Trade setup for today: Top 15 things to know before the opening bell

The market close higher for the fifth consecutive session on April 6 after the Reserve Bank of India surprised the Street by leaving interest rates unchanged and also raised the FY24 growth forecast to 6.5 percent from 6.4 percent.

Auto, financial services, metal, pharma and oil & gas stocks helped the market close higher.

The Sensex rose 144 points to 59,833, while the Nifty climbed gained over 40 points to end at 17,599 and formed a bullish candlestick on the daily charts.

“The Nifty is currently placed at the important resistance of the previous opening downside gap of March 10 around 17,600 levels.

The Nifty on the weekly chart formed a reasonable positive candle for the second consecutive week and is placed at the crucial hurdle of down sloping trend line around 17,600 levels,” Nagaraj Shetti, Technical Research Analyst, HDFC Securities, said.

The near-term trend is positive. The Nifty can see consolidation before decisively rising to 17,600-17,700.

The immediate support is at 17,500, he said.

The broader market outperformed the benchmarks, as breadth remained positive for yet another session.

The Nifty midcap 100 index was up six-tenth of a percent and the smallcap 100 index rose 0.8 percent.

The India VIX, which measures the expected volatility in the market, fell 4.95 percent to 11.80 levels.

Key support and resistance levels on Nifty

The pivot charts indicate that the Nifty may get support at 17,528 followed by 17,496 and 17,444.

If the index advances, 17,632 is the initial key resistance level to watch out for followed by 17,664 and 17,716.

The Bank Nifty underperformed the Nifty, advancing just 0.1 percent or 42 points to 41,041 and formed a small-bodied bullish candlestick with a long upper and a lower shadow on the daily charts.

“The index is now trading around the next resistance zone of 41,000 and if we sustain above this in the upcoming week, we expect the rally to continue higher towards the 42,000-mark,” Kunal Shah, Senior Technical & Derivative Analyst, LKP Securities, said.

The lower-end support is visible at 40,600-40,500, which will act as a cushion for the bulls, he said.

The Bank Nifty may take support at 40,872 followed by 40,765 and 40,591.

Key resistance levels are expected to be 41,219, then 41,326, and 41,500.

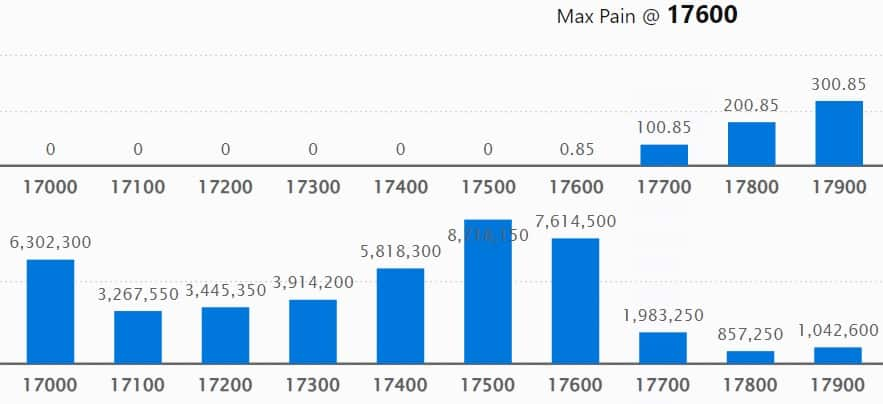

On the weekly options front, the maximum Call open interest (OI) was at 17,600 strike, with 96.65 lakh contracts, which is expected to be a crucial level for the Nifty in the coming sessions.

This was followed by 17,700 strike, comprising 92.76 lakh contracts, and 17,800 strike, with more than 47.86 lakh contracts.

Call writing was seen at 17,600 strike, which added 12.8 lakh contracts, followed by 18,400 strike, which accumulated 7.26 lakh contracts.

Call unwinding was at 17,700 strike, which shed 45.51 lakh contracts, followed by 17,500 strike, which shed 44.28 lakh contracts, and then 17,800 strike, which shed 30.76 lakh contracts.

The maximum Put open interest was at 17,500 strike, with 87.18 lakh contracts, which is expected to act as support in the coming session.

This was followed by the 17,600 strike, comprising 76.14 lakh contracts, and the 17,000 strike where there wer e63.02 lakh contracts.

Put writing was seen at 17,600 strike, which added 42.18 lakh contracts, followed by 17,900 strike, which added 4,650 contracts, and 17,800 strike, which added 3,050 contracts.

We have seen Put unwinding at 17,300 strike, which shed 63.24 lakh contracts, followed by 17,400 strike, which shed 57.59 lakh contracts, and 17,500 strike, which shed 48.96 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. The highest delivery was seen in Max Financial Services, Pidilite Industries, NTPC, Petronet LNG, and Britannia Industries among others.

An increase in open interest (OI) and price typically indicates a build-up of long positions. Based on the OI percentage, 60 stocks, including Cholamandalam Investment, Balrampur Chini Mills, Can Fin Homes, ABB India and Berger Paints, saw long build-ups.

A decline in OI and price generally indicates a long unwinding. Based on the OI percentage, 27 stocks, including Honeywell Automation, Titan Company, Crompton Greaves Consumer Electricals, United Breweries, and Coforge, saw a long unwinding.

49 stocks see a short build-up

An increase in OI along with a price decrease indicates a build-up of short positions. Based on the OI percentage, 49 stocks, including Colgate Palmolive, Dabur India, Bosch, Page Industries, and City Union Bank, saw a short buildup.

