LIC FY24: Healthy performance, big boost can come with composite licence

The insurance behemoth’s low valuation is the main attraction. If composite licences are allowed, it will enable LIC to foray into the health insurance sector as well.

Highlights

-

- Healthy performance in FY24

-

- Top-line growth revival led by group business in H2FY24

-

- Product mix improves, focus is on growing non-par products

-

- Margins flat

-

- Composite licence can be game changer

- Valuation reasonable, despite rally

The stock of Life Insurance Corporation of India (CMP: Rs 1,021; M Cap: Rs 646,035 crore; Rating: Overweight) has rallied around 50 percent in the past six months. This is a positive for LIC, which traded below the IPO price for a long time since its listing in May 2022.

The key question, however, is will the rally sustain?

Certainly, there is more steam left in the stock. And there are three reasons.

The first is the insurer’s low valuation. LIC is trading at 0.9 times EV (embedded value), as of March 2024, which is at a significant discount, compared with the average valuation of listed private peers. Surely, LIC’s performance lags private peers on many parameters. The valuation gap can narrow on its improving performance.

Second, LIC’s financial performance deserves equal attention. LIC lost market share in FY24 to private peers. That’s because it has been focusing on profitable growth and has taken steps to improve the product mix by focusing on high-yielding products.

And finally, LIC will be one of the biggest beneficiaries if a composite licence that enables an insurer to offer both life and non-life insurance products gets introduced.

The Standing Committee on Finance, headed by Jayant Sinha, has recommended a composite licence regime for the insurance sector. Currently, the regulations don’t allow a single entity to sell both life and non-life insurance products.

According to the management, LIC would be keen to enter the health insurance business through the inorganic route if a composite licence becomes a reality. It may consider acquiring a standalone health insurance company.

FY24 performance in line with long-term goals

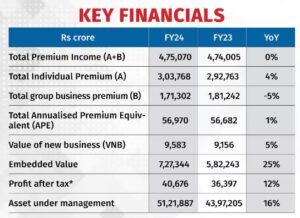

LIC’s net profit increased in FY24 but is not comparable to the previous year (FY23) as the corporation had changed its accounting policy in September 2022, regarding the transfer of amount pertaining to the accretion on the available solvency margin from non-participating policyholders account to shareholders account.

Anyways, profit is not the right yardstick to assess an insurer’s performance. Life insurance companies are assessed on top-line growth, which is the total annualised premium equivalent (APE), a measure of ascertaining business sales in the life insurance industry.

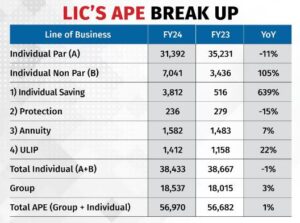

In the first half of current fiscal (H1FY24), LIC saw a decline of 10 percent year-on-year (YoY) in APE due to the fall in group premium even as individual premium remained flat. However, LIC’s management was confident of regaining lost ground in H2FY24 through various initiatives, especially product launches. In H2FY24, LIC’s APE growth picked up as group business revived sharply, as guided by the management, leading to almost flat APE in FY24.

Improving product mix

LIC’s product mix is skewed towards par savings products – the so-called endowment plans, as historically it focused on participating (par) products where a minimal return is guaranteed, and policyholders participate in the profit of the policy.

In contrast, the product mix of private players is more favourable with a higher share of pure protection products (term plans) that earn better margins.

Despite a flat top line in FY24, the encouraging aspect is that LIC is incrementally focusing on high-yielding products, especially since its listing. It launched six new non-par products in FY24. Consequently, the share of non-par business doubled to 18 percent of APE in FY24 from 9 percent in FY23.

Margin flat

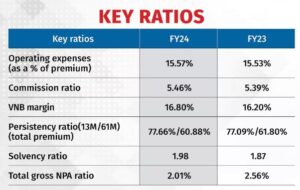

The VNB (value of new business) margins remained almost flat in FY24 as gains from a better product mix were offset by enhanced benefits on annuity business.

The absolute VNB increased 5 percent YoY in FY24. This is an important development as VNB (both growth and margins thereof) is the EPS equivalent for a life insurance company. It is the unit of measurement that investors use to gauge the profitability of the business.

VNB is the present value of profit that is expected to be generated over all future years by the new business written in a particular year. VNB represents the actual value created for equity shareholders in a particular period and hence determines the market valuations.

LIC’s VNB margins remain much lower than private peers, but there is a huge scope of improvement in VNB margins. A shift in product mix can push VNB margins further.

Valuation reasonable

A life insurance company’s valuation is determined by the embedded value (EV), which is the sum of the present value of all future profits from existing business, plus net worth.

LIC is trading at 0.9 times the EV, as of March 2024, despite a huge rally in the stock price. That’s because LIC’s EV increased by 25 percent YoY in FY24, driven by the buoyant equity markets and the consequent mark-to-market (MTM) gains.

Despite the rally, LIC’s stock has delivered an absolute return of a mere 8 percent since its listing in May 2022, massively underperforming the benchmark. We suggested LIC as weekly tactical pick in December and the stock is up 30 percent since then.

Going forward, in addition to the growth in EV, a stock upside can result from valuation re-rating. The valuation multiple assigned to the EV can expand as the management is confident of delivering a healthy top-line growth, along with a gradual improvement in margin. Hence, long-term investors should accumulate the stock.

Bymoneycontrol