Top 10 trading ideas for next 3-4 weeks as bulls look charged up for third straight week

We have seen the benchmark indices continuing their uptrend for the third consecutive week, tracking positive global cues and buying in most beaten-down stocks amid rising hopes for an end to the interest rate hike cycle sooner than later.

The Nifty50 gained 1.3 percent for the truncated week ended April 13 to close at 17,828, the highest closing level since February, taking the total three-week gains to over 5 percent.

The index has formed a bullish candlestick pattern on the weekly scale, making higher highs higher lows for three weeks in a row. Also it climbed above 50-week EMA (exponential moving average – 17,442).

From a technical perspective, there is a ‘rounding bottom’ formation visible on the daily time frame chart, which augurs well for the bulls.

“If we observe the weekly chart, we can see a fresh buy signal in the RSI smoothened with its signal line.

This indicates a continuation of up move in the near term,” Osho Krishan, Senior Analyst – Technical and Derivative Research at Angel One, said.

With the continuous nine-day winning streak, the support level continues to shift higher as we now see immediate support in the zone of 17,700 – 17,600; whereas 200-SMA around 17,500 is likely to act as a sacrosanct level.

On the flip side, the next set of resistance is seen at the psychological level of 18,000, followed by the next swing high of 18,137, according to him.

He advised that one should avoid being complacent as this recent up-move has been very steep without any breather and hence, some in-between pause or mild profit booking cannot be ruled out.

Hence, any profit-booking towards 17,600-17,400 levels is likely to generate a fresh buying interest from the traders for the upside levels of 18,000-18,300 levels, Rajesh Palviya, Vice President Research (Head Technical Derivatives) at Axis Securities said.

The major action during the week was seen outside the index as many front-line and mid-cap counters gave mesmerising moves.

Traders should continue to focus on such potential movers, however, one needs to be very selective as the low-hanging fruit is already gone, Osho advised.

Let’s take a look at the top 10 trading ideas by experts for the next three-four weeks. Returns are based on the April 13 closing prices:

Expert: Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities

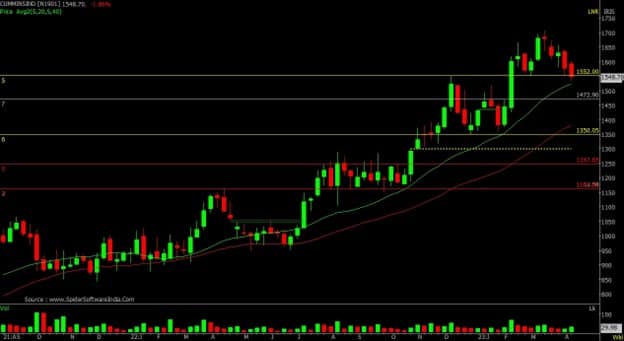

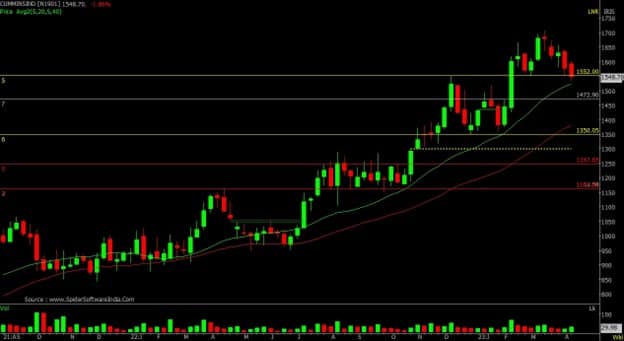

Cummins India: Buy | LTP: Rs 1,549 | Stop-Loss: Rs 1,480 | Target: Rs 1,660 | Return: 7 percent

The stock is on the verge of completing a correction between Rs 1,550 and Rs 1,515 levels. Based on its outperformance over the past several months, we do not think it will completely close the bullish gap it has left between Rs 1,480 and Rs 1,540 which it has left after the Q3FY23 numbers were announced.

A buy is recommended at current levels and Rs 1,500, with a stop-loss at Rs 1,480. On the upside, the stock may again move towards Rs 1,630 or Rs 1,660.

Glenmark Life Sciences: Buy | LTP: Rs 417.55 | Stop-Loss: Rs 370 | Target: Rs 450 | Return: 8 percent

It is consolidating between Rs 450 and Rs 370 levels. In fact, on daily basis, the stock is on the verge of making a double bottom at Rs 370 and to validate the same it may again move towards Rs 450.

Once it comes out of Rs 450, chances of reaching Rs 520 would be high, however, even from the current level, if it goes up to Rs 450 it will give good returns. The reward is commensurate with the risk.

One can buy at current levels and at Rs 390, with a stop-loss at Rs 370.

