TCS Q1 FY25 – Why the underperformance should reverse now

The return of demand and waning pricing pressure are among several positive factors.

Highlights

-

- Strong execution riding on BSNL order

-

- Better-than-expected margin despite compensation revision

-

- The company sees tailwinds for margins

-

- Deal wins a tad soft, alluding to a strong pipeline

-

- Meaningful headcount addition after three consecutive quarters of decline

-

- Commentary mixed although confident of better FY25 compared to last year

-

- AI adoption slow although interest level from enterprises high

-

- A higher probability of rate cut in the US and valuation discount to historic average make us constructive

TCS (CMP: Rs 3923.7, Market Cap: 14,19,629 crore, Rating: Overweight) has been a big under-performer in an otherwise raging bull market. In the past three months, with a negative return of 1.9 percent, the stock has hugely underperformed the Nifty return of 8 percent and the IT index return of 6.7 percent. We had turned tactically overweight on the IT sector last month and we now believe that IT bellwether TCS should reverse its underperformance.

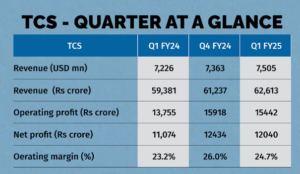

India order drives revenue in the quarter

Revenues grew by a sequential 1.9 percent in reported currency and 2.2 percent in Constant Currency which were better than our and Street expectations. A large part of the revenue surprise could be attributed to the ramp-up in the BSNL deal, underlining the strong growth of India as a market. In fact, 49 percent of the incremental revenue growth sequentially came from India, thanks to the deal.

The company, however, alluded to a broad-based recovery across all geographies and verticals (except Communication Media).

Margin – better than expected performance

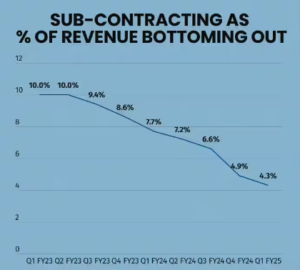

Despite the annual compensation revision that shaved off 170 basis points from margin, TCS reported 130 basis points sequential decline in operating margin, thanks to improving productivity, utilisation, and a decline in sub-contracting costs. In fact, operating margin rose 150 basis points YoY. The company expects steady margin gains hereon with pyramid (deployment of freshers), productivity, and utilisation as short-term levers and growth and pricing as drivers of margin for the long term.

Deal wins – a tad soft but pipeline healthy

In the absence of mega deals, the overall win in the quarter was lower sequentially and YoY. However, the management pointed to a few decisions spilling over to Q2 and alluded to a strong pipeline.

The company has also added clients across revenue buckets.

While optimistic about FY25, it did refer to a lingering softness in discretionary spending and demand because of vendor consolidation and operating model transformation kind of work. Finally, AI (artificial intelligence) is part of every deal discussion, but the executable opportunity size is still small. The company is now executing 270 AI projects. It has $1.5 billion AI deals and is re-skilling workforce in AI.

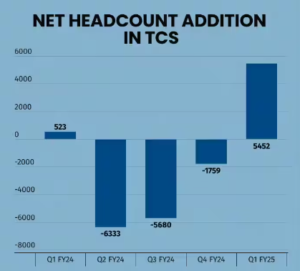

The supply-side pressures have decisively abated with attrition declining sequentially to 12.1 percent from 12.5 percent in the preceding quarter. As a sign of a stabilising environment, the company saw a net addition of people after three consecutive quarters of decline.

More than one reason to turn constructive

We have multiple reasons to turn constructive now. On the demand front, the worst seems to be over. Going by the earnings report of major enterprises, be it in financials or big techs, they all seem to be doing well. Hence, once there is clarity on the macro, the pent-up demand is likely to come back.

On the macro front, several indicators — from softer inflation and labour market to drying up of excess savings of households — point to a waning pricing pressure and a high probability of a September rate cut in the US.

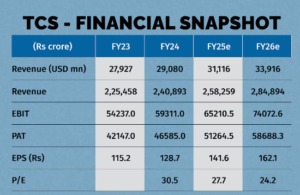

Finally, thanks to the underperformance, the stock at 28X one-year forward earnings is at a discount to its historic average (30x and above) and offers an attractive pre-tax payout yield of close to 3 percent.

Key risks: A severe cut in IT spending due to macro slowdown in developed countries.

Bymoneycontrol