What 2022 may have in store for the crypto asset investors

Year 2021 was a splendid year for crypto investors. That year we saw many crypto assets reach an all-time high. Facebook rebranded itself as Meta and other big giants stepped into Metaverse too. Let’s dig in what 2022 may have in store for the crypto asset investor.

A brief history of crypto assets till 2021

It has been more than a decade since the launch of first cryptocurrency – Bitcoin. Since then there have been many crypto assets in the market. According to CoinMarketCap, currently there are around 8000 crypto assets, however as per Investopedia there are over 18000 in existence as of March 2022. Although many of them have no following or trading volume.

From 2009 – 2014

Bitcoin became public in 2009. The market price was initially zero however, in 2010 the price rose slowly and by June 2011, the market price was $29.60. After that there was price dip and slow movement but 2013 witnessed huge gains in price. And for the first time in December, Bitcoin crossed $1000 mark.

The idea of a truly decentralized currency became popular and new crypto currencies were subsequently launched. The second one was Namecoin and then soon after in 2011, Litecoin was released.

In 2014, Bitcoin prices plummeted to around $300 and many suffered losses.

From 2015 – 2020

Ethereum became publically available in 2015. It was a different Blockchain and had Ether cryptocurrency to facilitate Blockchain based Smart contracts and Apps. The success of Ethereum resulted in renewed interest in crypto assets and once again the exchanges saw the bullish phase.

Prices of crypto assets slowly climbed and by December 2017, Bitcoin skyrocketed to $19345.

In 2020 due to Covid-19, crypto assets burst into activity. There was 416% increase in the Bitcoin price in the year 2020 alone.

From 2021 – Present

Bitcoin made & broke many price records. It surpassed $40000 in January and then again crossed $63000 by mid-April. Before year-end it crossed the $69000 mark too. While Ethereum notched a record high of $4004 in October.

In June 2021, El Salvador became the first country to accept Bitcoin as legal tender.

The overall Market Cap of crypto assets climbed to $2.3 Trillion in December 2021.

Would year 2022 be more beneficial for crypto asset investors

After the brief history outline, let us talk about the present and the future. Experts believed that 2022 would be even more beneficial for crypto asset investors than 2021.

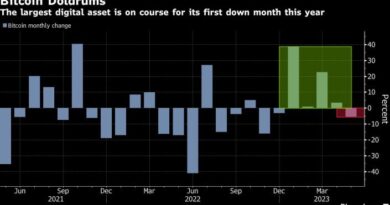

Before the ending of 2021, China cracked down on cryptocurrency declaring it illegal. It had already banned operation of intermediaries and miners within China. This led to price slump in year 2022.

Although the year start was not so promising but does it mean that they whole year would not be fruitful for crypto investors?

Well in our opinion the answer would be a big NO. We cannot expect the price jumps of previous years to repeat but we would definitely see positive market growth. Despite the international conflicts, war – market cap of crypto assets once again crossed $ 2 Trillion mark in early March.

What 2022 may have in store for the crypto asset investors

In the past, we have seen launch of many crypto-assets and their growth too. However, in the year 2022 we are seeing much more adoption of crypto assets in different industries. We have moved from the investment/trading only phase to much wider adoption in different industries.

Adoption – Now you can get your part-salary in crypto assets (in some countries only) or you can pay in crypto assets for your purchase. A popular food chain is planning to roll-on crypto assets with a loyalty program. This all suggests how quickly crypto assets are becoming part of our daily lives. With worldwide massive adoption, one can only guess what 2022 may have in store for the crypto asset investors.

Regulations – Regulations would also make a positive impact on crypto growth. The laws and guidelines would help sceptics too to invest in crypto assets.

NFT – NFTs are also one of the reasons for crypto growth in 2021. However, the buzz is not going to end soon. Apart from digital art, real estate is also being sold as NFT on a decentralized exchange. The possibilities are infinite.

Metaverse and Web 3.0 – The whole world is waiting for Metaverse and Web 3.0. These would impact positively on crypto markets. There is already demand for merchandise/land/businesses in Metaverse and this sale/purchase is possible through crypto tokens only.

Takeaway

We are still in the first quarter of year 2022. Markets are again showing positive signs despite some negative news. We will see more crypto companies going public in 2022 than in 2021 and all with high valuations too. Public sentiment is also more towards investing in crypto assets. All in all, we would see good returns this year too.

If you are still undecided, take a look at the list of crypto assets with the potential to explode in 2022. For beginners, we would advise diversifying your portfolio and putting only 5%-10% of your savings in the crypto assets. And be prepared for the volatility. Your crypto value can be halved within a day or reach a peak price too. Remember to hold them for the long term to realise huge gains.

Let us wait and see what 2022 may have in store for the crypto asset investors?