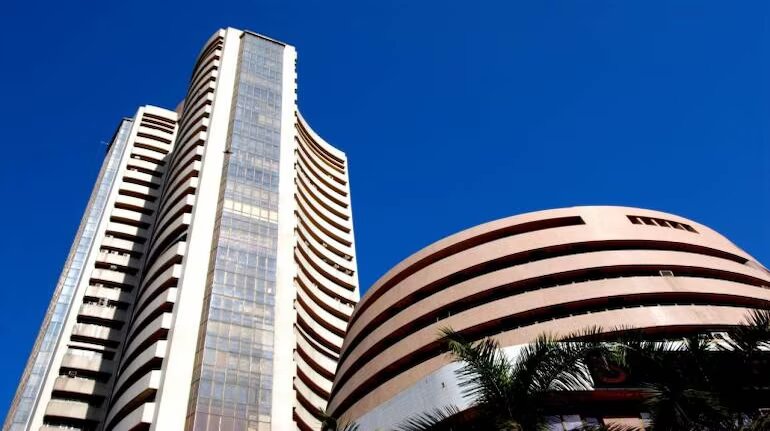

Stock market holiday today: BSE, NSE to remain shut for Ganesh Chaturthi on 19th September

The National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) will remain shut on September 19 because of Ganesh Chaturthi.

Equity, equity derivatives, interest rate derivatives, currency derivatives and securities lending and borrowing will also remain closed.

Wholesale commodity markets, including metal and bullion, will remain closed from 9am to 5pm and will be open from 5pm to 11:30/11:55pm.

On September 18, the Indian benchmark indices ended near the day’s low with the Sensex falling 241.79 points or 0.36 percent to 67,596.84, and the Nifty ending 20,133.30, down 59 points or 0.29 percent.

Top losers on the Nifty included Hindalco Industries, Jio Financial, HDFC Bank, Bharti Airtel and Adani Ports, while gainers were Titan Company, M&M, BPCL, HDFC Life and Power Grid Corporation.

On the sectoral front, PSU Bank index gained 3.4 percent, power, auto and FMCG indices up 0.5-.8 percent, while realty and metal indices shed 1 percent each, while bank, IT, pharma and pharma down 0.5 percent each.

The BSE midcap index fell 0.25 percent and Smallcap index down 0.5 percent.

The Nifty index has been consolidating within a broad range, with notable call writing activity observed at higher levels.

This suggests that market participants are cautious and have been selling call options to hedge against potential downward movements,” said Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities.

The sideways trend in the index is expected to persist in the upcoming trading sessions.

This is attributed to the anticipation of the outcome of the US Federal Reserve (US Fed) meeting, which is a significant event that can impact global financial markets.”

“The index has support at the 20,100 level and resistance at 20,200.

A break on either side of this range is likely to lead to trending moves, with potential implications for market direction,” he added.

The rupee ended marginally lower at 83.27 per dollar on Monday versus Friday’s close of 83.18.

“Ahead of the holiday, the Indian rupee closed at another record low close following risk-averse sentiments and a rally in crude oil prices.

This week will remain highly volatile following a series of central bank policy rate meetings across the developed and emerging market economies.

The baseline of it is the dollar to hold onto its strength through the week,” said Dilip Parmar, Research Analyst, HDFC Securities.

In the near term, spot USDINR is expected to cross the record high and may see a level of 83.50 to 83.70 while it could hold the support of 83,” he added.

ByMoneycontrol