Cholamandalam Investment and Finance: Buy | LTP: Rs 821 | Stop-Loss: Rs 770 | Target: Rs 945 | Return: 15 percent

The stock climbed as high as Rs 848 levels led by a broad bullish sentiment in the market. Currently, it is trading at life time high. It was below Rs 817 level for a long time.

Such formations give trending moves in the medium term. Based on this traders should be buyers on dips. Buy at the current level and also at Rs 800, with a stop-loss at Rs 770.

On the upside, depending on the extension, it should move towards Rs 870 and Rs 945 in the medium term.

JSW Steel: Buy | LTP: Rs 720.65 | Stop-Loss: Rs 682 | Target: Rs 780 | Return: 8 percent

JSW Steel has shown relative strength last week. While the Nifty has gained 1.3 percent last week, JSW Steel has gained a healthy 5.56 percent. In the process, the stock has closed above its recent trading range on the back of above average volumes, which augurs well for the uptrend to continue.

Technical indicators are giving positive signals as the stock is trading above the 20 and 50-day SMA. Momentum readings like the 14-week RSI (relative strength index) too are in rising mode and not overbought, which implies potential for further upsides.

With the intermediate technical setup too looking attractive, we expect the stock to move up towards its previous intermediate highs in the coming weeks. Buy between Rs 715-725 levels, with a stop-loss at Rs 682 and for a target of Rs 780.

Container Corporation of India: Buy | LTP: Rs 604.65 | Stop-Loss: Rs 571 | Target: Rs 660 | Return: 9 percent

After correcting from a high of Rs 829 tested in November 2022, Container Corporation found support around Rs 555 levels in March 2023. These are strong supports as they also roughly coincide with previous intermediate lows.

The stock has since then been climbing higher and making higher bottoms in the process. This week, the stock also broke out of its recent trading range on the back of above average volumes, indicating it is set to move higher in the coming weeks.

Technical indicators are giving positive signals as the stock is trading above the 20 and 50-day SMA. Momentum readings like the 14-week RSI too are in rising mode and not overbought, which implies potential for further upsides.

With the intermediate technical setup too looking attractive, we expect the stock to move up towards its previous intermediate highs in the coming weeks. Buy between Rs 600-610 levels, with a stop-loss at Rs 571 and for a target of Rs 660.

We have seen the benchmark indices continuing their uptrend for the third consecutive week, tracking positive global cues and buying in most beaten-down stocks amid rising hopes for an end to the interest rate hike cycle sooner than later.

The Nifty50 gained 1.3 percent for the truncated week ended April 13 to close at 17,828, the highest closing level since February, taking the total three-week gains to over 5 percent.

The index has formed a bullish candlestick pattern on the weekly scale, making higher highs higher lows for three weeks in a row. Also it climbed above 50-week EMA (exponential moving average – 17,442).

From a technical perspective, there is a ‘rounding bottom’ formation visible on the daily time frame chart, which augurs well for the bulls. “If we observe the weekly chart, we can see a fresh buy signal in the RSI smoothened with its signal line. This indicates a continuation of up move in the near term,” Osho Krishan, Senior Analyst – Technical and Derivative Research at Angel One, said.

With the continuous nine-day winning streak, the support level continues to shift higher as we now see immediate support in the zone of 17,700 – 17,600; whereas 200-SMA around 17,500 is likely to act as a sacrosanct level. On the flip side, the next set of resistance is seen at the psychological level of 18,000, followed by the next swing high of 18,137, according to him.

He advised that one should avoid being complacent as this recent up-move has been very steep without any breather and hence, some in-between pause or mild profit booking cannot be ruled out.

Hence, any profit-booking towards 17,600-17,400 levels is likely to generate a fresh buying interest from the traders for the upside levels of 18,000-18,300 levels, Rajesh Palviya, Vice President Research (Head Technical Derivatives) at Axis Securities said.

The major action during the week was seen outside the index as many front-line and mid-cap counters gave mesmerising moves.

Traders should continue to focus on such potential movers, however, one needs to be very selective as the low-hanging fruit is already gone, Osho advised.

Let’s take a look at the top 10 trading ideas by experts for the next three-four weeks. Returns are based on the April 13 closing prices:

Expert: Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities

Cummins India: Buy | LTP: Rs 1,549 | Stop-Loss: Rs 1,480 | Target: Rs 1,660 | Return: 7 percent

The stock is on the verge of completing a correction between Rs 1,550 and Rs 1,515 levels. Based on its outperformance over the past several months, we do not think it will completely close the bullish gap it has left between Rs 1,480 and Rs 1,540 which it has left after the Q3FY23 numbers were announced.

A buy is recommended at current levels and Rs 1,500, with a stop-loss at Rs 1,480. On the upside, the stock may again move towards Rs 1,630 or Rs 1,660.

