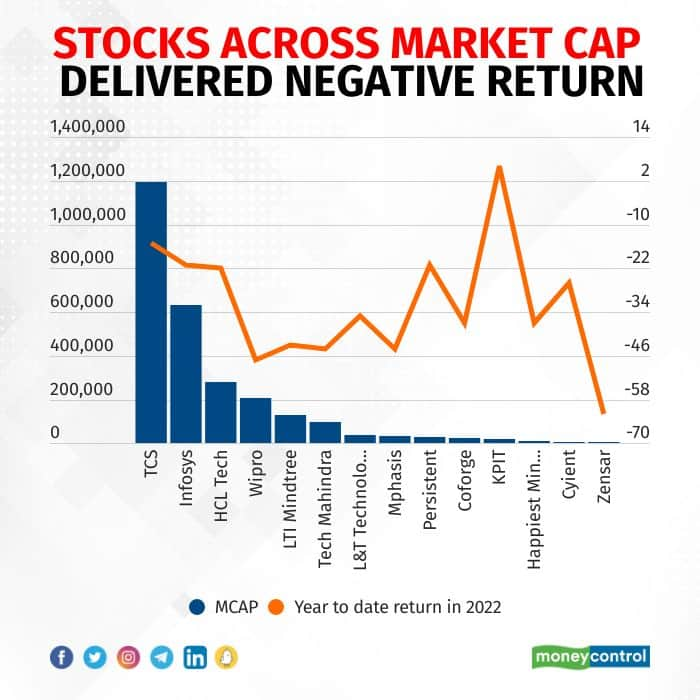

The year 2022 wasn’t easy for the Indian markets. While the benchmark Nifty has managed to generate a meagre return of little over 4 percent year to date, the IT index has been one of the big under-performers with a decline of over 24 percent in the same period.

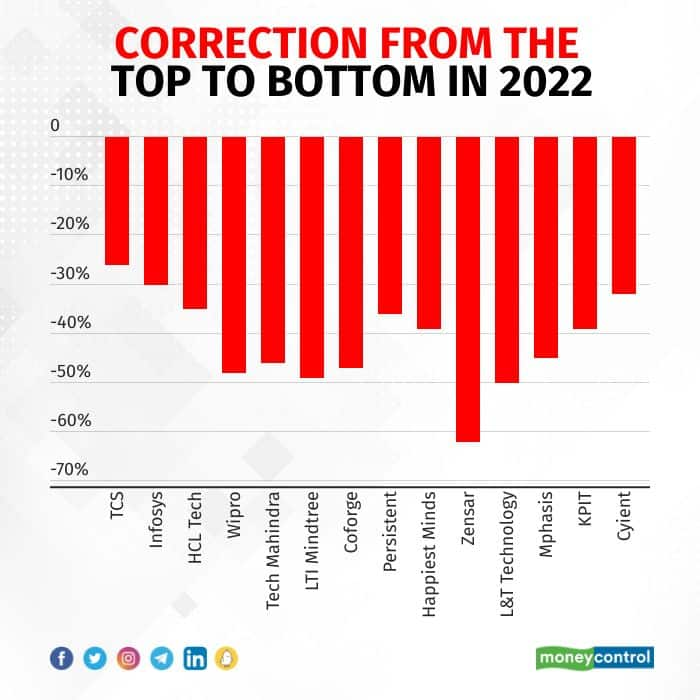

In fact, while the gap between the top and the bottom was 23 percent for Nifty, it was a whopping 42 percent for the IT Index. Year to date, except for one, every other stock has declined and underperformed the Nifty.

While the decline in the wake of the unprecedented central bank action to tame inflation in key western markets appears to be a no-brainer, confusion arises from the fact that, barring a handful, the majority of the Indian IT service companies have not experienced order cancellation, execution delays, or drying up of order pipeline. Then why should investors fret?

The reason lies in the macro itself. While the war against inflation continues and the long-drawn geopolitical conflict and supply-chain disruption make the inflation scenario worse, the possibility of a near-term soft landing looks bleaker. Most enterprise clients are looking at 2023 and beyond with caution and reprioritising spending, which could impact the nature of the projects being awarded or a delayed timeline.

The long-term narrative from all players remain the same — that technology spending is non- discretionary, it is at the heart of every business, and digital transformation and migration to cloud are themes that are here to stay. However, there is no gainsaying that caution is setting in with companies increasingly guiding to cost take-out projects as enterprises are in a cost-cutting mode while bracing for a possible recession.

The upcoming Q3, a seasonally weak quarter for IT service companies, could turn out to be a tad weaker, thanks to holidays and furloughs. The commentary from enterprises on their 2023 outlook in their post-earning communication too will be dotted with caution and scepticism.

Is IT Service an avoid in FY2024 as well?

While the narrative may get murkier, there could be light at the end of the tunnel. Though the nature of deals may change, higher offshoring could bring good news for many of the home-grown players. The rising trend of offshoring coupled with waning supply-side challenges as attrition eases and pyramid delivery (more billable freshers) gathers pace could aid operating margins. Notwithstanding lower growth, and hence, even in the absence of operating leverage benefits, most companies will sail through a difficult 2023. As the macro scare gives way to stability, technology demand will come back meaningfully to the survivors as it is a long-term trend and not a pandemic-induced blip.

