Larsen & Toubro: Improving fundamentals, strong earnings visibility to support the stock

Orders in hand have jumped, execution has been robust, and domestic capex cycle continues to grow.

Key Highlights:

-

- Strong execution in infrastructure supports strong growth in Q2FY24

-

- Margins improving with higher scale, lower cost, and better mix of projects

-

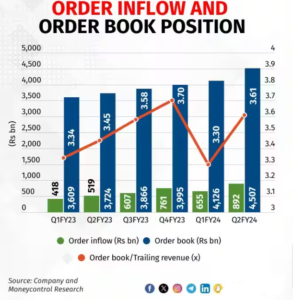

- Robust order inflows and order book provide strong revenue visibility

-

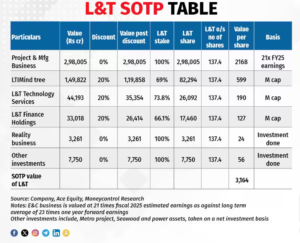

- Stock valued at Rs 3164 per share on a SOTP basis

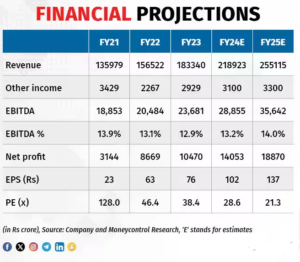

(CMP:2,929 Market Cap: Rs 411,686 cr Rating: Equalweight) is upbeat on the revival and growth in the domestic manufacturing sector. It is eyeing higher growth and better margins, which will help in delivering better earnings growth over the next two years. Orders in hand have jumped to an all-time high, execution has been robust, and domestic capex cycle continues to grow. Moreover, softer commodity prices, cash in the books, and the better performance of subsidiaries will continue to drive its financial performance in the coming years.

Result analysis

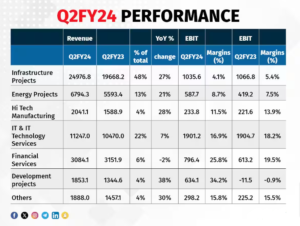

Robust double-digit growth led by infrastructure and power segment

L&T has posted robust double-digit growth in Q2FY24. The core infrastructure segment (which is the largest business segment) once again led the growth momentum. Robust project execution, led by a growing order book, boosted the top line. The energy segment also posted healthy growth, led by a pick-up in project execution in international projects. Hi-tech manufacturing, developmental projects, and other businesses also posted strong top-line growth.

Services business growth was lower, pulling down the overall growth for L&T. IT & IT technology services business grew in high single digits because of global headwinds. Also, the financial services business, which is seeing a rundown of the wholesale segment, posted a marginal revenue drop year on year (YoY).

Margin decline continues

Margins declined YoY. Margin pressures continued in the infrastructure segment owing to the continued execution of legacy projects. These were taken up during COVID-19 and do not have sufficient price escalation clauses to absorb the subsequent cost increases faced by the company. The margins of the IT services business also declined owing to salary hikes.

The energy segment margins improved, thanks to jobs crossing the valuation threshold. The margins of financial services also improved on the back of lower credit costs and better asset quality. Margin improvement in these businesses enabled to offset the margin drop in infrastructure and IT business to a certain extent.

Outlook

L&T received the highest-ever quarterly order inflow worth Rs 89,200 crore in Q2FY24, a 72 percent YoY growth. About two-thirds of the order inflow in Q2 was from international markets (mainly Middle East). International order inflows in Q2FY24 were 3.5x of Q2FY23 levels. L&T now tops the list of international EPC contractors working in the Middle East and North Africa (MENA) region in terms of value of projects under execution. Domestic order inflows declined by about 15 percent YoY to Rs 29,500 crore.

L&T indicated that the order pipeline (projects where it can evaluate and bid) continues to remain strong at Rs 8.5-9 lakh crore. About Rs 5-lakh-crore projects in the pipeline are in the core infrastructure segment, while about Rs 3 lakh crore are in the hydrocarbon segment.

With H1FY24 order inflows growing 65 percent YoY, L&T will easily surpass its FY24 order inflow guidance of 12-15 percent. L&T refrained from giving specific order inflow growth guidance for FY24. With the projects and manufacturing business showing a strong revenue growth of 36 percent YoY in H1FY24, L&T will also surpass its revenue growth guidance of 12-15 percent for FY24.

Core infrastructure business margins are expected to improve as the legacy projects are nearing completion. With a better mix of projects to be executed going ahead, L&T expects a progressive margin improvement from Q3FY24.

As per L&T, the ongoing Israel-Hamas crisis is unlikely to affect the company as most of the Middle East projects are in the Saudi Arabian market, which is unscathed by the conflict as of now.

Moreover, L&T does not have any supply-chain linkages in Israel. So, L&T’s execution is unlikely to be affected. However, we need to closely monitor the situation going ahead.

L&T is bullish on growth prospects in India given the pace of economic development, consumer and business optimism, higher government spending in infrastructure, and healthy balance sheets of banks and corporates which would revive private capex. L&T will also benefit from Gulf Cooperation Council (GCC) strong capex momentum which is expected to continue in the areas of oil & gas, industrialisation as well as energy transition projects.

Valuations

The L&T stock continues to ride on the recovery and the government-led capex cycle. Moreover, strong growth in orders, robust execution, improvement in margins, and financial performance has led to an improved outlook. Year till date, its stock has delivered over 40 per cent returns. It recently corrected from around Rs 3100 to Rs 2926 a share and now trades at 21 times its fiscal 2025 estimated earnings. Compared to the SOTP valuations of Rs 3164, the current market price offers an upside of 8 percent.

Bymoneycontrol