Market LIVE Updates: Indices trade higher amid volatility; RIL, HDFC Bank, ICICI Bank most active

Jefferies View On Cholamandalam Investment and Finance Company

-Q4 disbursement grew 65 percent YoY, well above our estimate

-Auto finance disbursement grew 39 percent YoY

-New business disbursements (23 percent QoQ) formed 22 percent of total

Cholamandalam Investment and Finance Company touched a 52-week high of Rs 846 and was quoting at Rs 844, up Rs 62.50, or 8 percent.

Morgan Stanley View On Tata Steel:

-Q4 sales volume declined 2 percent YoY but saw seasonal QoQ improvement

-Exports remained in a lull but domestic demand picked up

-European business sales remained lower than production

Tata Steel was quoting at Rs 104.35, down Rs 0.50, or 0.48 percent.

Paras Defence arm receives Type Certificate from DGCA

Paras Defence and Space Technologies’ subsidiary Paras Aerospace Private has received Type Certificate from DGCA (Directorate General of Civil Aviation), Drone Directorate, Govt. of India, for it’s Agri Drone – “Paras-Agricopter”.

Paras Defence and Space Technologies was quoting at Rs 493.70, up Rs 9.60, or 1.98 percent.

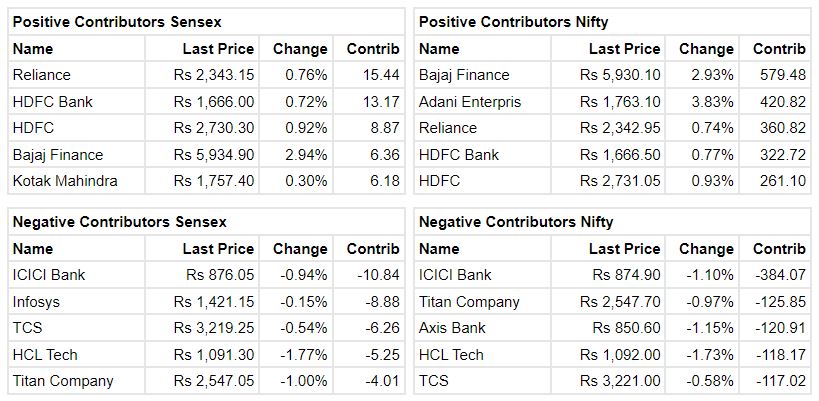

Market at 3 PM

Benchmark indices were trading higher amid volatility.

The Sensex was up 146.15 points or 0.24% at 59,835.46, and the Nifty was up 42.80 points or 0.24% at 17,599.80. About 2213 shares advanced, 1083 shares declined, and 84 shares unchanged.

Mitual Shah Head of Research Reliance Securities

The RBI MPC surprised the street by keeping the repo rate unchanged at 6.5% against consensus expectation of a 25bps hike. However, the governor reiterated that this was a pause and not a pivot. Inflation still continues to remain above target and the central bank remains focused on withdrawal of accommodation.

The MPC forecasted FY24 GDP growth at 6.5% while the inflation forecast was cut to 5.2% from 5.3% forecasted in the February meeting.

Overall cautious sounding on economy and global uncertainty would continue pressure on equity markets for near term, while its bottoming out slowly ahead of likely bounce back soon. Markets would be watchful of large IT results and inflation print to be announced next week.

Greaves Cotton director Kewal Handa resigns

Kewal Handa has resigned as Independent Director of Greaves Cotton with effect from April 5 due to his professional commitments. Kewal has confirmed that there are no other material reasons for his resignation.

Greaves Cotton was quoting at Rs 132.95, down Rs 2.40, or 1.77 percent.

Godrej Consumer Products reclaims Rs 1 lakh crore mcap on strong Q4 performance

Godrej Consumer Products (GCPL) has regained its Rs 1 lakh crore market capitalization following a 1% increase in its stock price, driven by strong double-digit volume and value growth in the March quarter. The company anticipates delivering consolidated double-digit growth in rupee terms, led by mid-single digit volume growth, gross margin recovery, and continued marketing investments, which should translate to robust double-digit Ebitda growth. Over the past month, GCPL’s stock has outperformed the market, surging 6% compared to a 0.51% decline in the S&P BSE Sensex, and over the last year, it has rallied 29% compared to a 0.51% rise in the benchmark index. The company hit a record high of Rs 1,138.50 in September 2021.

ByMoneycontrol