More than 70 smallcaps gain 10-28% as market finish at record closing high

On the back of upbeat global, domestic data and strong FIIs investments, Indian markets finished the week to fresh record closing high, ignoring likely US rate hike worries, slowing growth in China, and India’s rising trade deficit.

In this week, BSE Sensex gained 1.21 percent or 758.95 points to finish at 63,384.58, and Nifty50 rose 1.41 percent or 262.6 points to end at 18,826.

In this week, BSE Large-cap added 1.5 percent, BSE Mid-cap index gained 3 percent and BSE Small-cap index added nearly 3 percent.

“Both domestic and global markets have gone through a data-loaded week.

The sustained flow of better-than-expected macroeconomic data helped maintain positive sentiments across domestic equities. Notably, the healthy CPI, WPI, and IIP data contributed to investor optimism.

The domestic CPI data moderated, moving closer to the target set by the RBI, primarily due to a tone-down in food inflation and a favourable base, which increased the likelihood of a rate cut before the year ends,” said Vinod Nair, Head of Research at Geojit Financial Services.

“The headline indices were outperformed by mid- and small-caps, with the Nifty Mid-cap index trading at an all-time high.

Although concerns arose in the global market due to the Fed’s comments regarding a potential future rate hike increasing their year-end rate projection, these worries were short-lived.”

Elevated jobless claims data and a decline in import prices provided hope for an extended pause in rate changes by Fed.

The optimism was further boosted by better-than-anticipated retail sales, reflecting the robustness of the US economy,” he added.

All the sectoral indices ended in the green with BSE Realty index gained nearly 4 percent, Healthcare index added 3.6 percent, BSE FMCG index rose 3.3 percent an BSE Metal index added 3.2 percent.

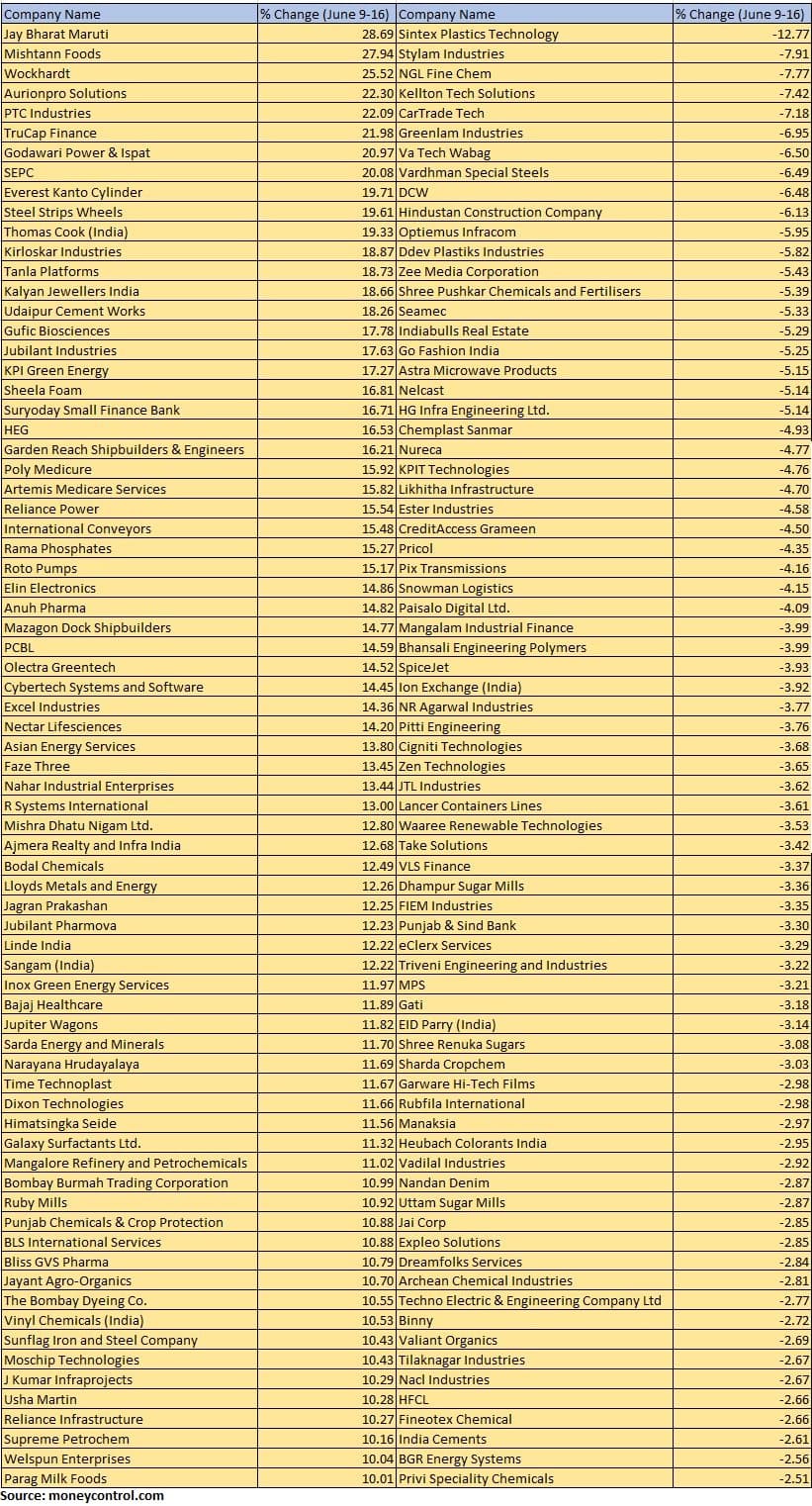

The BSE Small-cap index surged nearly 3 percent with Jay Bharat Maruti, Mishtann Foods, Wockhardt, Aurionpro Solutions, PTC Industries, TruCap Finance, Godawari Power & Ispat and SEPC rising over 20 percent each.

Losers included, Sintex Plastics Technology, Stylam Industries, NGL Fine Chem, Kellton Tech Solutions, CarTrade Tech, Greenlam Industries, Va Tech Wabag, Vardhman Special Steels, DCW and Hindustan Construction Company.

In this week, Foreign institutional investors (FIIs) bought equities worth Rs 6,645.99 crore, while domestic institutional investors (DIIs) bought equities worth Rs 1,319.21 crore.

Where is Nifty50 headed?

Jatin Gedia, Technical Research Analyst, Sharekhan by BNP Paribas:

The Nifty closed above 18,800 which was acting as a stiff resistance earlier.

The daily and hourly momentum indicator have a positive crossover which is a buy signal.

We expect the Nifty to continue with positive momentum during the next week as well.

On the upside the target would be all time high of 18888 and beyond that 19,000.

In terms of levels, 18,670 – 18,650 shall act as a crucial support zone while 18,888 – 18,900 is the immediate hurdle zone.

Amol Athawale, VP-Technical Research Analyst at Kotak Securities:

On weekly charts, the index has a formed bullish candle which also supports further uptrend from the current levels.

For the trend following traders, 18,720 would be the key level to watch out, and above the same the index could move up till 18,980.

On the other hand, below 18,720 or 20-day SMA, any uptrend would be vulnerable, below which the market could slip till 18,600-18,550.

For Bank Nifty, as long it is trading below the 20 day SMA or below 44,000, the weak sentiment is likely to continue.

Below the same, it could slip till the 50-day SMA or 43,250.

On the flip side, a fresh uptrend is possible only after the dismissal of 44,000, and above the same it could retest the level of 44,300.

ByMoneycontrol