Radico Khaitan — Should you raise a toast to Q4 earnings?

The stock appears to have priced in the strong performance of the liquor maker.

Highlights

-

- Premium segment volumes increased 20 percent in FY24

-

- Gross margins dipped 80 bps on a sequential basis

-

- Poor performance by the Popular segment

-

- Luxury and Semi-luxury volumes surged over 50 percent last year

-

- Strong pipeline of new products

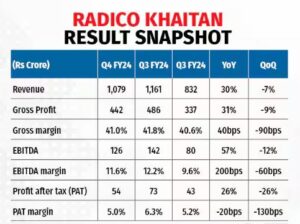

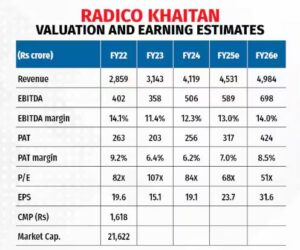

Liquor manufacturer Radico Khaitan (CMP: Rs 1,618; Market Cap: Rs 21,622 crores; Rating: Underweight) posted very strong Q4 numbers, with revenues growing 30 percent year on year (YoY). While FY24 yearly revenues surpassed Rs 4,000 crore, it also marked Radico’s fourth consecutive quarter of revenue growth of more than 20 percent.

Impressive off-take in the Premium segment

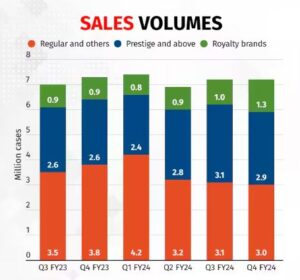

Radico’s volumes for Q4 stood nearly flat at 7.2 million cases. However, the premium segment (Prestige & Above) sustained the ongoing business momentum, clocking a volume growth of over 14 percent YoY and accounting for over 70 percent of consolidated revenues. In value terms, the premium segment sales grew much faster at 16 percent YoY due to an uptick in realisation. The volumes of Royalty Brands also surged on a low base. The popular segment continues to struggle as off-take contracted 22 percent YoY due to portfolio rationalisation and excise duty revisions. Additionally, a sharp surge in non-IMFL revenues, on account of full capacity utilisation at the Sitapur plant, boosted the Q4 top line.

Scaling up the luxury portfolio

Radico’s core product offering — Magic Moments Vodka — clocked 6.3 million cases in FY24 (up from 5.2 million cases last year), thereby reaching net sales of over Rs 1,000 crore. Meanwhile, Morpheus Super Premium Brandy achieved 1.3 million cases in FY24. Given the consistent volume outperformance, the company continues to fortify its foothold in the industry with both Magic Moments and Morpheus Super Premium Brandy, accounting for ~60 percent market share in their respective product categories. The Luxury (Rampur Single Malt Whisky, Sangam World Malt Whisky, Kohinoor Reserve Indian Dark Rum etc.) and Semi-Luxury (Royal Ranthambore Whisky, Happiness in a Bottle Gin etc.) portfolio clocked a volume growth of more than 50 percent in FY24. The distribution of Jaisalmer Gin and Royal Ranthambore has now been expanded to 22 states and 20 states, respectively.

Margins could revert to normal

The management has indicated that the situation on the raw material basket (Grain, ENA, and Glass bottle) continues to be volatile as grain price inflation had a negative impact of over 500 basis points on H2 gross margins. The management expects grain prices to soften hereon on the back of an expected normal monsoon and improved crop yields. The medium-term guidance for operating margins remains in the range of 16-17 percent.

Net debt has peaked

During FY24, Radico commissioned the distillery plant and bottling operations at Sitapur and the dual feed plant at Rampur. The Sitapur plant has a capacity of 350 KLPD, which should be sufficient to meet the in-house ENA requirements for the next 4-5 years.

Interest expenses swelled to Rs 59 crore in FY24 on account of debt-funded capital expenditure. Net debt at the end of the year stood at Rs 687 crore. With most of the capex getting over, the management anticipates a gradual reduction in leverage over FY25 and FY26 through internal accruals.

Outlook and recommendation

etter-than-industry performance and market share gains have triggered an upward rerating in Radico’s stock over the past three years. From a valuation standpoint, Radico trades at FY26 P/E multiples of 51. We continue to retain our underweight stance on the stock as current valuations seem to capture the anticipated growth in earnings over the medium term.

Bymoneycontrol