The near-term outlook is rather weak and doesn’t present an appealing investment opportunity.

Highlights

-

- Q2FY24 performance dragged lower due to weak realisations

-

- Farmer-level demand is picking up

-

- New molecule registrations to support volumes in FY24

-

- Pricing will not improve materially anytime soon

-

- Margin pressure in the near term

-

- Valuation cheap, but not attractive

Sharda Cropchem

(SCC; CMP: Rs 423; Market cap: Rs 3,812 crore; Rating: Equal-weight) posted another weak quarter as it continued to wobble, buffeted by multiple headwinds. We think near-term risks have dimmed growth prospects and will keep margins under pressure for some more time.

Weakness persisted in Q2

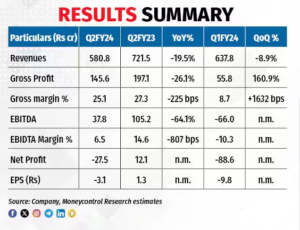

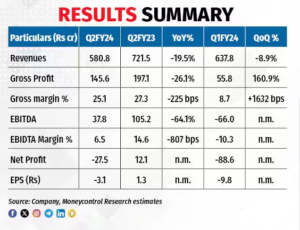

In Q2FY24, SCC posted a revenue decline of 20 percent year on year (YoY), driven by a sharp fall in realisations across regions. The revaluation of inventory due to falling product prices and higher other expenses further impacted the gross margin, which fell by 225 basis points (bps) while the EBITDA (earnings before interest, tax, depreciation, and amortisation) margin of 6.5 percent contracted 800 bps YoY.

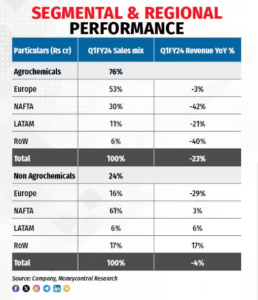

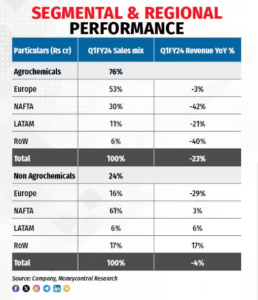

The agrochemical segment’s top line declined 23 percent YoY. The NAFTA region predominately saw the largest revenue decline, to the extent of 42 percent YoY, as a lot of sales return had to be booked owing to falling product prices and the existing channel inventory.

Revenues from the non-agrochemical segment (24 percent of the business mix) declined 4 percent YoY, primarily due to weak pricing. Container shipping costs are embedded in the ASP (average selling price) realised by SCC. Shipping costs have fallen ~70-80 percent from their peak levels and are likely to remain subdued due to slowing demand.

SCC has managed to further reduce its total debt to Rs 2 crore in Sep’23 from Rs 3 crore in Mar’23 and Rs 38 crore in Mar’22. However, due to the high inventory that SCC had to book for sales return, the cash conversion cycle is impacted and stood at 120 days in Sep’23 against 91 days last year.

Volume and pricing environment hasn’t changed much for SCC

High inflationary environment, adverse weather conditions in Europe and LatAm, and an oversupply situation created by China have led to a weakness in the global crop protection chemical market.

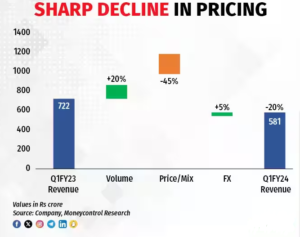

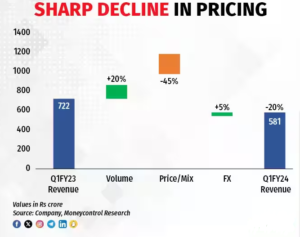

Realisations accounted for a ~45 percent decline in revenues in Q2 for SCC. Though volumes grew YoY, the company had to sell the products at far lower prices.

Pricing pressure continues to hamper the generic crop chemicals market as prices of certain molecules, such as Gluphosinate Ammonium — a key product of the company, have dropped to the extent of 70 percent.

The inventory is getting consumed as demand at the farmer’s level is slowly picking up. Crude oil prices are on the rise again and raw material prices could well bottom out now and stabilise. However, we don’t expect any material improvement in pricing in the near term.

A bleak outlook

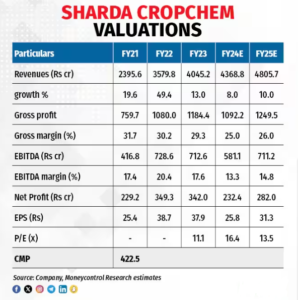

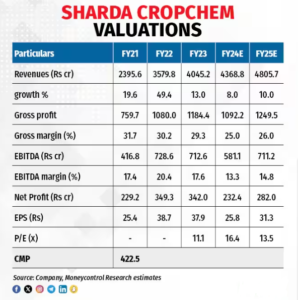

The FY24 guidance is for ~8-10 percent revenue growth and is expected to be driven by volumes as realisations have eroded way too much and will remain under pressure in the second half of the year.

SCC has guided to a capex of ~Rs 400 crore in FY24 which will be used for product registration of molecules going off-patent in the next few years. It has about 2,885 registrations already in place and has filed for another 1,100 applications, which should support volumes going ahead.

However, the company will have to clear up a huge amount of inventory that it has booked in H1, due to sales returns from customers. We think this will put a lot of pressure on the company to sell its inventory at lower prices, which in turn will impact margins in the near term.

Valuation & recommendation

At the current market price, the stock is trading at a P/E of 13.5 times its FY25 projected earnings. The valuations are below its long-term historical averages. However, given the near-term concerns, we think the risk-reward ratio is skewed downwards. We wouldn’t recommend fresh entries at this point.

Bymoneycontrol

Insidesmarket.com