VIP Industries: Can investors bet on the management’s promise?

Multi-pronged strategy to recoup lost market share, strong sector tailwinds are positives.

Highlights

-

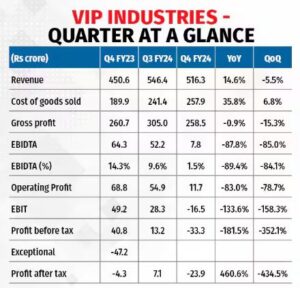

- VIP delivered a double-digit top-line growth in Q4, thanks to the low base of the year-ago quarter

-

- Gross margin suppressed on lower contribution from Bangladesh

-

- Operating margin nosedives on certain exceptional items

-

- The company guiding to multi-pronged comeback strategy

-

- Expects market share gains from H1 FY25

-

- Meaningful margin gains indicated in H2FY25

-

- Sector tailwinds remain strong

-

- Patient investor willing to take risks can look at buying the stock

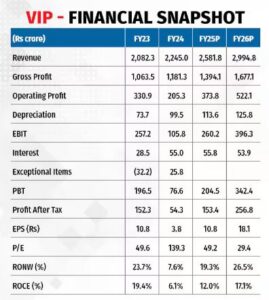

VIP Industries (VIP, CMP: Rs 53 Market Cap: Rs 7,567 crore, rating: Overweight) reported a decent top-line growth, partially attributed to the low base due to the fire at the Bangladesh facility in the year-ago period. Gross margin was suppressed on lower contribution from Bangladesh and certain one-offs led to a sharp decline in the operating margin. The company is having multi-pronged strategy to recoup lost market share and is guiding to growing ahead of the market in FY25. It also expects meaningful margin expansion in the second half of FY25. While the goal appears easier said than done, the strong sector tailwinds with record air traffic and hotel occupancy make us positive on the sector. While the valuation is at a discount to Safari, the promise is yet to play out, making it an ideal stock for a patient risk-taker.

A weak quarter overall

Revenue grew 15 percent YoY, thanks to the impact of the Bangladesh fire in the base quarter. The company is guiding to a recovery in the top-line in FY25. Should the industry grow by 12 percent in FY25, VIP hopes to outperform the industry.

Margin nosedives

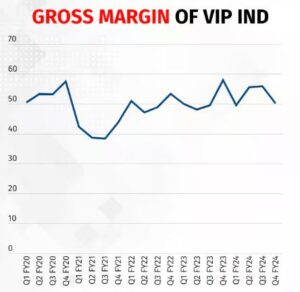

The gross margin for the quarter came in at 50 percent due to lower contribution from the Bangladesh facility.

VIP’s operating margin nosedived to 1.5 percent, thanks to weak gross margin as well as a one-off expense of Rs 15 crore — partially on account of downsizing the Bangladesh facility.

The management expects a blended operating margin of 15 percent in FY25, with exit margin for Q4 at 18 percent. As the soft luggage inventory reduces by the second half of the fiscal, contribution from Bangladesh will improve and freight and warehousing expenses will reduce gradually. Hence, a meaningful margin uptick is expected in the second half.

Strategy to capture market share

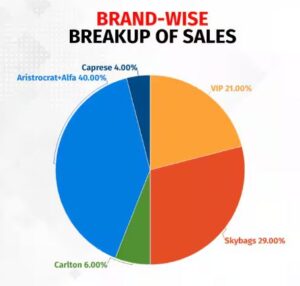

The Aristrocrat is now a Rs 1000-crore economy brand and the company has seen a decline in the share of premium and mass premium brands to 56 percent from 60 percent last year. The focus is now on the premium portfolio and April saw a slew of launches with a focus on brands such as the VIP, Skybag, and the Carlton.

The company has decided to go slow on network expansion and wants to focus on enhancing the productivity of the existing network.

Balance sheet repair

Thanks to the market share loss, VIP ended the year with an inventory of Rs 900 crore. Of this, the soft luggage inventory was Rs 300 crore. The focus is to reduce this first as net debt has consequently swelled to Rs 485 crore from Rs 122 crore in the previous year. The company is hopeful of reducing Rs 200 crore of luggage inventory and liquidate the soft luggage in the first half and bring down debt.

Demand trend encouraging

The boom in travel that was considered a revenge travel post Covid shows no signs of abating with all the leading indicators — growth in air passengers and record hotel occupancy — showing a positive trend.

Travel is increasingly becoming a fixed part of the household budget, especially for the younger generation. Frequent travels are turning luggage into lifestyle products, while the growing affluence and customers’ preference for branded products are fuelling the growth of the organised sector. The increased frequency and duration of travel are leading to the considerable shortening of the replacement cycle. Luggage is extending to customer cohorts on the back of event-based consumption like wedding, student travel, gifting etc.

Outlook

VIP now faces formidable competition in the premium category from Samsonite and several foreign brands that are making inroads in the Indian market, not to forget the home-grown Safari targeting the segment with Urban Jungle. However, the opportunity size is also steadily growing.

Should the company walk the talk, a rerating is possible. While Q1 is not expected to be as robust as earlier years for the industry, and for VIP, FY25 is a year of transformation, there is no denying the long-term secular trend.

VIP is still trading at a 24 percent discount to Safari’s valuation. For a patient risk-taker, this is an entry opportunity.

Risks: Inability to improve market share in light of heightened competition

Bymoneycontrol