Thangamayil Jewellery: Why are we bullish on this regional jewellery player?

The strategic shift to the organised segment and the focus on non-gold jewellery augur well for the company.

Highlights

-

- Q3 results miss estimates

-

- Healthy network expansion to drive growth

-

- Jewellery market shift to the organised segment beneficial

- Margins to improve

The Q3 FY24 results of

(TMJL; CMP: Rs 1,360; market cap: Rs 3,731 crore; Rating: Overweight) were lower than expected as heavy rain and floods in the southern part of Tamil Nadu affected retail stores leading to a loss in sales.

Among the consumer discretionary segments, jewellery demand continues to remain strong and the management expects the sales growth momentum to sustain. The jewellery industry is experiencing a steady shift towards the organised segment, which is beneficial for reputed jewellery chains such as TMJL. The company has maintained healthy store expansion plans and aims to enter big metro cities such as Chennai next fiscal. This will strengthen its presence in the Tamil Nadu market.

TMJL has a loyal customer base and its SSSG (same store sales growth) is strong, leading to store operating efficiencies as well as return ratios. It is among the reputed jewellery companies and remains our preferred bet to play the formalisation theme in the jewellery industry.

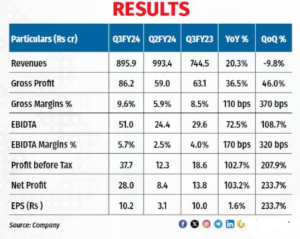

December 2023 performance

Revenues grew 20 percent year on year (YoY) and were lower than expectations. As per the management, heavy rain and floods in the southern parts of Tamil Nadu affected retail sales of 8 outlets. Overall sales loss in Q3FY24 was to the tune of about Rs 25 crore. Retail sales grew 25 percent YoY to Rs 854 crore, while wholesale sales declined 33 percent to Rs 41 crore. Gold jewellery sales grew 25 percent YoY, while non-gold jewellery sales grew at a slightly slower rate of 22 percent YoY. The share of non-gold jewellery declined by about 25 basis points YoY to 9.7 percent of revenues in Q3FY24.

Gross margins improved about 100 basis points YoY owing to the higher sales of studded (diamond) jewellery. Operating leverage as well as lower advertisement and publicity expenditure led to EBIDTA margins improving at a higher rate of 170 basis points YoY. Operating profit grew 73 percent YoY while net profit doubled to Rs 28 crore.

Healthy network expansion to continue

Over the next three to four quarters, TMJL plans to open about eight new showrooms (compared to the December 2023 count of 56). Apart from the expansion into Tier 2 and Tier 3 towns, TMJL aims to enter Chennai in H2FY25. TMJL will open a big flagship store in Chennai followed by 3-4 additional stores nearby to tap the capital city. TMJL will continue to expand in Tamil Nadu, which is the largest jewellery market in India.

Apart from opening new stores, TMJL aims to renovate two existing showrooms to attract new consumers and increase the overall store productivity.

New store addition as well as renovation of existing stores will be funded mostly via internal accruals.

Shift towards organised segment

TMJL stated that the jewellery market in India is steadily shifting towards the organised segment. With youth consumers preferring branded products and because of aggressive network expansion, organised players are gaining market share. The phased implementation of mandatory hallmarking regulations (requires purity certification) is also beneficial for organised jewellery players.

As per CRISIL research, the share of organised players is expected to increase from about 36 percent in FY22 to about 45 percent by FY26, thus benefiting TMJL.

Expect margins to improve

TMJL is increasing the share of non-gold jewellery. The company is selling sliver jewellery and targeting existing gold customers for studded diamond as well as platinum jewellery. Non-gold jewellery is a relatively high-margin business which will aid in margin improvement.

With operating leverage, owing to strong top-line growth as well as healthy SSSG (same store sales growth), we expect TMJL’s margins to improve.

We have factored in about 130 bps margin improvement for TMJL in FY25 compared with FY23 levels.

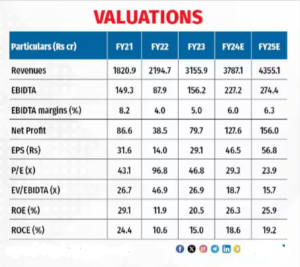

Valuations

At the CMP, the stock is trading at a P/E of about 24 times FY25 projected earnings. TMJL has a strong earnings outlook as well as robust return ratios. Hence, we advise investors to add the stock in the portfolio.

Bymoneycontrol