These stocks stand to gain if the Budget proves generous for the middle class

All consumer-facing stocks should do well if there is a tweak in income tax slabs or rates.

Highlights

-

- Consumption expected to get a boost should a tax cut materialise

-

- Tweaking slabs as well as an increase in standard deduction expected

-

- Middle class likely to benefit

- MC Pro identifies stocks to play the probable upside

There is little doubt now that India has seen a K-shaped recovery (uneven performances by sectors) after the COVID pandemic. This, coupled with high inflation, has impacted items of mass consumption, although premium categories appear to be doing fine.

The GDP data also suggests that government capex has been the driver of growth whereas consumption continues to languish. Against this backdrop and armed with an additional dividend bonanza of over Rs 1 lakh crore from the RBI, the budget is expected to unleash tax cuts directed at giving more in the hands of the middle class.

According to the grapevine, the standard deduction, which is now Rs 50,000, may be doubled to Rs 1 lakh under the new tax regime along with the lowest taxable income slab going up from Rs 3 lakh to Rs 5 lakh.

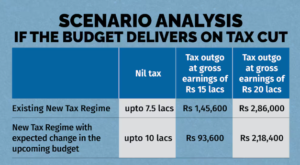

While an individual with Rs 7.5 lakh gross income doesn’t pay taxes under the new regime at present, thanks to the rebate under 87A for taxable income up to Rs 7 lakh, this could potentially go up to Rs 10 lakh with the increase in standard deduction, a change in the minimum tax slab, and an amendment to Section 87A.

We see tangible benefits to a typical middle-income earner, with say gross earnings of Rs 15-20 lakh per

More money in the wallet of the middle class can find its way to consumption across an array of products — both staples and discretionary, although more in the latter category.

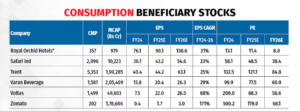

FMCG companies such as HUL, Dabur, and Emami, long struggling with volumes, can see some relief. Varun Beverages, which is already reaping the benefits of increased capacity, rising distribution reach, and a very hot summer, too should see a positive impact.

The growing trend of out-of-home food consumption, which is fast catching up in smaller cities as well, stands to benefit Zomato, and QSRs (quick service restaurants) such as Jubilant Foodworks (Domino’s) and Devyani International (KFC and Pizza Hut).

With rising consumer spending, demand for premium dairy products like flavoured milk, yogurt, and cheese is expected to soar. Heritage Foods, with its strong focus on value-added products, is ideally placed to capture this spending.

With rising urbanisation and record heat, the demand for air conditioners is rapidly increasing. Voltas, a leading AC manufacturer, is therefore a standout choice.

Fresh incentives (like rebate on home loan interest, tax benefits) for the middle-income group in Budget 2024 could invigorate retail demand across the real estate value chain and aid the top line of home improvement majors such as Dalmia Bharat, Havells India, Kajaria Ceramics, and Cera Sanitaryware.

As middle-class incomes rise, the demand for two-wheelers (2Ws) increases significantly. Higher disposable incomes enable more spending on personal transportation. Two-wheelers also provide flexibility in congested urban areas and symbolise improved status and lifestyle. Hero Motocorp and Bajaj Auto are the main beneficiaries of this trend.

Finally, travel is making steady inroads and finding a permanent place in middle-income household’s budget as well. As middle-class incomes rise, air travel demand increases significantly. With enhanced connectivity, Interglobe Aviation (IndiGo) is in a sweet spot in this space. IRCTC, with its monopoly in ticketing, water, and rail catering should also see an improving demand environment. The other adjacent sectors to reap benefits are hotel companies in the mid-market space such as Lemon Tree Hotels and Royal Orchid Hotels as well as Safari, the mass to premium market luggage brand.

Bajaj Finance, one of the largest retail-focused NBFCs, stands to benefit from the overall consumption push.

Disclaimer: MC Pro has tried to identify companies that could benefit from a probable tax cut in the Budget. This is not a recommendation to buy a portfolio.

Bymoneycontrol