PVR Inox Q2: Merger synergy, content line-up help deliver blockbuster numbers

Movie lineup for the next two quarters looks robust across different genres; occupancy likely to remain strong in the second half.

Highlights

-

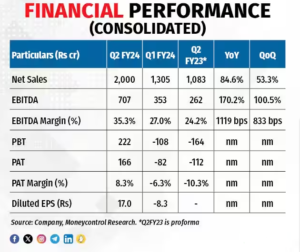

- Sequential revenue jump of 53.3 percent

-

- Q2FY24 EBITDA margin at 35.3 percent

-

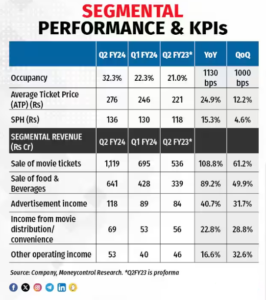

- Occupancy at 32.3 percent with a record admit of 4.8 crore

-

- To add 92 screens, close 27 screens in the second half of FY24

-

- A very strong content line-up in Q3 & Q4

-

- Valuation at FY25 EV/EBITDA of 7.1x, upgraded to equal-weight

(CMP: Rs 1744.55; Market Capitalisation: Rs 17,091 crore, Rating: Equal Weight) reported a very strong set of numbers in Q2 on the back of a strong performance by Bollywood, Hollywood and regional movies. This translated into the highest revenue and the highest ever admits in the company’s history. The highest-ever ATP (average ticket price) and SPH (F&B spend per head) were driven by the merger synergy, implying a Rs 20-23 rise in the ATP and a Rs 5.3-6.5 increase in the SPH. PVR Inox paid off debt of Rs 327.6 crore in the quarter.

Q2FY24 Financial Performance.

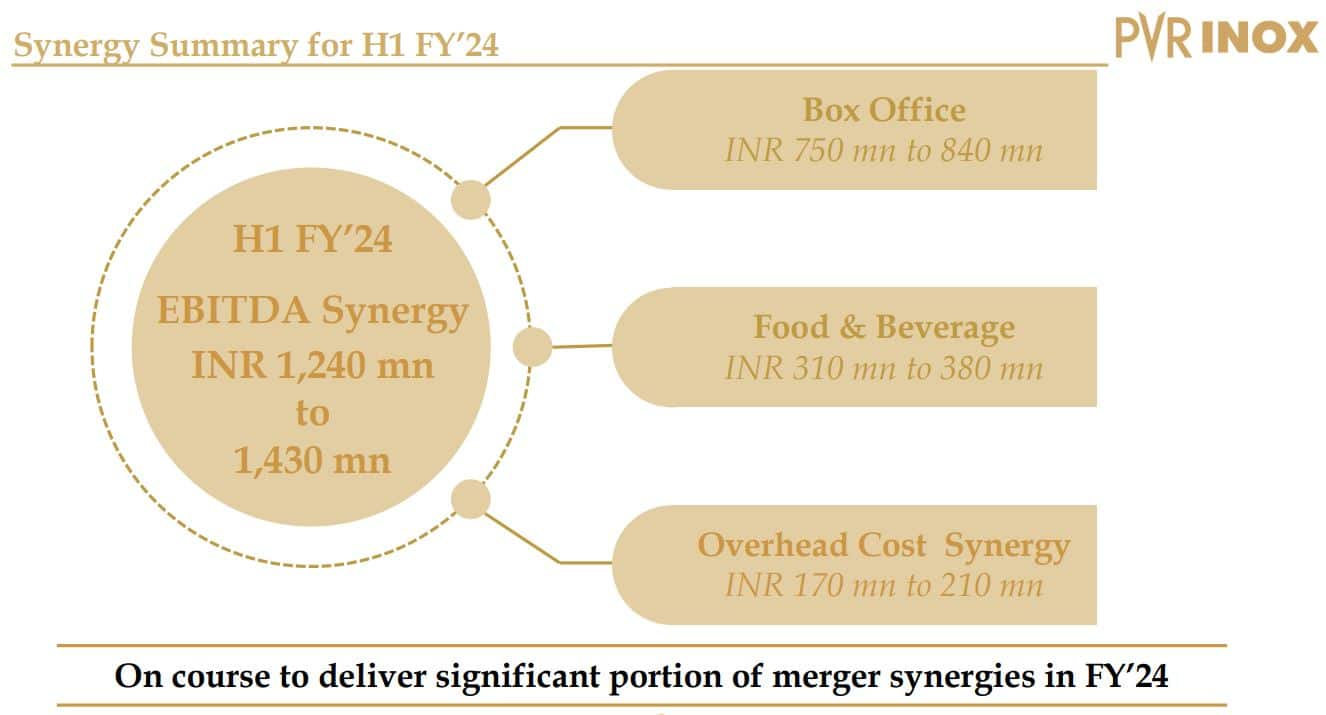

Merger synergy impact in the first half of FY24

PVR Inox declared a merger synergy of Rs 20-23 for the ATP in H1FY24. This was coupled with an organic year-on-year (YoY) growth of Rs 8-11, translating into Rs 75-80 crore box office EBITDA synergy (net of GST and distributor share). Similarly, a Rs 5.3-6.5 growth in the SPH led to an F&B EBITDA synergy of Rs 31-38 crore for the first half of FY24. The company’s management expects that the current SPH levels will continue, while the ATP levels are expected to remain strong as well.

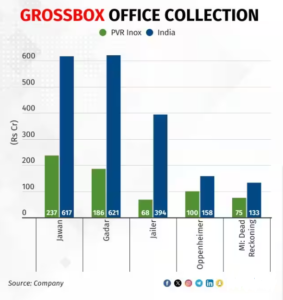

Large box office collection

The Q2 box office collections were strong with multi-blockbuster movies, including Jawan, Gadar, Jailer, and Oppenheimer, which attracted cinema-goers in large numbers. Further, mid-scale movies also performed well and maintained the occupancy momentum with a variety in content and language. Overall, a 32 percent occupancy with 4.84 crore admits fetched significant revenue through ticket sales as well as F&B sales.

Advertising revenue recovering

PVR Inox’s advertising revenue jumped 31.7 percent sequentially to Rs 117.6 crore as blockbuster movies attracted advertisers back to multiplexes. Advertising income per screen is still lower than the pre-COVID levels and full recovery is expected only in FY25. It would also be contingent on the occupancy levels and commercial success of a movie.

Outlook

PVR Inox delivered a strong performance in the quarter in line with Street expectations as the crowd was pulled back with back-to-back movies having a strong cast and story. The movie line-up for the next two quarters looks robust across different genres and languages. This gives confidence that occupancy will remain strong in the second half as well. With both ATP and SPH expected to remain around the current figures, the launch of the PVR Inox Passport subscription could add to revenues by improving occupancies during weekdays.

PVR Inox plans to add around 92 screens in the second half of FY24 and will be closing around 27 screens, effectively adding 65 screens. Further, with synergy, the management expects a 200-basis-point margin improvement for the full year and to turn FCF positive by the end of FY24.

Valuation

We raise our estimates for FY24 revenue, FY24/FY25 EBITDA and EPS, anticipating strong occupancy, higher ATP and SPH, and synergy benefits of the merger. At the current market price of Rs 1744.6, PVR Inox is trading at an FY25 EV to EBITDA multiple of 7.1x, which in our view indicates market-level return potential. Therefore, we upgrade the stock to equal-weight rating.

Bymoneycontrol