Trent: Should you hold on to this multi-bagger stock?

The company plans to aggressively scale up business across formats, and with its current presence in only 155 cities, there is a huge growth potential.

Highlights

-

- Stellar Q3FY24 results

-

- Aggressive scale-up across formats

-

- Standalone margins improve; subsidiaries/JV turn profitable

-

- Strong earnings visibility

(CMP: Rs 3,938; Market cap: Rs 139,987 crore; Rating: Overweight) posted strong Q3FY24 results. It continues to deliver robust earnings growth despite challenging business conditions on the back of subdued consumer discretionary spends.

Over the years, Trent has been able to build sub-brands that appeal to the consumers and has broadened its product portfolio to tap the wider fashion spectrum.

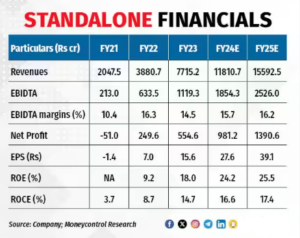

The company would continue to aggressively scale business across formats and with its current presence in only 155 cities, there is a huge growth potential.

Trent’s strategy of maximising per square feet sales, mostly own brand product portfolio, lower inventory shrinkage and better operating synergies, after business scale-up, would ensure profitable growth, going ahead. A loyal consumer base of more than 9 million WestStyle Club members, which ensures repeat purchase, is also one of the key strengths for the company.

Since our recommendation in April 2022, the stock has more than tripled, ranking as one of the best-performing retail stocks under our coverage. We continue to stay bullish on the stock.

December 2023 performance

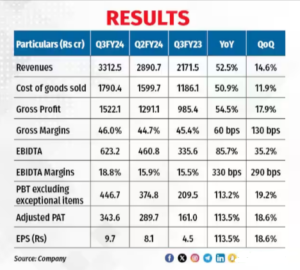

Trent posted a strong 52 percent year-on-year (YoY) revenue growth in Q3FY24. Rapid store expansion as well as a strong like-for-like growth of 10 percent across fashion formats drove the growth. Trent’s revenues have grown at 40 percent CAGR, compared to the pre-COVID levels (Q3FY20).

Gross profits improved marginally by about 60 bps YoY. However, a strong operating leverage as well as improved business synergies led to EBITDA margins improving strongly by 330 bps on a YoY basis. Trent’s net profit more than doubled on a YoY basis to Rs 343 crore.

Rapid network expansion across fashion formats

Trent is continuing aggressive network expansion across its core fashion business. In the 9MFY24 period, the flagship lifestyle brand, Westside, has added 12 stores, reaching an overall count of 227, as of December 2023. The value fashion concept, Zudio, has expanded at a faster clip, with 108 new store additions in 9MFY24, reaching an overall store count of 460, as of December 2023.

Trent is also expanding its recently launched (just prior to COVID-19) other fashion concepts, viz., Utsa (for modern women), Misbu (for Gen Z and millennials) and Samoh (premium ethnic wear). As of December 2023, Trent has opened about 28 new stores for Utsa, Misbu as well as Samoh, indicating a broadening of product portfolio and varied offering to consumers.

Apart from the mainstay apparels, emerging categories such as beauty and personal care, innerwear as well as footwear continued to gain traction with the consumers. Trent has been able to capture the wider fashion needs of the consumers with the emerging categories contributing about 19 percent to Trent’s revenues.

Standalone business margins improve; subsidiaries/JV contribution turns positive

Trent’s standalone business (about 90 percent of revenues) margins improved marginally by 20 bps in the 9MFY24 period. With a rapid increase in network, Trent has been able to realise greater synergies in the business operations.

In the 9MFY24 period, subsidiaries and joint ventures turned profitable at the net level from about Rs 60 crore loss in the 9MFY23 period. Trent has been indicating strong improvement in performance of the Star hypermarket business (Star business posted losses in FY23).

A strong like-for-like and volume growth and increasing share of own brand products have been contributing to improved operating performance for the business. Trent believes Star to be a key and additional growth engine to the portfolio.

Valuation

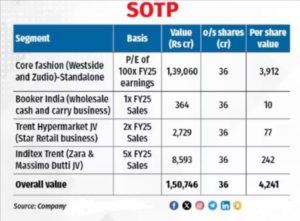

Our SOTP (sum-of-the-parts) valuation methodology implies an upside of about 8 percent from the current levels. Trent has strong growth prospects. Hence, long-term investors can continue to add the stock.

Bymoneycontrol

Insidesmarket.com