LIC – modest performance in Q1 FY25, but valuation remains main draw

Margins improvement will take time, but the product-mix story is playing out.

Highlights

-

- Top-line growth revives, led by group business in Q1 FY25

-

- Product mix improves, focus is on growing non-par products

-

- Margins fall across products, but overall margin inch up slightly due to better product mix

-

- Valuation reasonable despite the rally

Life Insurance Corporation of India (CMP: Rs 1,089; Mcap: Rs 688,792 crore; Rating: Overweight) posted a moderate earnings performance in the first quarter of FY25 (Q1 FY25). While top-line growth was healthy and there was a slight improvement in margins, LIC’s VNB margins remain much lower than private peers.

LIC’s stock has rallied over 65 percent in the past one year. Despite the rally, LIC is trading at 1 times the EV (embedded value) as of March ’24, which is at a significant discount compared with the average valuation of listed private peers. Surely, LIC’s performance lags private peers on many parameters, but the valuation gap can narrow on LIC’s improving performance.

That said, LIC’s financial performance deserves equal attention along with its low valuation. LIC lost market share in FY24 to private peers. But Q1 FY25 shows that the insurance behemoth has regained some market share. More encouraging has been the improvement in the product mix.

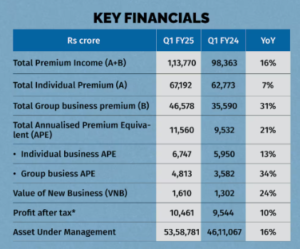

LIC’s net profit increased by 10 percent year on year (YoY) in Q1 FY25. However, profit is not the right yardstick to assess an insurer’s performance. Life insurance companies are assessed on top-line growth, which is total annualised premium equivalent (APE), a measure of ascertaining business sales in the life insurance industry.

LIC’s APE growth picked up as group business revived sharply as guided by the management last year, leading to an overall APE growth of 21 percent in Q1 FY25. The growth in individual business APE was modest at 13 percent YoY, significantly lagging the growth in group business that saw the APE rising 34 percent YoY in Q1 FY25.

Consequent to the growth in group business, LIC’s market share by first year premium income increased to 64.02 percent, as per the IRDA figures for Q1 FY25, compared to 61.42 percent in the corresponding quarter last year (Q1 FY24).

Improving product mix

LIC’s product mix is skewed towards par savings products — the so-called endowment plans, as historically it is focused on participating (par) products where a minimal return is guaranteed and policyholders participate in the profit of the policy. In contrast, the product mix of private players is more favourable with a higher share of pure protection products (the term plans) that earn better margins.

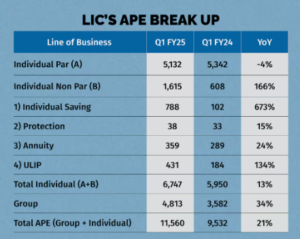

The encouraging aspect is that LIC is incrementally focusing on high-yielding products, especially since its listing. It launched six non-par products in FY24. Consequently, the share of individual non-par business has more than doubled to 23.9 percent of the APE in Q1 FY25 from 10.2 percent in Q1 FY24.

Margins under pressure

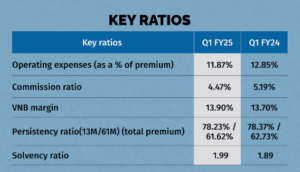

The VNB (value of new business) margins improved a bit to 13.9 percent in Q1 FY25, a rise of 20 bps YoY.

Margin across products (both par and non-par products) were down. The non-par segment has seen a steady decline in margins from 72 percent in Q1 FY23 to 43 percent in Q1 FY24 and a further decline to 39.8 percent in Q1 FY25. This is because of higher benefit payouts in this segment as the management has prioritised growth over margins.

Despite a fall in margins across the line, there was a slight gain in the overall margin due to a better product mix.

The management’s focus on growth was also reflected in the absolute VNB growth of 24 percent YoY in Q1 FY25. This is an important development as the VNB (value of new business) is the EPS equivalent for a life insurance company – it is the unit of measurement that investors use to gauge the profitability of the business. It represents the actual value created for equity shareholders in a particular period and hence determines the market valuations.

Valuation reasonable

A life insurer’s valuation is determined by the embedded value (EV), which is the sum of the present value of all future profits from the existing business plus the net worth.

LIC is trading at 1 time the EV as of March’24, which is at a significant discount compared with the average valuation of listed private peers.

LIC’s current valuation more than prices in the concerns of stiff competition from private players and lower VNB margins.

While EV may grow gradually, the valuation multiple assigned to EV can certainly expand. Strong business growth with improving product mix can lead to a gradual valuation re-rating. Hence, long-term investors should accumulate the stock.

Bymoneycontrol