A decrease in OI along with a price increase is an indication of short-covering. Based on the OI percentage, 53 stocks were on the short-covering list.

These included Mahanagar Gas, Astral, Hindustan Aeronautics, Aarti Industries and Hindalco Industries.

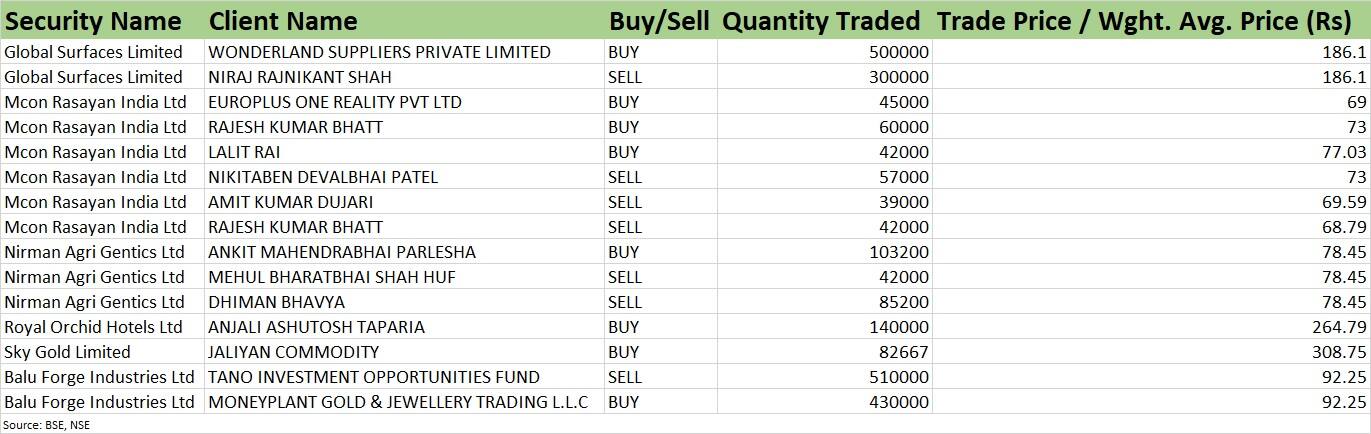

(For more bulk deals, click here)

Investors’ meetings on April 10

Deep Industries: Officials of the company will interact with analysts and investors.

Hindware Home Innovation: The management will participate in a group investor meeting organised by Nuvama Wealth Management.

Elin Electronics: The company’s management will meet representatives of Motilal Oswal Financial Services.

Bharat Forge: The company’s officials will interact with 3P Investment Managers.

Supriya Lifescience: Officials of the company will interact with analyst/institutional investors.

Stocks in the news

Titan Company: The company recorded healthy double-digit growth across all of its key businesses, with revenues growing by 25 percent YoY aided by higher growth contributions from watches & wearables and emerging businesses.

Tata Motors: Jaguar Land Rover registered a 30 percent year-on-year growth in retail sales at 1.02 lakh units for the quarter ended March FY23, driven by Europe (up 47 percent YoY), the UK (up 42 percent), China (up 29 percent), overseas (up 29 percent) and North America (up 12 percent), but for the full year, sales fell 6 percent to 3.54 lakh units from the previous year.

Muthoot Finance: The gold loan financing company said its board declared an interim dividend of Rs 22 a share (face value Rs 10 each) for FY23. The total interim dividend outgo will amount to Rs 883.19 crore.

CreditAccess Grameen: The microfinance company registered a 24 percent growth in Q4FY23 disbursements at Rs 7,171 crore compared to the year-ago period. Its assets under management grew 27 percent to Rs 21,032 crore in the same period.

Adani Wilmar: The FMCG company registered a year-on-year volume growth of close to 14 percent in FY23, which enabled it to cross Rs 55,000 crore of revenue for the year.

It closed the financial year 2023 with around Rs 3,800 crore of revenue in the food & FMCG segment, a growth of about 40 percent YoY in volumes and 55 percent YoY in revenue terms.

Rail Vikas Nigam: RVNL has emerged as the lowest bidder for the Mumbai Metro line 2B project worth Rs 378 crore.

RVNL had participated in the bidding along with Siemens India.

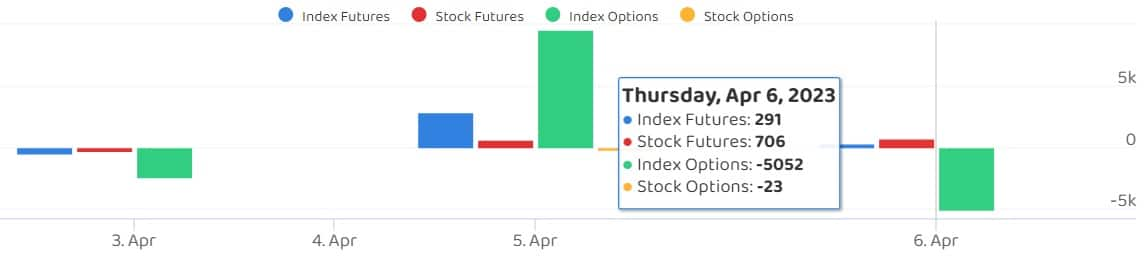

Fund Flow

Foreign institutional investors (FII) bought shares worth Rs 475.81 crore, whereas domestic institutional investors (DII) sold shares worth Rs 997.08 crore on April 6, National Stock Exchange’s provisional data showed.

Stocks under F&O ban on NSE

The National Stock Exchange has not added any stock to its F&O ban list for April 10.\

ByMoneycontrol