Rich product mix, soft input prices help Maruti post strong Q2 numbers

The company’s leadership position in the passenger car segment, strong order book, and new products, coupled with a reasonable valuation, make it an attractive long-term bet.

Highlights

-

- Strong set of numbers on a year-on-year as well as on a sequential basis

-

- Rich product mix, operating leverage and softening of raw material costs help margins

-

- Strong order book continues to corroborate robust demand

- Valuations reasonable; accumulate for the long term

Maruti Suzuki India Ltd (

; CMP: Rs 10,561; M Cap: Rs 3.2 lakh crore; Rating: Overweight), the leader in the passenger car segment, posted a strong set of numbers in Q2FY24, compared with the same quarter last year, thanks to the demand for new high-value products, the benefit of operating leverage, and the softening of raw material prices.

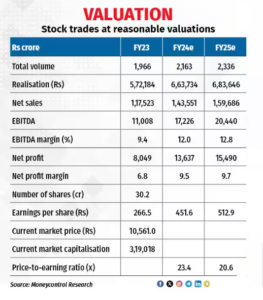

Maruti’s leadership position in the segment, strong order book, and new products, coupled with a reasonable valuation (20.6 times FY25 projected earnings), make it an attractive bet for the long term.

Quarter in a nutshell

Key highlights

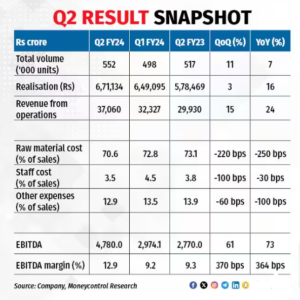

In Q2FY24, the company registered a 7 percent year-on-year (YoY) growth in volumes, led by new products in the SUV segment. The realisation, however, improved substantially at 16 percent, which led to a 24 percent YoY growth in revenues. The improvement in realisation was led by a rich product mix due to multiple launches in the premium SUV segment.

The softening of raw material prices and operating leverage, stemming from higher volumes, helped the company to post an EBITDA (earnings before interest, tax, depreciation and amortisation) margin expansion of 364 basis points (bps) on a YoY basis. On a sequential basis, the margin expanded by 370 bps.

Outlook

Demand momentum as evident from the strong order book: According to the management, the passenger vehicle industry is likely to grow 5-7 percent in FY24, and the company expects to outperform the industry, with a 10 percent YoY growth, driven by its strong network and product launches, especially in the SUV category.

The preference for personal mobility continues to act as a growth catalyst for the company.

This, coupled with new products, continues to drive demand. On the back of new SUV products, the company has garnered a market share of 23 percent in the segment in Q2FY24, against 20 percent in Q1FY24, achieving a leadership position in the Rs 10-20 lakh segment. It recently launched Invicto, a strong hybrid powertrain car, the company’s maiden offering in the Rs 20-lakh-plus segment.

Moreover, the company has a strong order book of 2,88,000 units and with the normalisation of chip supply, MSIL should be able to step up production. A strong order book continues to corroborate the strong demand for cars.

On the export side, Q2FY24 volumes grew 9.7 percent YoY, following the recovery in various markets. The company continues to be the largest exporter of passenger cars, with 69,000 units shipped overseas in the quarter gone by.

On the whole, we expect demand to remain robust from a long-term perspective.

Raw material costs have softened

The steep rise in raw material prices had impacted Maruti’s margins. Now, with metal prices softening, the benefit has started trickling in as is evident from Q1 and Q2FY24 numbers. The management expects the prices of raw materials to remain stable, if not soften from here.

Capacity expansion

In line with the increasing demand, the company is planning to expand capacity. It plans to set up a facility in Haryana which can produce 2,50,000 units per annum. The company is expected to incur a total capital expenditure of Rs 8,000 crore, most of which is expected to go into the new plant.

Acquisition: Gujarat plant to be acquired from the parent

In Q1FY24, the board had approved the acquisition of the Gujarat plant — Suzuki Motor Gujarat (SMG) — from its parent, Suzuki Motor Corporation (SMC). The deal is likely to take place at a book value of Rs 12,700 crore. The deal will help the company improve production efficiency and easy-decision making. However, the deal is expected to make MSIL’s business asset-heavy, as opposed to the asset-light business model.

Valuation

Valuation-wise, the stock is now trading at 20.6 times FY25 projected earnings, which is reasonable. We, therefore, advise investors to accumulate the stock in a staggered manner, with an eye on the long term.

Risks

A further shortage in semiconductor chips and a rise in raw material prices can adversely impact the financials of the company.

Bymoneycontrol