Weekly Tactical Pick: Adding this stock will improve your portfolio health

The company is best-placed to benefit from the synergies between paediatric and OB-GYN segments.

Highlights

-

- Focus on healthcare remains key for the government

-

- Private healthcare players should gain from secular trends

-

- Rainbow’s capacity expansion plans remain on track

- Reasonable valuation at 23x FY26e EV/EBITDA

Healthcare has been a focus area for the government as it aims to achieve the target of spending 2.5 percent of the GDP (gross domestic product) in healthcare by 2025 against ~2.1 percent now. In the interim budget, the government focused on “healthcare for all”, which is likely to see substantial measures, going ahead.

Apart from the government’s focus on improving the healthcare infrastructure, various other catalysts act in favour of the healthcare players. A rise in lifestyle-related illnesses, higher insurance penetration, and increasing household incomes have all led to a greater demand for quality healthcare services among Indians.

We think private healthcare providers, with their aggressive expansion plans, have a lot of headroom to gain from these favourable trends. Rainbow Children’s Medicare Ltd (Rainbow; CMP: Rs 1,294; M Cap: Rs 13,136 crore; Nifty: 23,567) thus makes it as our tactical pick this week.

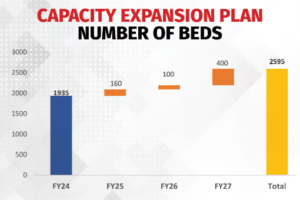

Rainbow is a niche player in the children’s health space. It is the largest children’s hospital in terms of bed capacity, having grown from a 50-bed single hospital in 1999 to 1,935 beds as of FY24.

With the widest range of paediatric services offerings in the country, Rainbow operates on a high number of cases in tertiary and quaternary care. Its ARPOB (average revenue per occupied bed) stood at ~Rs 55,800 in FY24, growing 14 percent YoY. Its revenue and EBITDA have grown at a CAGR of 15 percent and 19 percent, respectively, between FY22 and FY24, with the EBITDA margin averaging at 32 percent. Its ROCE of ~25 percent also remains comparable with the listed peers in the industry.

The company plans to add ~660 beds in the next three years to reach ~2,595 by the end of FY27, increasing its capacity by ~35 percent. This should aid volumes and occupancy in the coming years. Supported by its balance sheet strength and a healthy cashflow generation, Rainbow will be able to fund most of its expansion capex through internal accruals.

Rainbow’s OB-GYN (obstetrics-gynaecology) segment also continues to grow well. Driven by the higher occurrences of fertility complications and the strong growth in assisted reproductive technology, the management plans to add IVF services to all its existing and upcoming hospitals. This is likely to aid this segment’s profitability going ahead.

Reasonable valuation

Driven by a rising population, a higher number of working women those who are expecting, higher insurance spends, rising middle-high income group, and a preference towards specialised maternity and childcare services, we think there is ample room for the company to benefit from these secular growth trends.

The stock fell about ~19 percent from its all-time highs in early May. Post the correction, it is now trading at a reasonable valuation of ~23x FY26e EV/EBITDA. We recommend using the market weakness to accumulate the stock.

Bymoneycontrol