Kaynes Technology: After a spectacular run, what should investors do?

OSAT business appears to have priced in current valuation. Hence, approval delay may have an impact in the near term.

Highlights

-

- Revenue growth better than guidance

-

- EBITDA margin lower than last year due to product mix

-

- Order book, excluding smart meters, at Rs 4,115 crore

-

- FY25 EMS business outlook includes revenue growth of 60%

-

- EBITDA margin guidance of 15%

- At FY26 PE of 49x, valuation may have some more upside

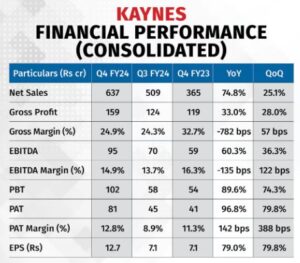

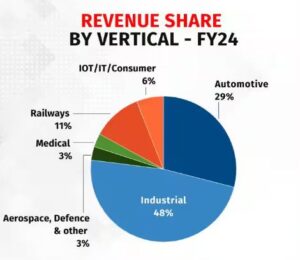

(CMP: Rs 3,403.5; Market cap: Rs 21,754 crore; Rating: Equal weight) reported a strong revenue growth of 25.1 percent quarter on quarter (QoQ)/74.8 percent year on year (YoY), led by the industrial segment, which includes the EV (electrical vehicle), aerospace, defence and railway verticals.

Revenue growth translated into a 36.3 percent sequential EBITDA (earnings before interest, tax, depreciation and amortization) growth and 122 basis point (bps) EBITDA margin expansion over Q3FY24.

Q4FY24 financial performance

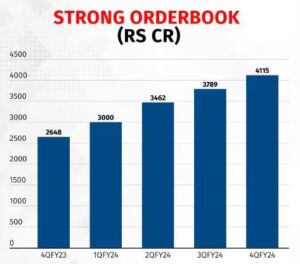

The order book at the end of the year stood at Rs 4,115 crore, up 55 percent and executable over the next five quarters, offering a clear visibility of the FY25 revenue.

A large chunk of this is dominated by the automotive and industrial verticals. On a sequential basis, the order book grew by 8.6 percent while the average monthly order inflow grew by 15 percent. The management commentary suggests that they have much better visibility from here and some of the A&D vertical orders are 5-10 years long.

Single customers driving excess growth

Kaynes’ customer concentration of the Top1/Top5 segment was 26 percent/53 percent, respectively, in FY24, which has gone up sharply in the last two years.

In FY23, revenue growth in the top customer segment was 86 percent, in contrast to the total revenue growth of 59 percent. This rose significantly in FY24, with the top customer revenue growing by 247 percent and revenue growth, excluding it, coming down drastically to 34.8 percent, which is closer to the industry growth rate.

OSAT approval could lend an upside

The Kaynes management expects approval for its OSAT (outsourced semiconductor assembly and testing) business, after the formation of a new government.

The new venture would help the company bolster its presence in the semiconductor value chain.

Kaynes has already tied up with Recynergy Technology and Aptos Technology, both based in Taiwan, for technical know-how in semiconductor testing and packaging. OSAT business appears to have priced in the current valuation. Hence, approval delay may have an impact in the near term.

Outlook

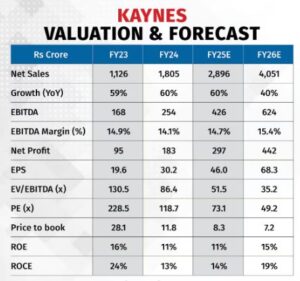

Kaynes Technology has proven itself to be materially different from other EMS (electronics manufacturing service) businesses, with consistent performance and delivering on the outlook, unlike its peers. PAT growth in FY24, at 92.5 percent, includes the impact of other income, which has risen almost 5x due to the QIP (qualified institutional placement) money raised during the year.

The management commentary has been strong and the outlook doesn’t fully include businesses such as railways (Kavach programme) and smart meters, for which the order flow can be Rs 400-500 crore but not in the FY24 order book.

Beyond FY25, high-performance computing server manufacturing orders with CDAC, long-term aerospace orders, medical electronics, and railway- related orders should maintain the growth momentum.

The management has also pointed out that significant revenue comes from the industrial & automotive verticals, which are high-volume, lower gross margin businesses. Going forward, the company expects it to come down to a 60:40 ratio (industrial & automotive vs A&D, railway, medical) and eventually to 50:50, translating into a margin improvement, north of 15 percent. OSAT approval and PCB production commencement are still 1.2-2 years ahead. Therefore, the actual outcome may add to the tailwinds.

Valuation

Kaynes Technology currently trades at an FY26 PE of 49.2 times and at a PEG of 1x. In our view, this indicates that the EMS business growth is broadly priced in and the OSAT approval could be the near-term catalyst. Therefore, it may have some upside from here. Investors can add the stock with a medium-term view.

Risks

Deceleration in revenue growth, execution delay, margin dilution, and a longer working capital cycle. Delay and/or rejection of the OSAT project.

Bymoneycontrol