Glenmark Life Sciences: Buy | LTP: Rs 417.55 | Stop-Loss: Rs 370 | Target: Rs 450 | Return: 8 percent

It is consolidating between Rs 450 and Rs 370 levels. In fact, on daily basis, the stock is on the verge of making a double bottom at Rs 370 and to validate the same it may again move towards Rs 450.

Once it comes out of Rs 450, chances of reaching Rs 520 would be high, however, even from the current level, if it goes up to Rs 450 it will give good returns. The reward is commensurate with the risk.

One can buy at current levels and at Rs 390, with a stop-loss at Rs 370.

Cholamandalam Investment and Finance: Buy | LTP: Rs 821 | Stop-Loss: Rs 770 | Target: Rs 945 | Return: 15 percent

The stock climbed as high as Rs 848 levels led by a broad bullish sentiment in the market. Currently, it is trading at life time high. It was below Rs 817 level for a long time.

Such formations give trending moves in the medium term. Based on this traders should be buyers on dips. Buy at the current level and also at Rs 800, with a stop-loss at Rs 770.

On the upside, depending on the extension, it should move towards Rs 870 and Rs 945 in the medium term.

Expert: Subash Gangadharan, Senior Technical & Derivative Analyst at HDFC Securities

JSW Steel: Buy | LTP: Rs 720.65 | Stop-Loss: Rs 682 | Target: Rs 780 | Return: 8 percent

JSW Steel has shown relative strength last week. While the Nifty has gained 1.3 percent last week, JSW Steel has gained a healthy 5.56 percent. In the process, the stock has closed above its recent trading range on the back of above average volumes, which augurs well for the uptrend to continue.

Technical indicators are giving positive signals as the stock is trading above the 20 and 50-day SMA. Momentum readings like the 14-week RSI (relative strength index) too are in rising mode and not overbought, which implies potential for further upsides.

With the intermediate technical setup too looking attractive, we expect the stock to move up towards its previous intermediate highs in the coming weeks. Buy between Rs 715-725 levels, with a stop-loss at Rs 682 and for a target of Rs 780.

Container Corporation of India: Buy | LTP: Rs 604.65 | Stop-Loss: Rs 571 | Target: Rs 660 | Return: 9 percent

After correcting from a high of Rs 829 tested in November 2022, Container Corporation found support around Rs 555 levels in March 2023. These are strong supports as they also roughly coincide with previous intermediate lows.

The stock has since then been climbing higher and making higher bottoms in the process. This week, the stock also broke out of its recent trading range on the back of above average volumes, indicating it is set to move higher in the coming weeks.

Technical indicators are giving positive signals as the stock is trading above the 20 and 50-day SMA. Momentum readings like the 14-week RSI too are in rising mode and not overbought, which implies potential for further upsides.

With the intermediate technical setup too looking attractive, we expect the stock to move up towards its previous intermediate highs in the coming weeks. Buy between Rs 600-610 levels, with a stop-loss at Rs 571 and for a target of Rs 660.

SIS: Buy | LTP: Rs 379.35 | Stop-Loss: Rs 342 | Target: Rs 430 | Return: 13 percent

SIS has bounced back from a low of Rs 318 touched in March 2023 where it made a 52-week low. The stock has since then risen sharply and made a higher bottom in the process. The rise was accompanied with healthy volumes, which augurs well for the uptrend to continue.

Technical indicators are giving positive signals as the stock is trading above the 20 and 50-day SMA. Momentum readings like the 14-week RSI too are in rising mode and not overbought, which suggests potential for more upsides.

With the intermediate setup too looking attractive, we expect the stock to move up towards its previous intermediate highs in the coming weeks. Buy between Rs 375-382 levels, with a stop-loss of Rs 342 and for a target of Rs 430.

TVS Motor Company: Buy | LTP: Rs 1,163 | Stop-Loss: Rs 1,090 | Target: Rs 1,227 | Return: 5.5 percent

Auto stocks seem to have regained momentum after the recent corrective phase. Within this sector, TVS Motor has shown a relative outperformance and the stock has given a breakout from its trendline resistance with rising volumes. The RSI oscillator is hinting at a positive momentum and hence, we expect the uptrend to continue.

Traders can buy the stock on dips in the range of Rs 1,140-1,120 for potential short term targets of Rs 1,190 and Rs 1,227. The stop-loss on long positions should be placed below Rs 1,090.

Dabur India: Buy | LTP: Rs 527 | Stop-Loss: Rs 510 | Target: Rs 558 | Return: 6 percent

The stock has gone through a corrective phase in last four months and prices are now trading around the previous swing low supports.

The RSI oscillator is hinting at a possibility of a positive crossover and the volumes have started increasing indicating buying interest in the stock at support.

Traders can buy the stock in the range of Rs 527-520 for potential short term targets of Rs 544 and Rs 558. The stop-loss on long positions should be placed below Rs 510.

ByMoneycontrol