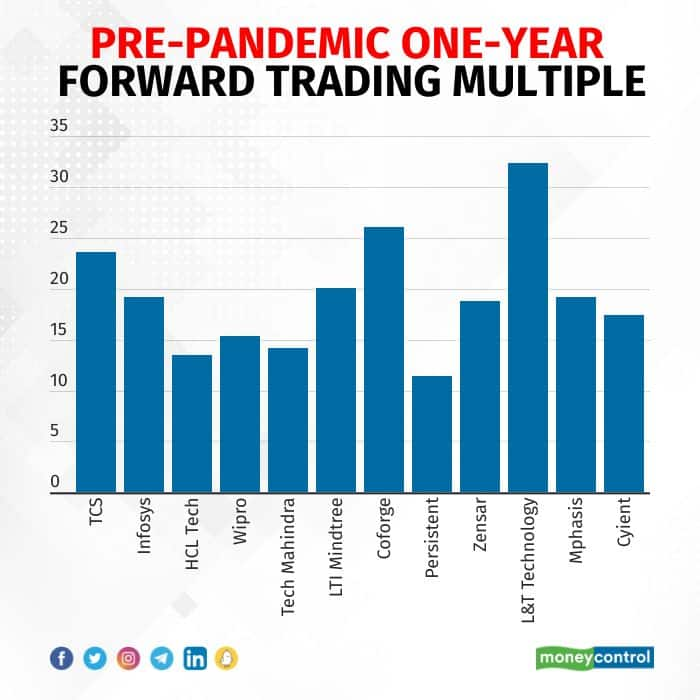

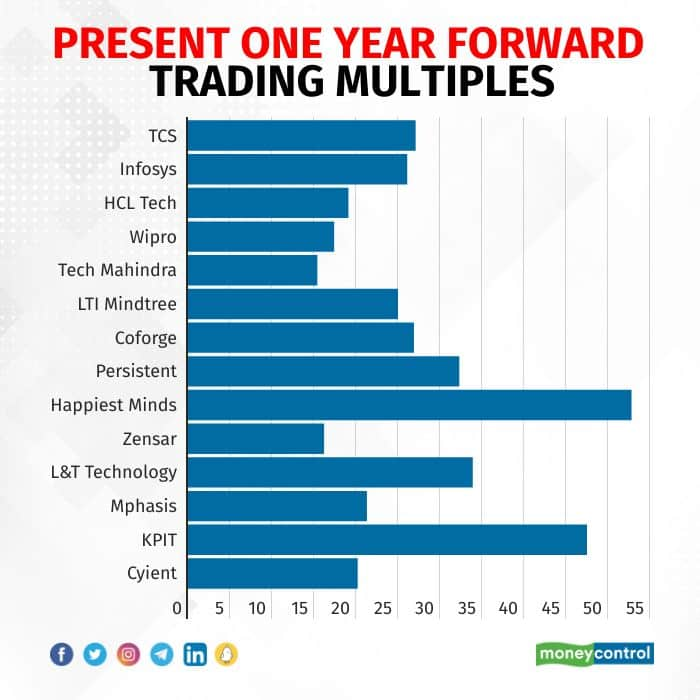

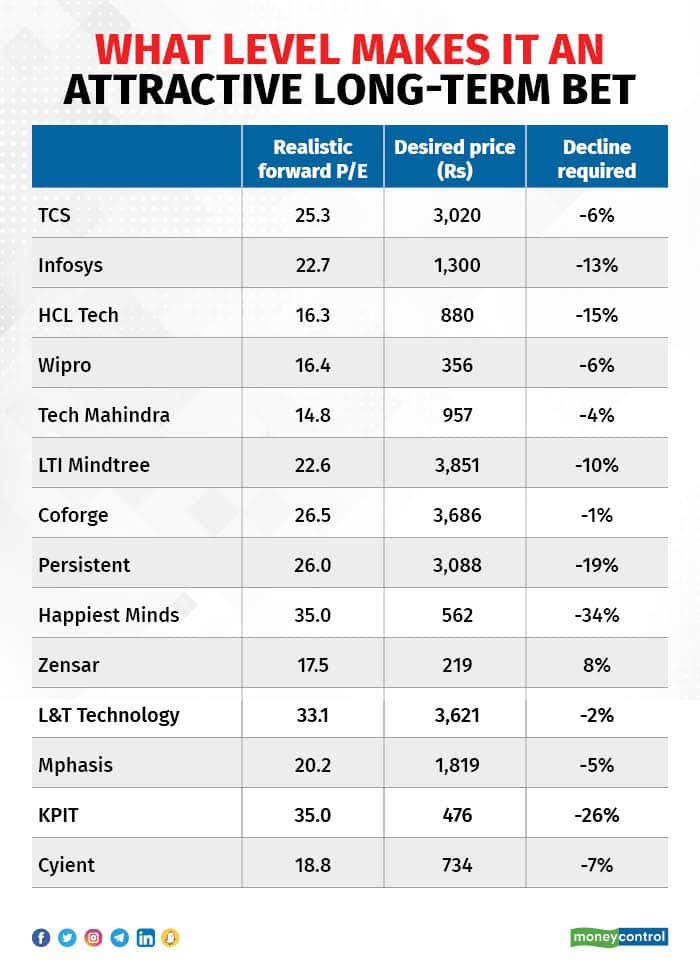

We will be watchful about the correction for long-term entry opportunity. Given the jitters about a possible recession in the US & Europe, valuation could revert to pre-pandemic level.

However, a more probable level could be somewhere between the prevailing valuation and pre-pandemic. This could be because the outlook for overall technology spending still remains buoyant for the medium to long term.

Should this correction play out meaningfully, long-term investors could look to add some strong technology companies at a price correction of anywhere between 5 percent and 35 percent.

Key risks: Deep and prolonged recessions have a severe impact on technology budgets.

insidesmarket.com